The euro began the second week of October on a high note but ended in decline. The armed conflict in the Middle East and the extensive statements by Federal Reserve officials, indicating that the market is doing the central bank's job, contributed to a drop in the yields of U.S. Treasury bonds. This allowed the EUR/USD bulls to launch a counterattack, pushing the quotes above the 1.06 level, which, however, is as far as their strength could carry them.

In reality, the correction in the euro appeared to be a misunderstanding. The Eurozone is clearly lagging behind the United States in terms of economic growth, a fact confirmed by the latest IMF forecast. The International Monetary Fund raised its estimates for U.S. GDP in 2023 and 2024 while lowering the figures for the currency bloc. According to the latest ECB meeting minutes, the central bank does not intend to raise deposit rates any further. Unless, of course, there's a sudden surge in inflation.

The acceleration of consumer prices in the U.S. in September, on the contrary, brought back discussions in the forex market about the resumption of the Federal Reserve's monetary tightening cycle. Moreover, all the drivers of rising Treasury bond yields are still in play. The Fed continues quantitative tightening (QT) and intends to keep rates elevated for a very long time.

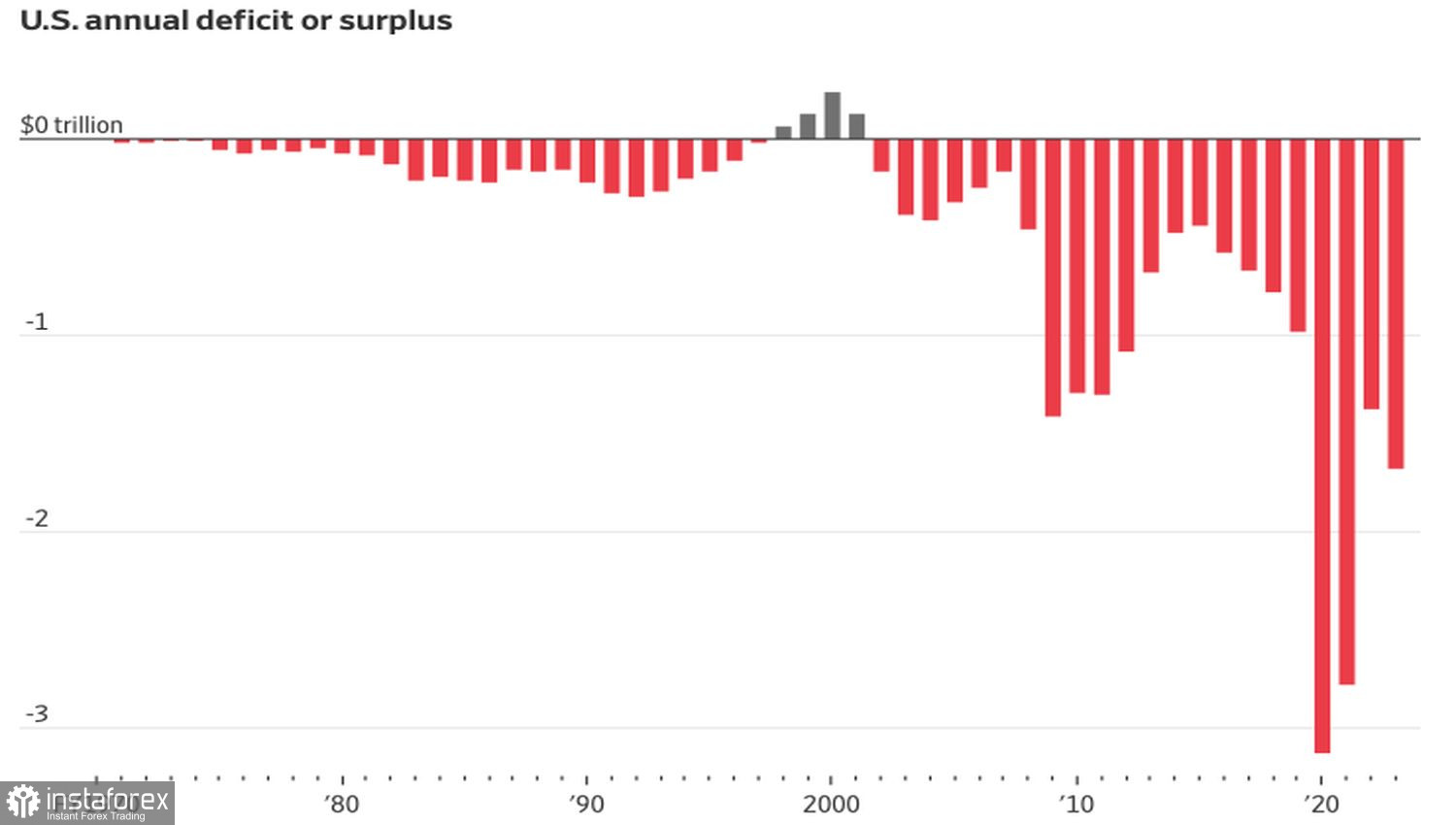

The U.S. Treasury is frightening investors with massive bond issuances amid increasing budget deficits. In fact, the Congressional Budget Office projects that the deficit will remain at 5-7% of GDP over the next decade. Since the end of World War II, the longest period of budget deficit exceeding 5% was only three years.

Dynamics of the U.S. budget deficit

Therefore, despite what the FOMC officials may say, it's unlikely they'll be able to halt the rally in Treasury bond yields. Sellers of bonds continue to hold the upper hand, playing cards such as the Federal Reserve's monetary policy tightening, massive U.S. Treasury issuances, and the strength of the U.S. economy. You can gauge the continued strength of the United States from the labor market statistics for September.

Could geopolitics change anything? If an armed conflict in Israel involves Tehran, it's quite possible. Given the sharp confrontation of Iran, Russia, and China with the West, I wouldn't be surprised to see newspaper headlines filled with words about a Third World War. In such a scenario, there's a high probability of capital flight into U.S. Treasury bonds, which would lower their yields and weaken the dollar. However, this scenario seems unlikely for now.

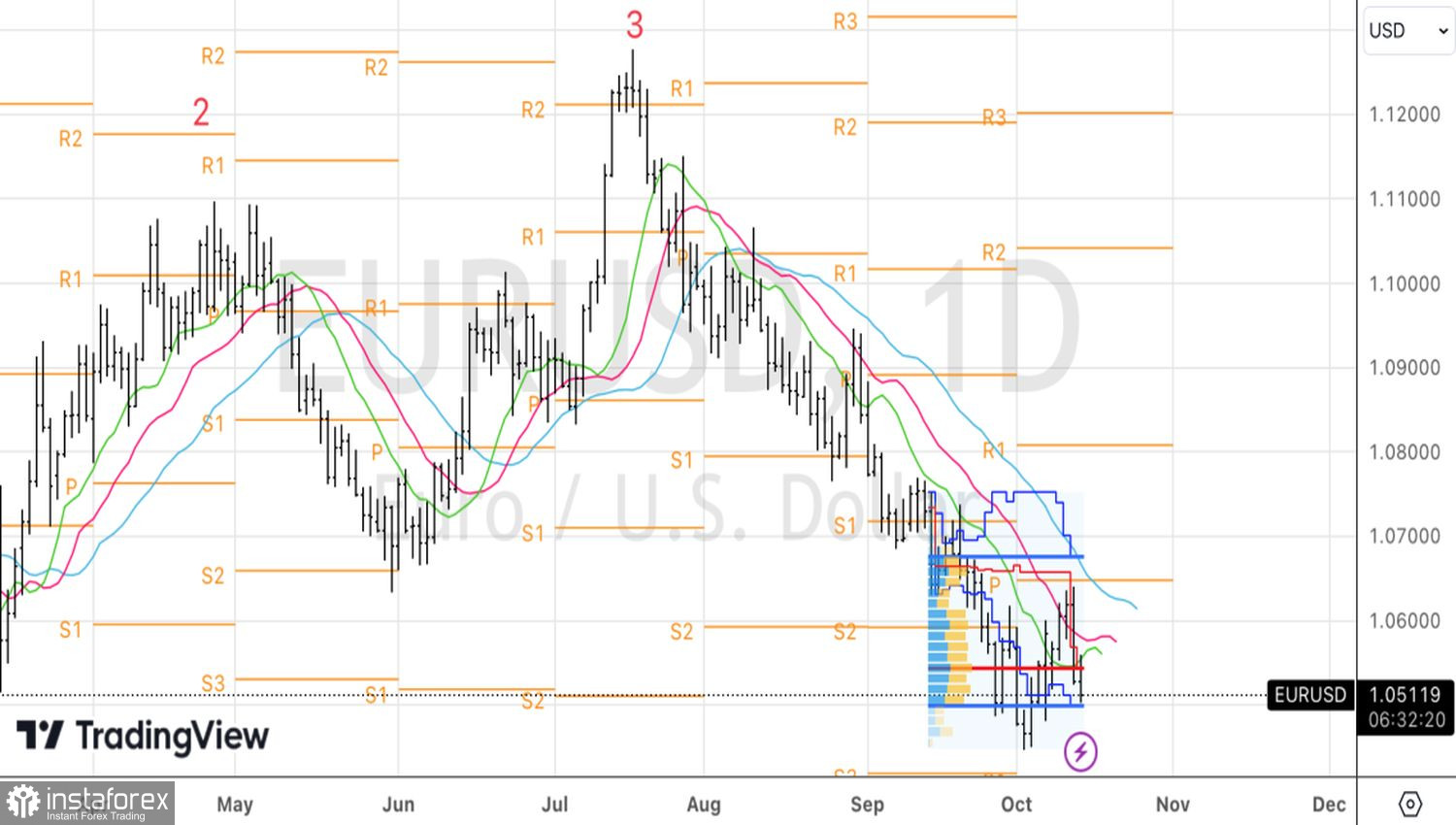

Dynamics of financial conditions in the U.S.

Undoubtedly, from time to time, the yields of U.S. debt securities will trend lower, but the overall upward trend remains in place. Especially considering that financial conditions in the United States are roughly the same as they were a year ago.

Technically, a return of EUR/USD quotes below the lower boundary of the fair value range of 1.05-1.067 would indicate a total advantage for the bears. It makes sense to maintain and periodically increase the shorts formed just below 1.0575.