Following the results of two inflation releases, the dollar once again made its presence known. Interestingly, traders of dollar pairs completely disregarded the report on the Producer Price Index, all components of which entered the "green zone." However, they strongly reacted to the rather contradictory Consumer Price Index. Despite the conflicting signals, traders interpreted the report in favor of the American currency.

In particular, the EUR/USD pair hit a three-day low on Thursday, dropping from 1.0640 to 1.0526. A move of more than 100 pips in just a few hours is impressive (by today's standards). However, do not rush to open short positions: the sellers of the pair not only failed to extend their success but also couldn't hold onto their positions. At the start of Friday's trading, buyers regained the initiative. This raises the question: will inflation truly help the greenback turn the situation in its favor, or was it a temporary, momentary success? Let's try to understand the current situation.

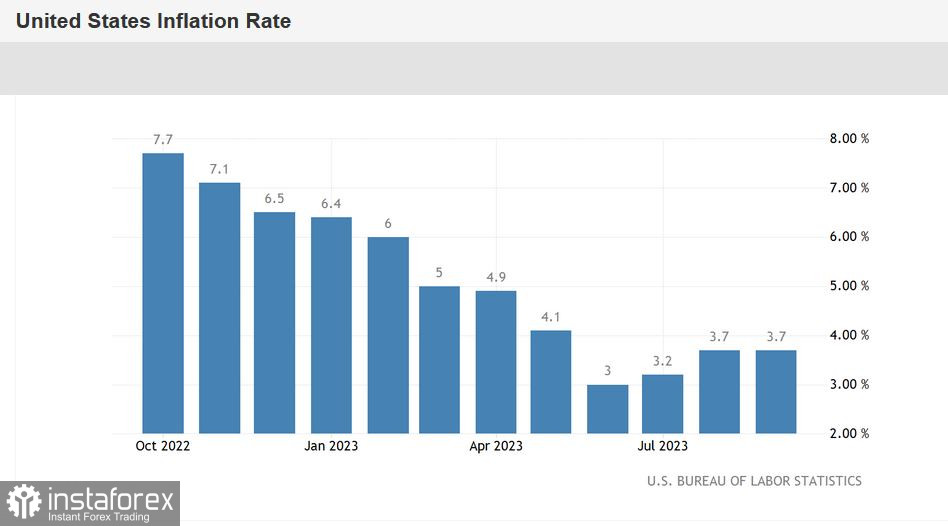

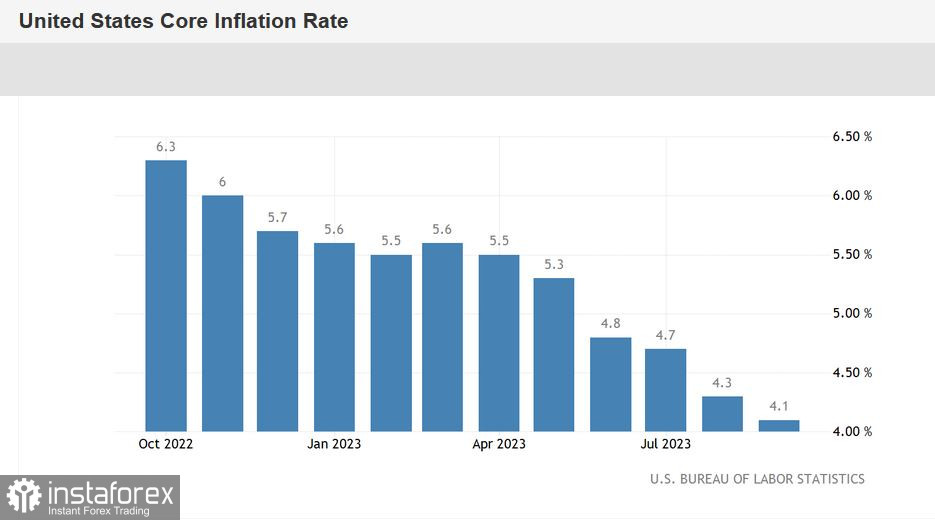

Let's begin with the dry statistics. According to the data published yesterday, the overall Consumer Price Index (CPI) in September remained at the August level, at 3.7% YoY (with a forecasted decrease to 3.6% YoY). The indicator had been declining over the past 12 months but started picking up pace again in July and August. The core CPI, excluding food and energy prices, came out as expected, at 4.1%. This is a two-year low, the weakest growth rate since September 2021.

In other words, the overall CPI continues to show stubbornness while the core index consistently decreases. The Producer Price Index, published on Wednesday, only complicated the puzzle: all components of the report were in the "green zone," reflecting an acceleration in the inflation indicator.

It is worth noting that by the end of the past week, the hawkish sentiment in the market regarding the Federal Reserve's future actions noticeably weakened, especially in the context of the upcoming meeting, which will take place next month. Currently, the probability of a rate hike in November is only 9% (according to CME FedWatch Tool data). For comparison, at the beginning of October, the chances of a 25-point scenario at the November meeting were nearly 50%. As for the December meeting, there is also a certain level of skepticism among market participants. The probability of a rate hike at the final meeting of the year has decreased from 40% to the current 30%.

As we can see, traders are almost certain that the Federal Reserve will maintain the status quo in November, but they still have some hopes for the December meeting. The inflation reports published this week did not tip the scales in favor of the hawks. However, it's important to make one significant caveat: in the current situation, it's not the reports themselves that matter, but their interpretation. In other words, the released data can sway the balance both in favor and against the dollar, and the key role here will be played by the Federal Reserve members.

Recall that at the beginning of October, the dollar significantly strengthened its position despite a weak report on the growth of the core PCE index, which reflected a decrease to 3.9%. Support for the greenback came from representatives of the Federal Reserve. In particular, Cleveland Fed President Loretta Mester noted that the Federal Reserve will likely have to raise interest rates again this year, as the risks for inflation are currently skewed to the upside. Federal Reserve Governor Michelle Bowman voiced a similar position. According to her, further interest rate hikes and maintaining them at the current level for a long time "will be appropriate."

In the wake of these statements, the U.S. Dollar Index hit an almost year-long high, reaching the 107 level, while the EUR/USD pair hit a six-month low, marking at 1.0449.

However, then the Non-Farm Payrolls were published, reflecting weak wage growth. Following this, more cautious statements were made by Federal Reserve representatives. Several members of the U.S. regulator expressed doubts about the advisability of further monetary tightening. Among them were Mary Daly, Lael Brainard, and Philip Jefferson.

After their statements, the balance shifted back in favor of EUR/USD buyers, as the dollar weakened across the board amid a significant drop in hawkish expectations.

These shifts in sentiment indicate that the market is at a crossroads. The Federal Reserve elevated the greenback, and then it sunk it. Now, the fate of the American currency is again in the hands of the Federal Reserve. If Fed members become concerned about the dynamics of key inflation indicators, the dollar will remind us of its presence. However, the market may have effectively priced in the maintenance of the status quo at the November meeting. Therefore, if the Federal Reserve hints at a possible rate hike in December, such rhetoric will work in favor of the greenback.

According to currency strategists at Danske Bank, recent releases have revived hopes for further Federal Reserve policy tightening. In particular, experts point out that after several months of decline, housing prices in the U.S. unexpectedly rose. Meanwhile, overall inflation shows resilience, which may worry the "neutral" Federal Reserve representatives.

In other words, if the Fed tightens its rhetoric in response to inflation reports, the dollar will quickly regain its lost positions. This means that in the EUR/USD pair, the greenback will return to the support level of 1.0450 (the lower Bollinger Bands line on the D1 timeframe), which proved challenging for EUR/USD bears in early October. However, an alternative scenario cannot be ruled out, in which Fed members maintain a cautious stance, emphasizing the decrease in the core PCE index and expressing skepticism about the advisability of further monetary tightening. In this case, the pair will return to the range of 1.0650-1.0750.

At the moment, the situation is uncertain: traders only have dry statistics at hand, and for the development of a bullish or bearish scenario, a corresponding interpretation from the Federal Reserve is needed.