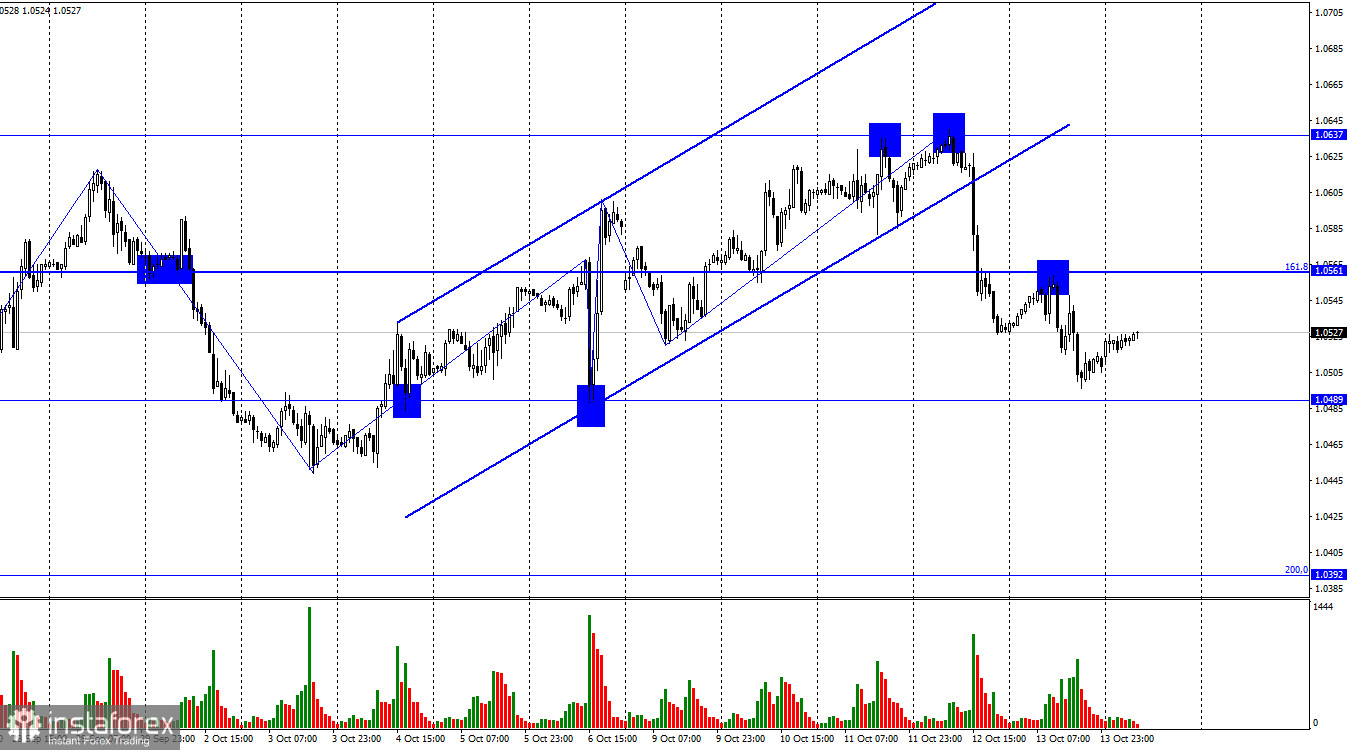

On Friday, the EUR/USD pair bounced off the corrective level of 161.8% (1.0561), reversing in favor of the US dollar, and continued its decline towards the level of 1.0489. If the pair consolidates above this level, it will favor the euro, potentially leading to some growth towards 1.0561. A sustained break below 1.0489 significantly increases the likelihood of further declines. Trader sentiment has shifted to a "bearish" outlook due to the pair exiting the upward trending channel, although recent movements have resembled more of a horizontal pattern.

The wave situation at this time is ambiguous. Friday's decline led to a breakthrough of the October 9th low, suggesting a shift towards a "bearish" trend. However, the possibility of a new reversal in favor of the euro and a subsequent rally towards the 1.0637 level exists due to a probable horizontal movement in the 1.0450–1.0490 range. In my view, extra caution should be exercised at this time.

Last week, the news background was not the strongest. Inflation in the United States neither decreased nor increased, and traders spent the entire week trying to guess what would happen with the FOMC interest rate in November. Judging by the inflation rate, it should increase by another 0.25%. Based on statements from FOMC members, there is an 80–90% chance that the rate will not be raised.

In my opinion, the Fed has no reason to rush with tightening. The rise in inflation to 3.7% could be a coincidence or a "seasonal phenomenon." If the rate is raised in December rather than in November, no one will be disappointed. Nevertheless, for the dollar to continue its rise now, it would be crucial to receive confirmation of its readiness to tighten monetary policy in two weeks. Such confirmation is currently lacking. Therefore, the dollar may experience a slight decline this week.

On the 4-hour chart, the pair rebounded from the 100.0% correction level at 1.0639, reversed in favor of the US dollar, and started to decline towards the 127.2% Fibonacci level at 1.0466 after a "bearish" divergence formed on the CCI indicator. The impending "bullish" divergence has been canceled. There are many signals on both charts at the moment, and they do not provide a clear answer regarding the direction to expect for this week. The market situation is not straightforward and definitive at this time.

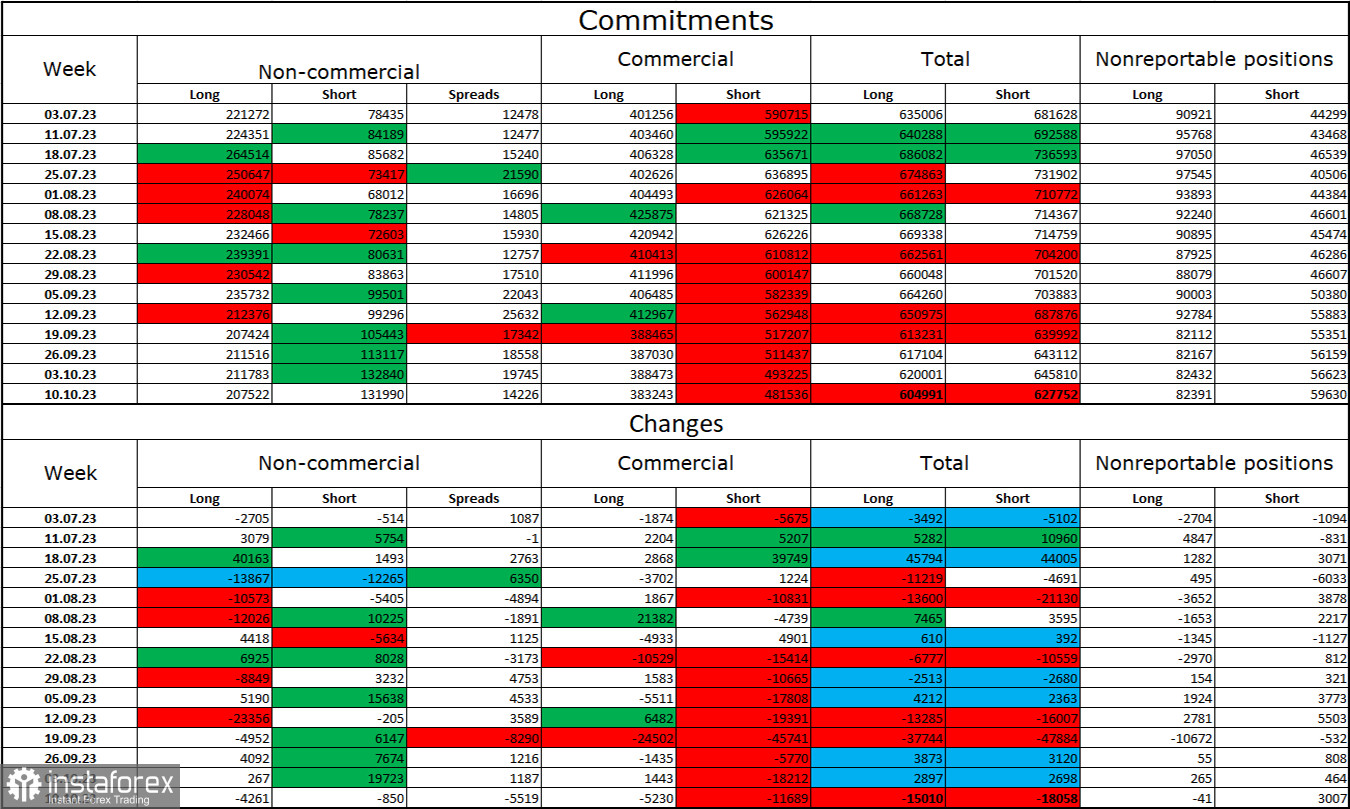

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 4,261 long contracts and 850 short contracts. The sentiment of large traders remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now amounts to 207,000, while short contracts amount to 132,000. The difference is now less than double, whereas a few months ago, the gap was threefold. I believe that the situation will continue to shift in favor of the bears. Bulls have dominated the market for too long, and now they need a strong news background to start a new "bullish" trend. Such a backdrop is currently lacking. Professional traders may continue to close their long positions in the near future. I think the current figures suggest a continuation of the euro's decline in the coming months.

Calendar of news for the United States and the European Union:

On October 16th, the economic events calendar does not feature any attention-grabbing entries. The impact of the news background on traders' sentiment will be absent today.

Forecast for EUR/USD and trader recommendations:

Selling the pair was possible when closing below the trend channel on the hourly chart, with targets at 1.0561 and 1.0525. Both targets have been achieved. Today, I recommend buying when closing above the level of 1.0561 on the hourly chart with a target of 1.0637 or on a rebound from 1.0489.