Yesterday, the pair formed just one entry signal. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0623 as a possible entry point. A decline to this level and its false breakout generated a good entry point into long positions. However, the pair failed to develop a strong upward movement. In the second half of the day, no good entry points were formed.

For long positions on EUR/USD

As the CPI report revealed yesterday, inflation in the US remained at elevated levels in September. Prices increased by 0.4% compared to August, exceeding the forecast of 0.3%. This factor, coupled with a tight labor market, may prompt the US Federal Reserve to raise the rate once again in November this year, meaning that all dovish comments made recently do not really matter. Today, the EU will publish the CPI data in France and Italy, as well as the data on industrial production in the eurozone. The speech by Christine Lagarde is unlikely to shift the market sentiment today as it does not cover monetary policy. So, if the euro extends its decline in the European session, I will enter the market after the formation of a false breakout of the new support at 1.0527 that was formed yesterday. This will create a good entry point into long positions with the aim of developing a further upward correction. The upside target will be the resistance at 1.0559 where I expected the sellers to show their presence. Breaking and testing this range from above will provide an opportunity for a surge towards 1.0586 where moving averages support the bears. The ultimate target will be the 1.0608 area where I intend to take profits. If EUR/USD declines and there is no buying activity at 1.0527 in the first half of the day, the pressure on the euro will increase, allowing the sellers to regain ground. In this case, only a false breakout at 1.0508 will give an entry signal. I will open long positions immediately on a rebound from 1.0484, aiming for an upward intraday correction of 30-35 pips.

For short positions on EUR/USD

The euro bears have an excellent opportunity to reclaim control over the market. To do this, they will need to maintain a strong presence at the nearest resistance of 1.0559, given that the eurozone economic data is weak. A false breakout at this point during the ECB President's speech will generate a sell signal, with a prospect of a decline towards the 1.0527 support that was once tested in the Asian session. If bears are determined to make a comeback, they need to seize control over this level. A breakout and consolidation below this range, as well as its upward retest, will give another sell signal with the target at the low of 1.0508. The ultimate target will be the 1.0484 level where I will take profits. If EUR/USD rises during the European session and bears are absent at 1.0559, bulls might attempt to recoup losses from yesterday. In this scenario, I will delay going short until the price hits the resistance at 1.0586. I may consider selling there but only after a failed consolidation. I will go short immediately on a rebound from the high of 1.0608, aiming for a downward correction of 30-35 pips.

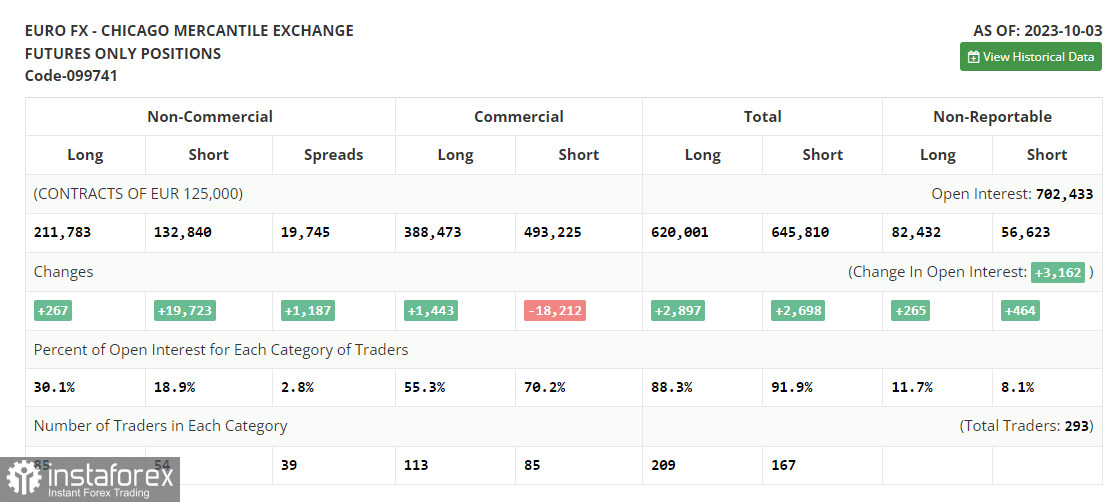

COT report

The Commitments of Traders report for October 3 recorded a minimal rise in long positions and a sharp increase in short positions. Apparently, after the central banks' meetings, markets realized that interest rates will be raised further in the fight against inflation. This will definitely drive the US dollar higher which is already reflected in the COT reports. Notably, these reports have not yet factored in the changes caused by the recent US jobs data which twice exceeded the forecast. In addition, the military conflict in the Middle East also undermines risk sentiment, thus spurring demand for safe-haven assets such as the US dollar. The COT report indicates that non-commercial long positions went up by just 267 to stand at 211,783, while non-commercial short positions jumped by 19,723, reaching a total of 132,840. As a result, the spread between long and short positions increased by 1,187. The closing price dropped to 1.0509 from 1.0604, further underscoring the bearish market sentiment.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates that sellers have seized control of the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0490 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.