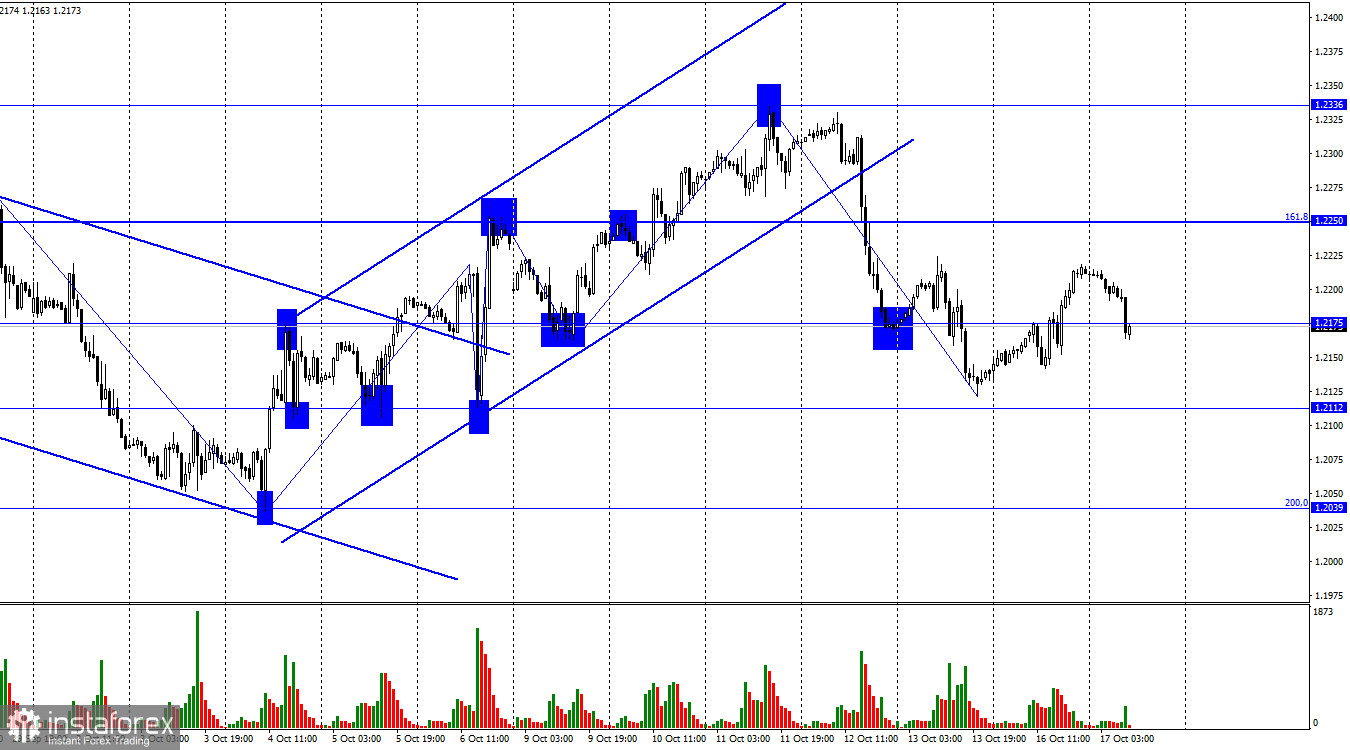

On the hourly chart, the GBP/USD pair reversed in favor of the British on Monday and rose above the level of 1.2175. However, today there was a return to the level of 1.2175, and if it holds below, it will favor the US dollar and further decline towards the levels of 1.2112 and 1.2039. The level of 1.2175 is not strong; the price easily surpassed it on Friday and Monday. I wouldn't expect too many signals at this level. The bears have taken the initiative at the moment.

The decline of the British pound by 200 points at the end of last week led to a break of the low on October 9th. Thus, we received the first sign of a trend change to the "bearish" one. However, I assume that this time the "bearish" trend will be weak and short-lived. I don't see any reasons for a strong rise in the US dollar this week. Even at the end of last week, there were few of them. The rhetoric of FOMC members has begun to change in a "dovish" direction, which should put pressure on the US dollar, not the other way around.

The information background for the British currency remains rather weak. This morning, a report on wages was released, which once again indicated a strong increase in August. Obviously, by September or October, the pace may be much lower, but reports are published with a two-month delay, making it very difficult to draw conclusions from them. The British pound reacted to this report with a drop, but these data are not a reason to continue the decline throughout the day. Reports on unemployment and jobless claims were also supposed to be released, but there is no information on these indicators yet.

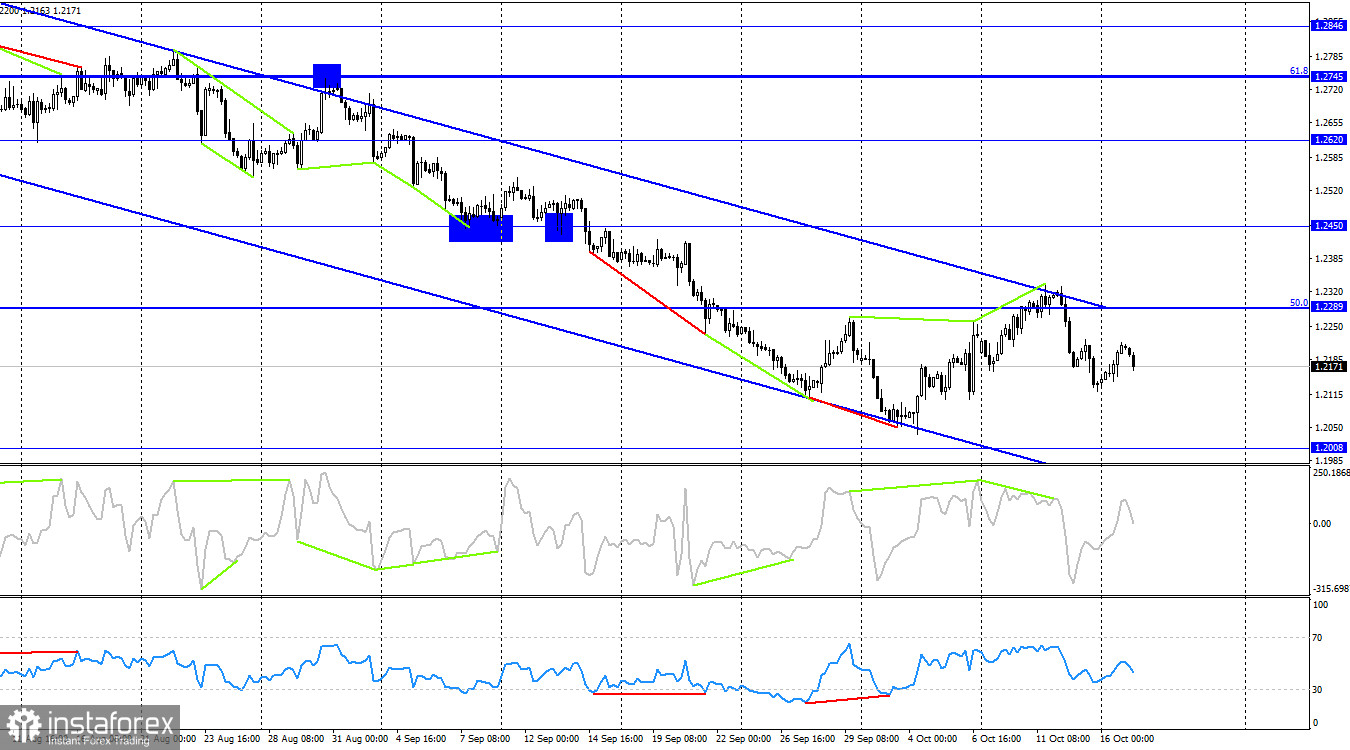

On the 4-hour chart, the pair has established itself above the Fibonacci 50.0% level at 1.2289 but almost immediately started a new decline. The "bearish" divergence on the CCI indicator strongly supported this, and consolidation above the descending corridor did not occur. The impending "bullish" divergence on the CCI indicator was canceled. In fact, the decline in quotes can continue on the 4-hour chart, but both pairs currently have a complex and tangled technical picture.

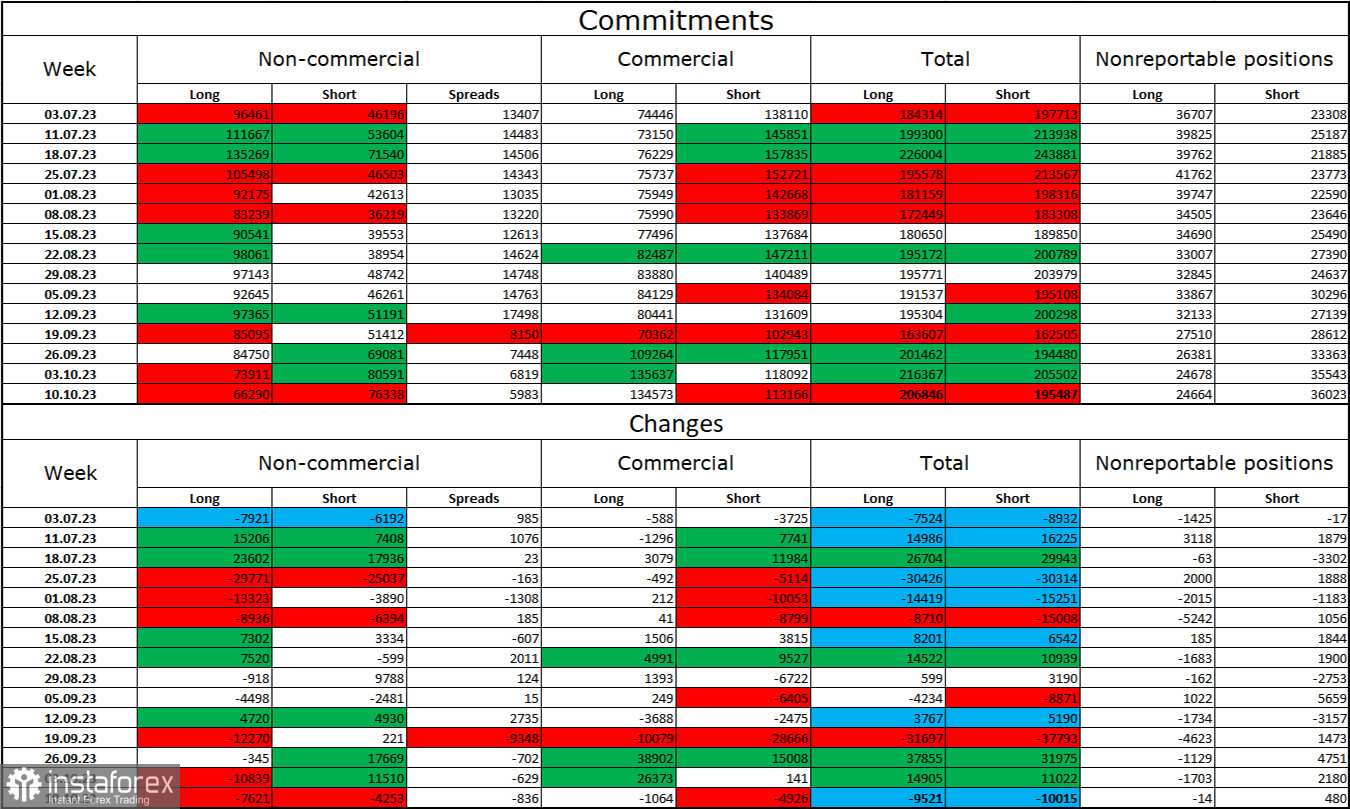

Commitments of Traders (COT) Report:

The sentiment of "non-commercial" traders in the past reporting week has become more "bearish." The number of long contracts in speculators' hands decreased by 7,621 units, while the number of short contracts decreased by 4,253 units. The overall sentiment of major players has turned "bearish," and the gap between the number of long and short contracts is increasing, but now in the opposite direction: 66,000 versus 76,000. In my opinion, the British pound still has excellent prospects for further decline. I do not expect a strong pound rally in the near future. I believe that over time, bulls will continue to liquidate their buy positions, as in the case of the European currency. Only a close above the descending corridor on the 4-hour chart will make me consider a new "bullish" trend. I am not expecting a decline in the British pound this week, but I consider it possible.

News calendar for the US and the UK:

UK – Unemployment Rate (06:00 UTC).

UK – Change in Jobless Claims (06:00 UTC).

UK – Change in Earnings (06:00 UTC).

US – Retail Sales (12:30 UTC).

US – Industrial Production (13:15 UTC).

On Tuesday, the economic events calendar includes five interesting entries, one of which has already been released, and two seem to be missing. The impact of the information background on market sentiment today will be of moderate strength.

GBP/USD forecast and trading recommendations:

Short positions on the British pound were possible when closing below the ascending corridor on the hourly chart, with targets at 1.2250 and 1.2175. Both have been realized. New short positions on the British pound will be possible when closing below 1.2175, with targets at 1.2112 and 1.2039. Buys today are possible on an hourly chart rebound from the level of 1.2112, with targets at 1.2175 and 1.2250.