Details of the Economic Calendar on October 13

The acceleration of the decline in industrial production in the EU, from -2.2% to -5.1% (versus expectations of -3.2%), led to the weakening of the European currency.

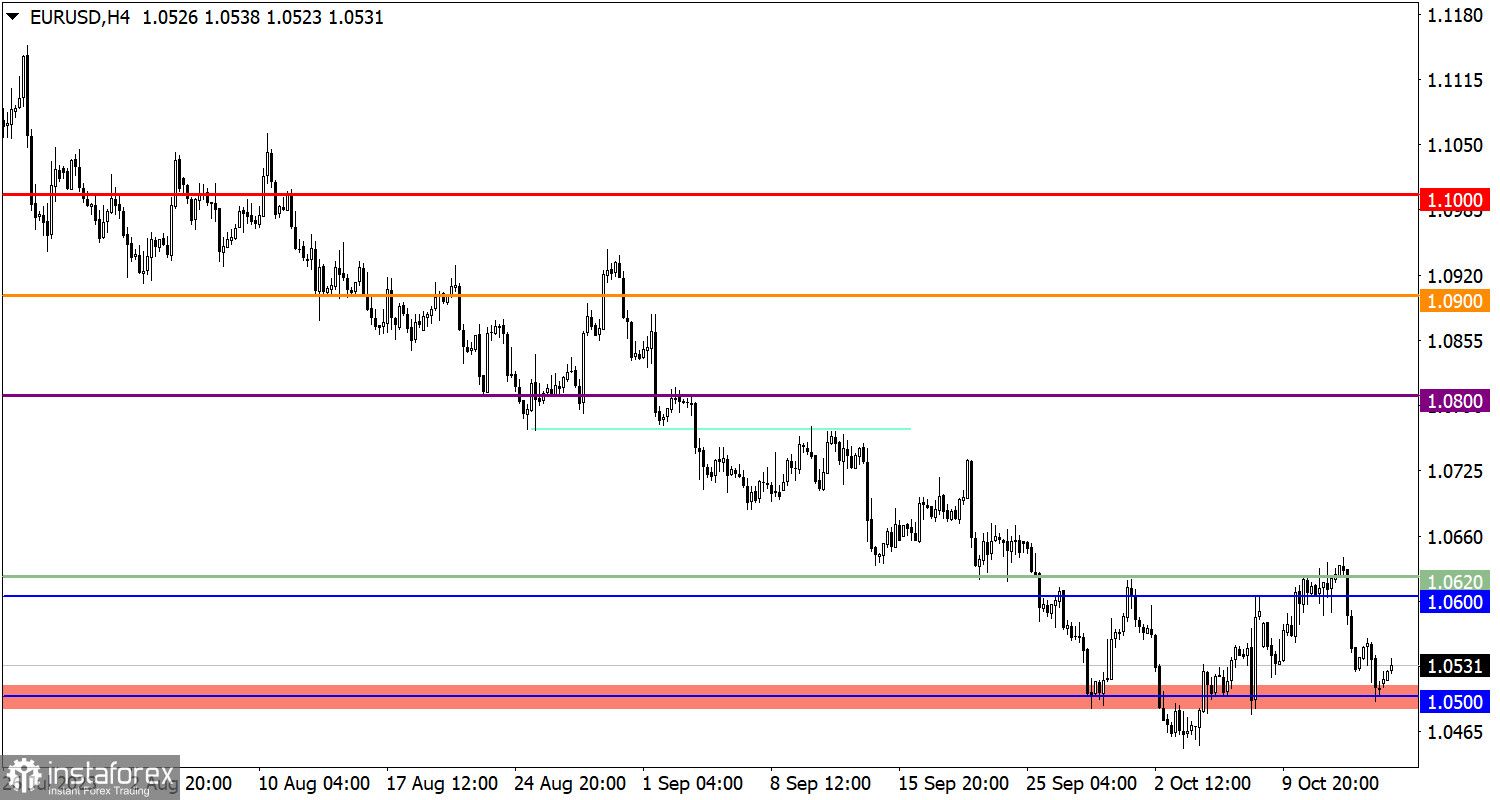

Analysis of Trading Charts from October 13

The EUR/USD currency pair reached the 1.0500 support level during an intense downward movement, where the volume of short positions decreased. As a result, the downward cycle slowed its formation, and a correction followed.

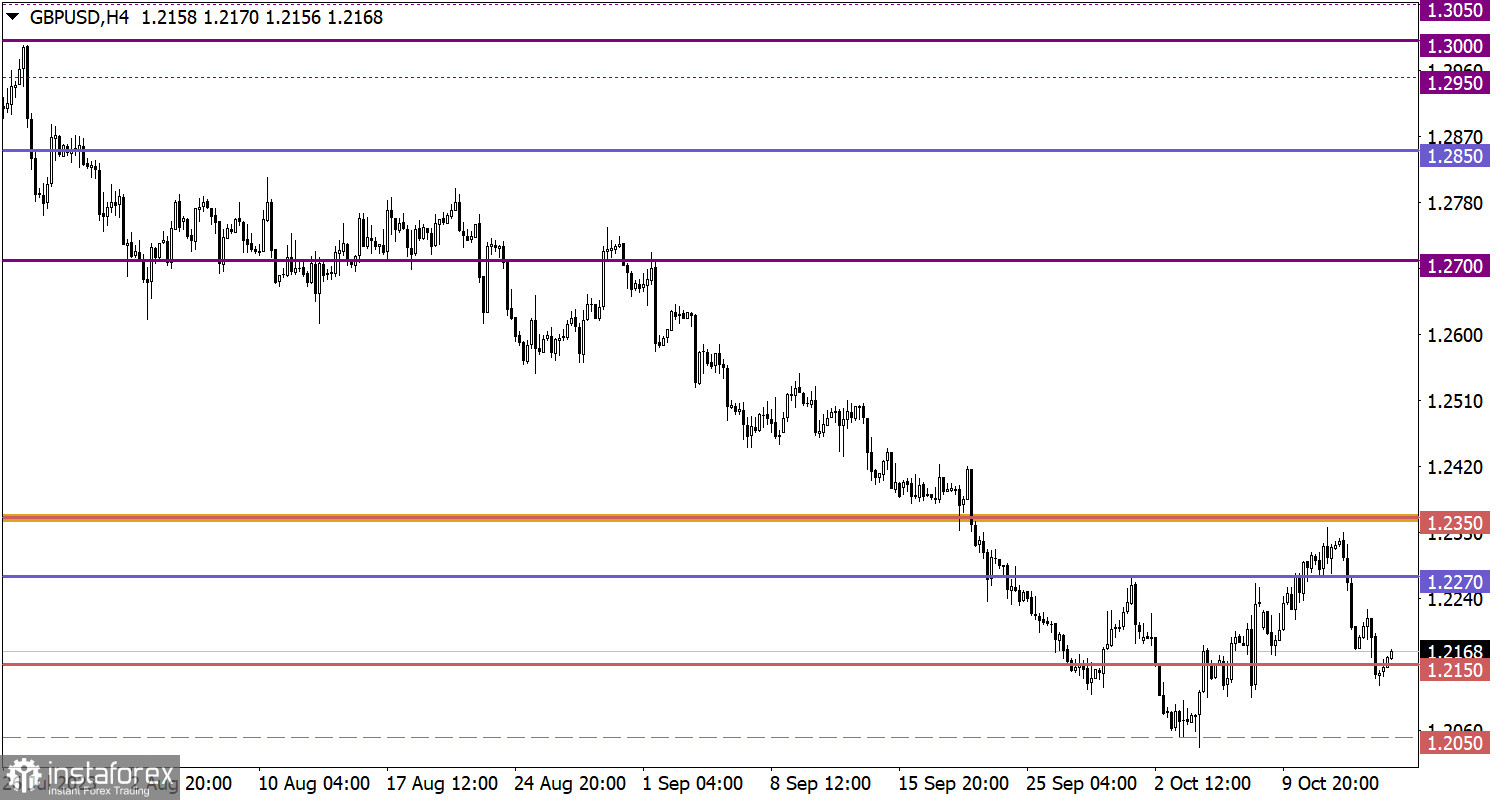

The GBP/USD pair had the same dynamic, where quotes initially moved towards the 1.2150 support level. Here, too, a reduction in the volume of short positions occurred, which was reflected in the chart as a rebound.

Economic Calendar for October 16

Monday, as usual, is accompanied by an empty macroeconomic calendar. The publication of important statistical data in the European Union, the United Kingdom, and the United States is not expected.

As a result, investors and traders are likely to rely on incoming news and information flow to make market decisions.

EUR/USD Trading Plan for October 16

From a technical analysis perspective, a price rebound from the level of 1.0500 may trigger an upward movement to the level of 1.0550. As for the continuation of the downward trend, traders will consider this scenario if the price stabilizes below the level of 1.0500.

GBP/USD Trading Plan for October 16

To continue the downward movement, it is necessary for the price to stabilize below the level of 1.2150. This may lead to an increase in the volume of short positions and a movement towards the upper range of the psychological level of 1.2000/1.2050. As for the upward scenario, traders view it as a possible price rebound from the 1.2150 support level.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.