US inflation remained at 3.7%, matching expectations. However, dollar continued to rise because the stability of inflation prompted everyone to consider the rise in the producer price index, leading to the conclusion that inflation may start rising again.

Dollar may continue its upward movement today due to the data on industrial production in the eurozone, which forecasts say will decline from -2.2% to -3.2%. The International Monetary Fund also worsened its forecast for the region, particularly to Germany, which may experience an even deeper recession.

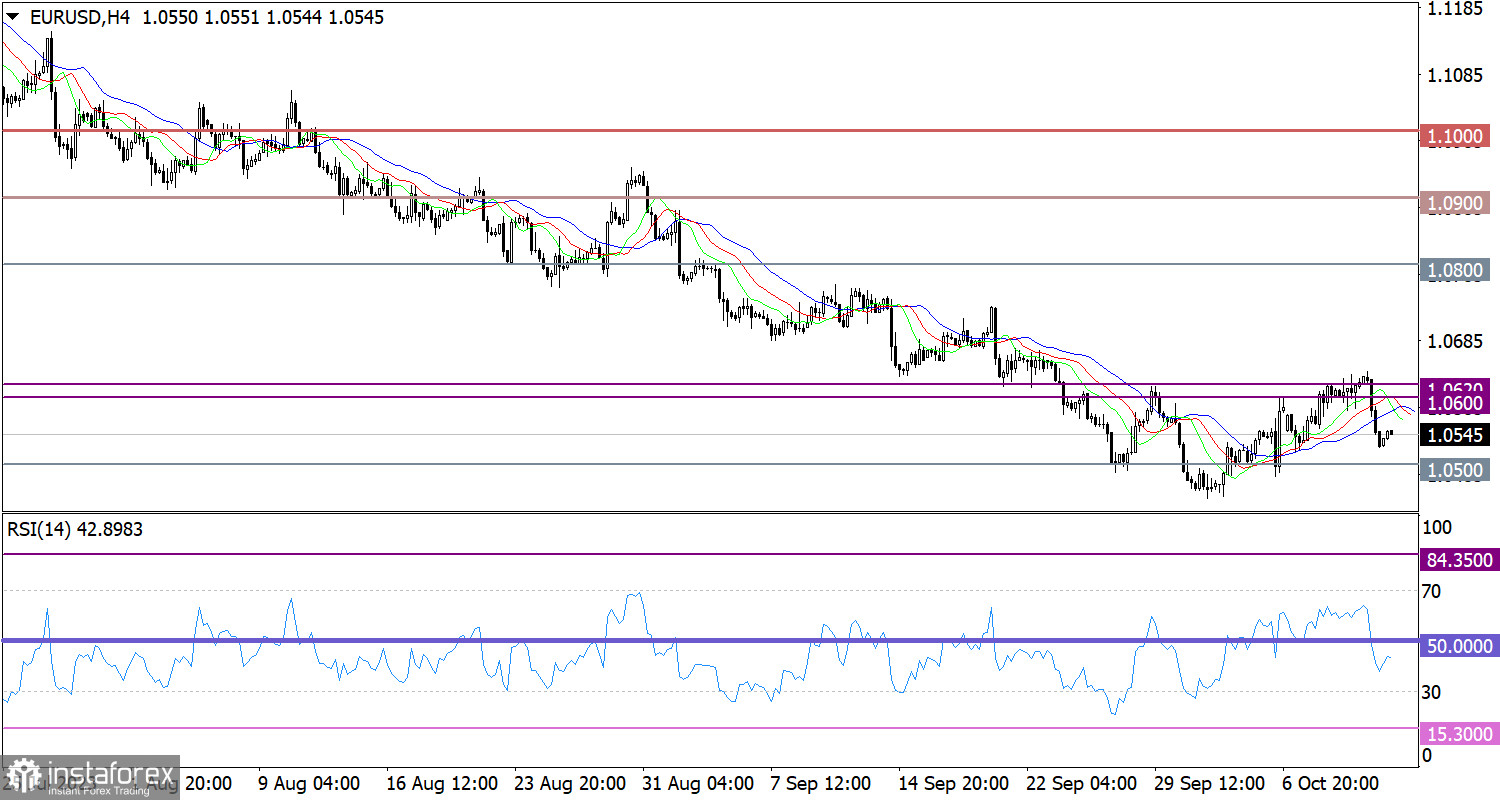

EUR/USD briefly surpassed the resistance zone of 1.0600/1.0620 during a correction. However, after the release of US inflation data, everything changed dramatically. The volume of dollar positions increased, leading to a speculative price movement below 1.0550.

The RSI H4 indicator shows a crossing of the 50 median line from above to below, indicating an increase in dollar positions.

As for the Alligator H4 indicator, it shows that the moving averages changed direction, also indicating an increase in dollar positions.

Outlook and trading tips:

The current movement allows traders to ignore the overbought signals for euro in the short term. This means that a subsequent price movement towards the local low may occur.

Comprehensive short-term and intraday indicator analysis suggests a downward cycle.