EUR/USD

EUR/USD made a powerful downward move, triggered by the US CPI for September, which showed a continued overall inflation rate of 3.7% y/y, contrary to expectations of a decrease to 3.6% y/y. Core CPI also fell from 4.3% y/y to the expected 4.1% y/y, suggesting that the Fed may not change its policy in the near future, so yesterday's 90-pip drop in euro seems excessive.

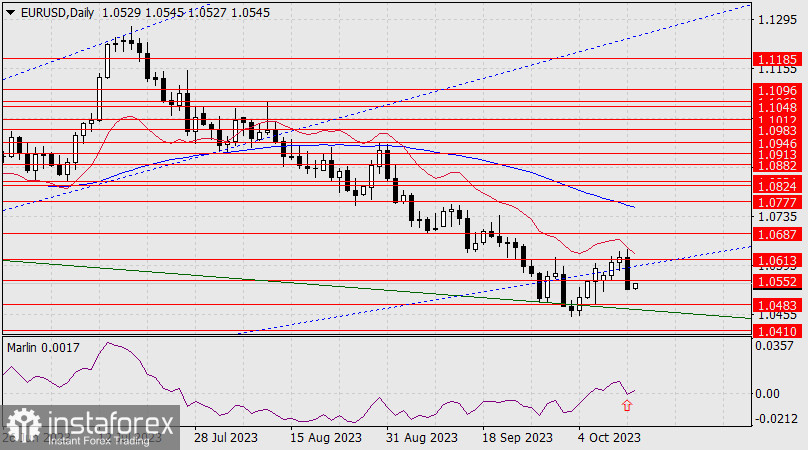

The recent price movement may be a temporary speculative attack on euro buyers, as the Marlin oscillator turned upward from zero. Confirmation of this will be the price returning above 1.0613. Meanwhile, the confirmation of the seriousness of sellers' intentions to develop a downtrend will be the price breaking below 1.0483. In that case, the nearest target will be the level of 1.0410.

On the four-hour chart, the pair settled below the level of 1.0552 and the MACD line, while the Marlin oscillator moves downward. However, there may be a consolidation above 1.0552, unless the pair stays below yesterday's low of 1.0526. If that happens, euro will attempt to test the support level of 1.0483, and the false downward movement will persist.