Details of the Economic Calendar on October 16

Monday, as usual, was accompanied by an empty macroeconomic calendar. Important statistical data releases in the European Union, the United Kingdom, and the United States did not take place.

Analysis of Trading Charts from October 16

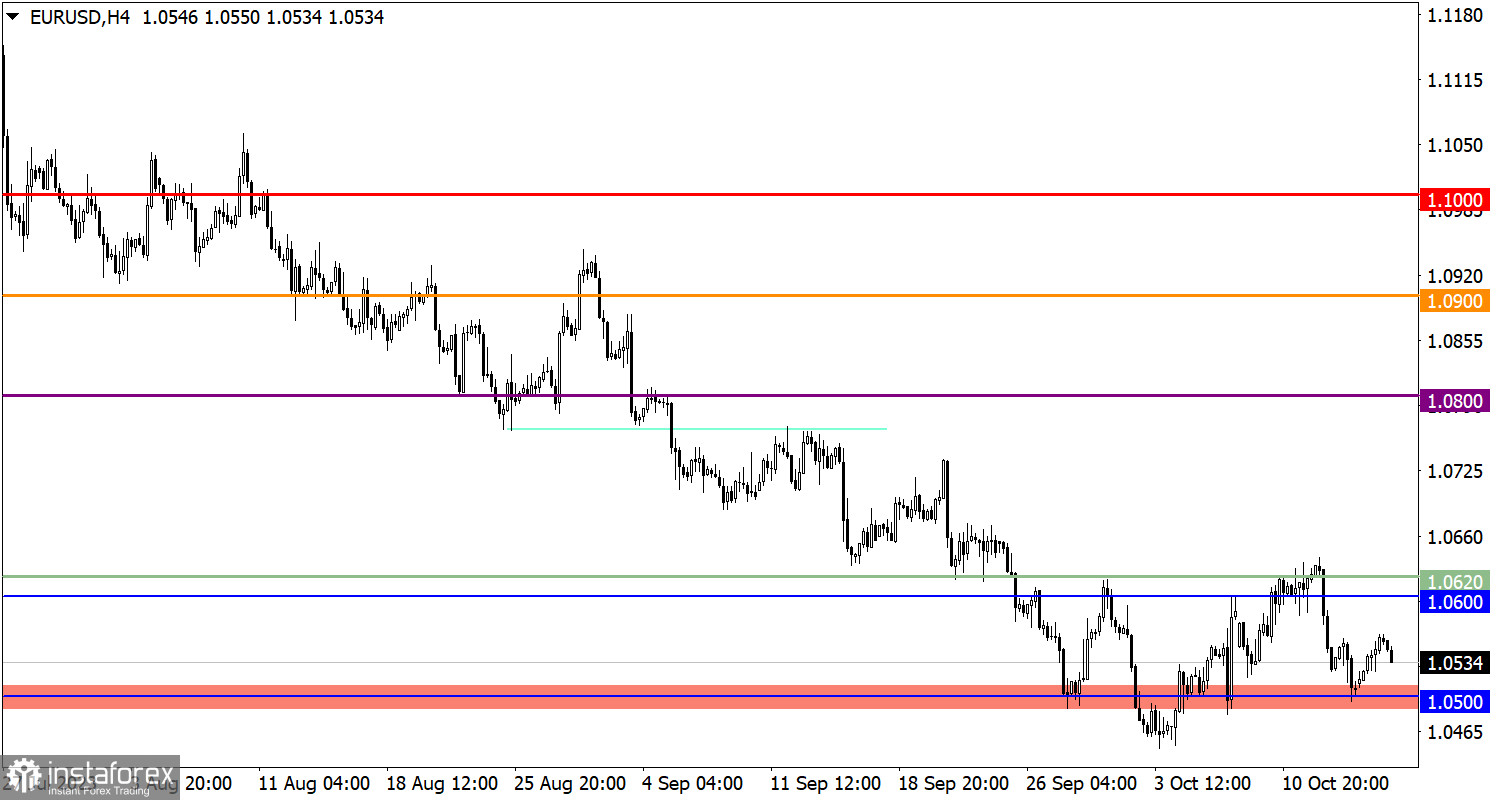

The EUR/USD currency pair once again reduced the volume of short positions when it reached the 1.0500 support level. This slowed down the current downward trend and led to a rebound.

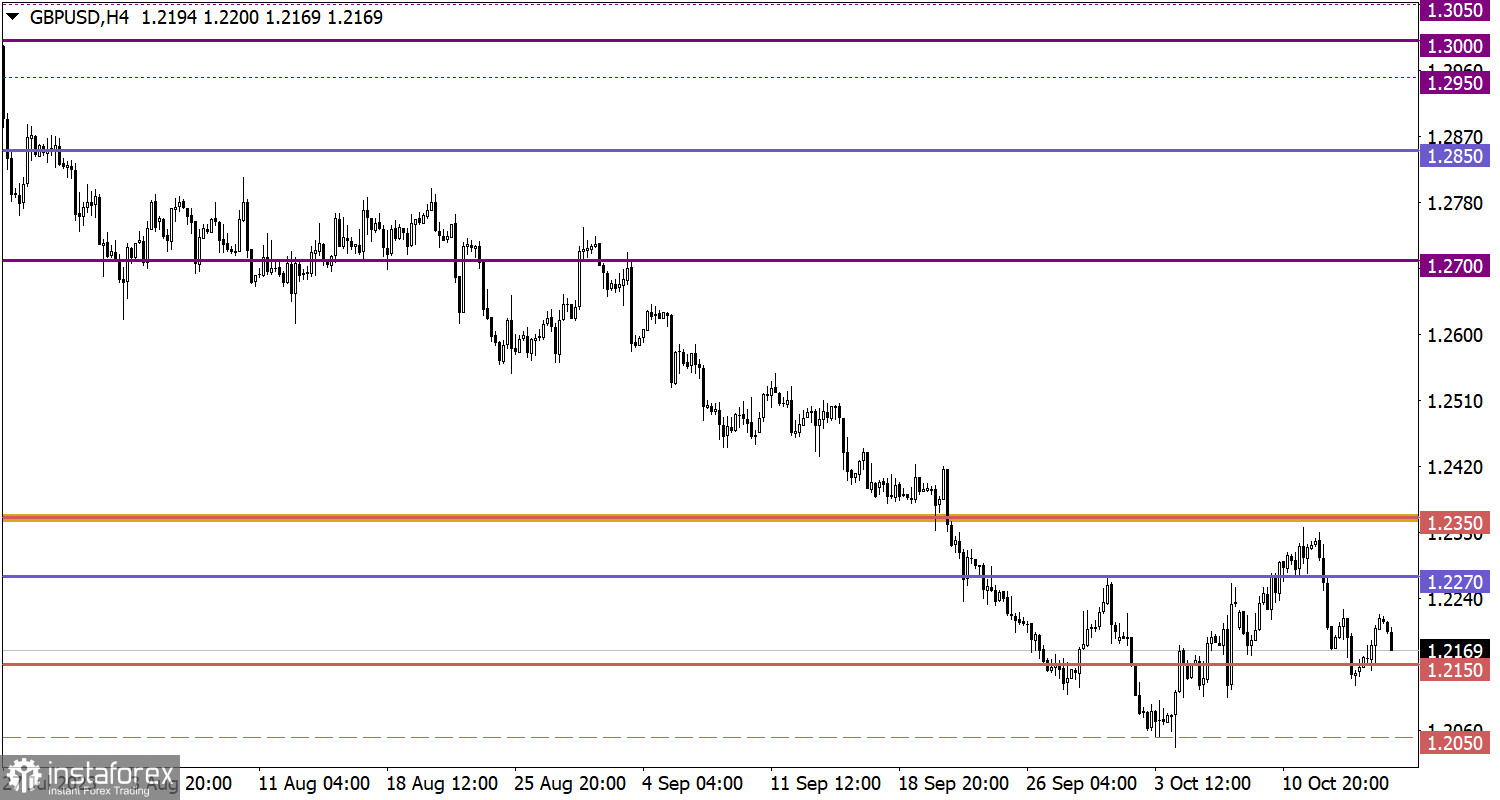

The GBP/USD pair also demonstrated a rebound from the 1.2150 support level. This led to an increase in long positions and temporarily pushed the quote above the 1.2200 mark.

Economic Calendar for October 17

At the opening of the European trading sessions, the publication of data on the state of the UK labor market was expected, but an unusual situation occurred. The publication of unemployment data in the UK was suddenly postponed to the following week, although wage data were published as expected. These strange actions raised doubts about the credibility of British labor market statistics. The British pound instantly started to weaken, also affecting the euro's exchange rate. However, the magnitude of price changes remained insignificant, possibly because the U.S. dollar still remained overbought.

During the American trading session, data on retail sales in the United States is expected, with the forecasted growth slowing from 2.5% to 1.5%. A decrease in industrial production is also expected, which currently stands at 0.2%, dropping to -0.8%. If the negative statistics are confirmed, the U.S. dollar may come under pressure from sellers.

EUR/USD Trading Plan for October 17

Despite the brief strengthening of the euro, there have been no significant changes on the trading chart. The market still remains in a downward trend, and a pullback has occurred within the structure of this trend.

GBP/USD Trading Plan for October 17

For further upward movement during the pullback, it is necessary for the price to hold above the level of 1.2230. In this case, an increase in long positions towards 1.2300 is possible.

As for the downside scenario, traders consider it in case the current pullback slows down and leads to the price returning to the support level of 1.2150. In this case, a continuation of the previously established downward trend in the market is possible.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.