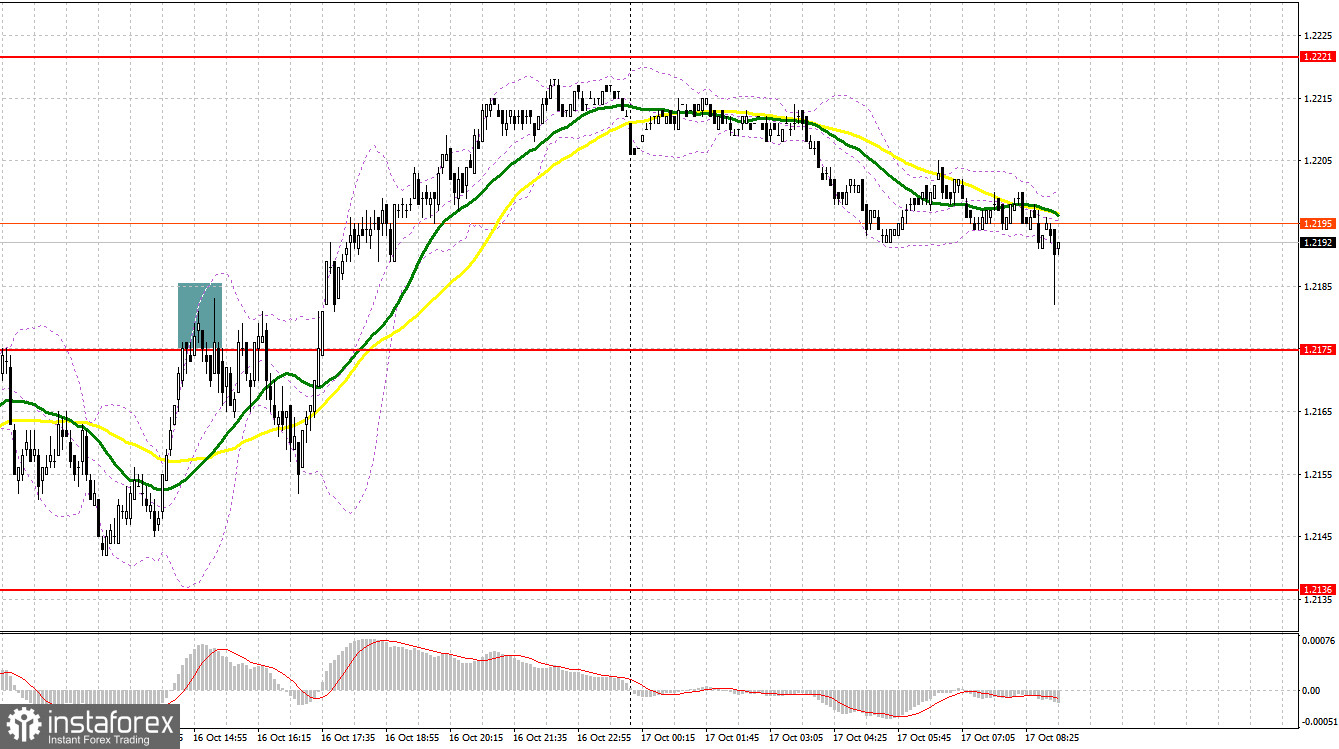

Yesterday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2175 as a possible entry point. A rise and a false breakout at this mark produced a sell signal, sending the pair down by more than 39 pips. In the afternoon, defending the resistance level at 1.2175 and a false breakout made it possible to take about 30 pips.

COT report:

Before delving into the technical picture of the pound, let's see what happened in the futures market. In the COT (Commitment of Traders) report for October 10, we see a decrease in both long and short positions. This suggests that traders made slight adjustments to their positions ahead of an important US inflation report that was released at the end of the previous week. Given that US prices continue to rise, it's likely to negatively impact the Federal Reserve and its decisions regarding interest rates. So, despite the pound's recent attempts at correcting higher, it could end with another sell-off and the pair could fall to new monthly lows. This week, there are quite a number of Federal Reserve officials who are scheduled to speak, which will serve as an important reference point. The latest COT report said that long non-commercial positions fell by 7,621 to 66,290, while short non-commercial positions dropped by 4,253 to 76,338. As a result, the spread between long and short positions narrowed by 836. The weekly price reached 1.2284 versus 1.2091 in the previous week.

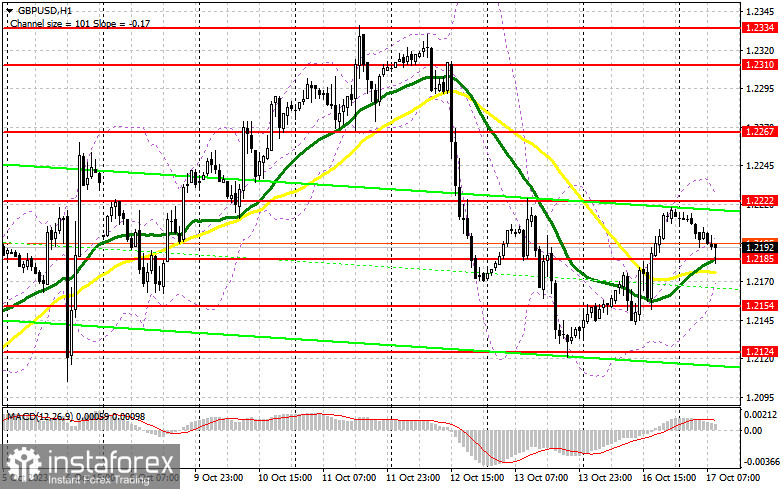

For long positions on GBP/USD:

The UK just released a weak average earnings report, and traders may also look to the release of the unemployment report, as well as a speech by Bank of England MPC member Swati Dingra. Weak data will exert pressure on the pair. For this reason, I expect the bulls to be active when the price reaches the nearest support level at 1.2185, which is in line with the bullish moving averages. A false breakout on this mark will produce a buy signal and preserve chances to reach a major resistance at 1.2222, formed at the end of last week. A breakout and downward test of this range may push the pound to recover, producing a buy signal and allowing the pair to reach a new resistance at 1.2267. In case the pair climbs above this range, the price could surge to 1.2310, where I'd be looking to take profits. If the pair declines to 1.2185 without buyer activity, and the pair immediately rises from this level, bearish pressure on the pound will increase which will prevent the pair from trading within the sideways channel. In this case, I will postpone long positions until a false breakout at 1.2154, from where the large players were active yesterday. I plan to instantly buy GBP/USD on a bounce from 1.2124, aiming for a daily intraday correction of 30-35 pips.

For short positions on GBP/USD:

The bears repeatedly tried to sell the pound and exert pressure on the pair, but the bulls regained control during the US session. Today, it is crucial to defend the resistance level at 1.2222, which also acts as the upper band of the sideways channel. A false breakout at this level will confirm the presence of large sellers and give a sell signal to continue the downtrend and could push the pair towards the support level at 1.2185. Breaching this level and subsequently retesting it from below will strengthen the bears' advantage, providing a window to aim for the 1.2154. The more distant target will be 1.2124, where I'd be taking profits. If GBP/USD grows and there are no bears at 1.2222, the bulls will get the upper hand. In such a scenario, I will refrain from going short until the price hits next resistance at 1.2267. You can sell here as well but only after a failed consolidation. If downward movement stalls there, one can sell the British pound on a bounce from 1.2310, bearing in mind a 30-35-pips downward intraday correction.

Indicator signals:

Moving Averages

Trading just above the 30- and 50-day moving averages indicates a sideways trend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of an upward movement, the upper band of the indicator near 1.2222 will act as resistance. If the pair declines, the lower band of the indicator near 1.2160 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.