Despite the sharp rise in oil prices amid events in the Middle East, the Canadian dollar has failed to gain significant support.

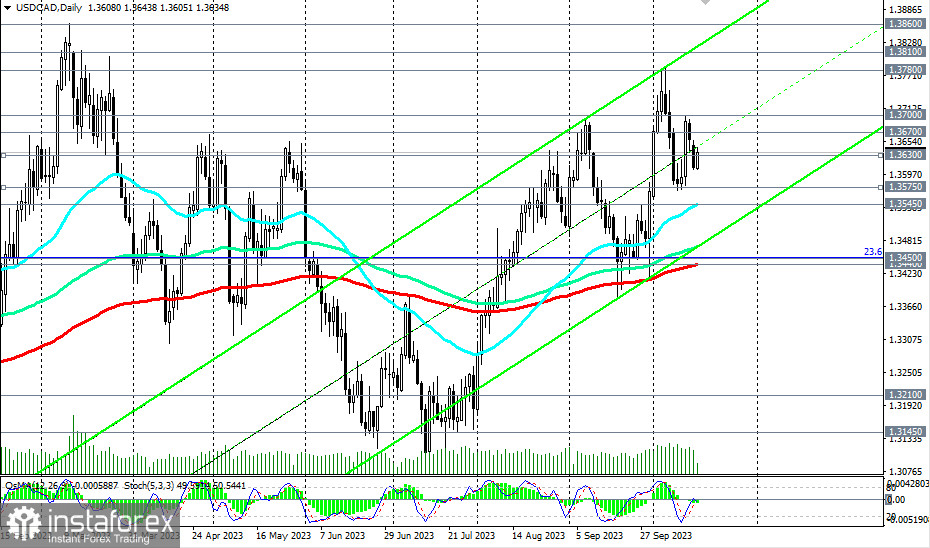

The USD/CAD pair still maintains its positive long-term and medium-term dynamics despite the decline over the past two trading days.

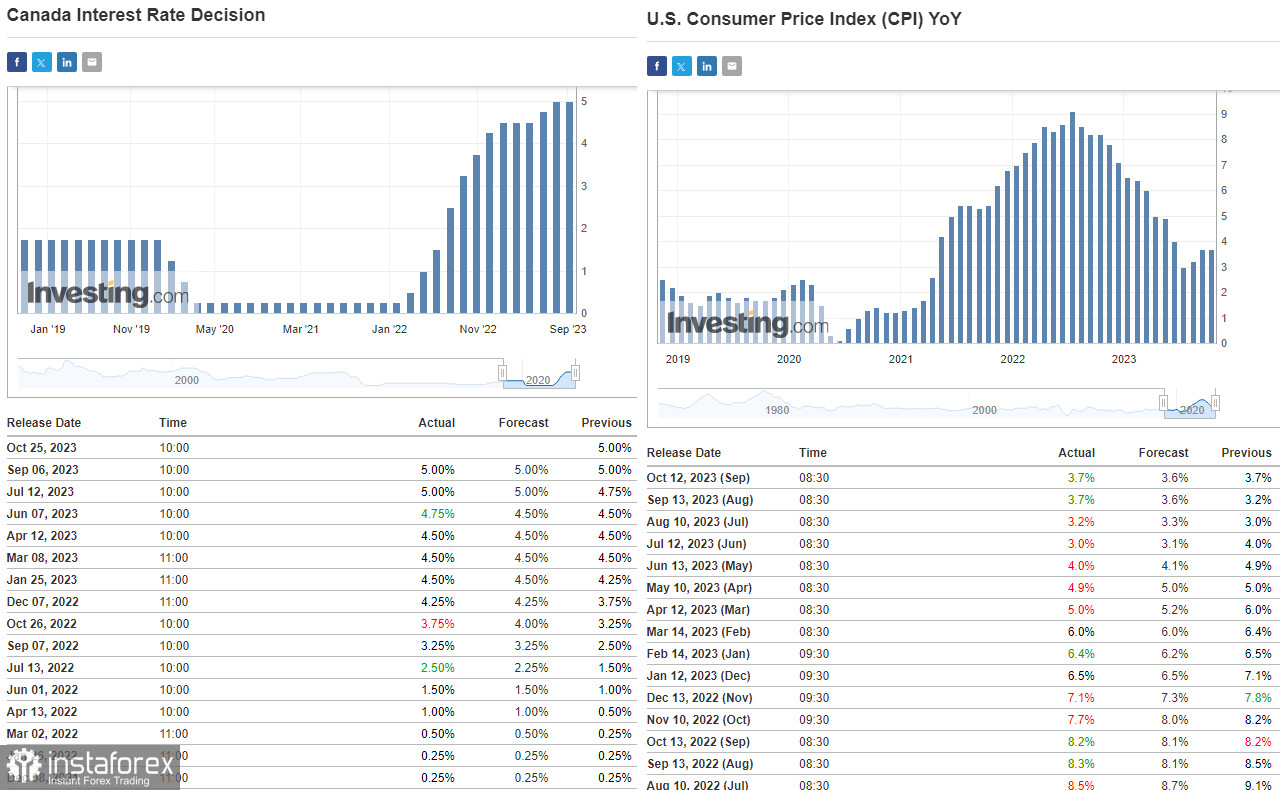

Today at 12:30 GMT, fresh inflation data for September will be published in Canada. It is expected that the core and underlying annual indicators will remain close to their current levels at 4.0% and 3.3%, respectively.

This means that market participants' expectations regarding the Bank of Canada's tight monetary policy remain intact.

At the beginning of last month, as is known, the leaders of the Bank of Canada decided to keep the key interest rate unchanged at 5.0%. In their accompanying statement, they reiterated their readiness to raise rates again, as they are concerned about the persistence of inflationary pressures.

In the first week of the month, Statistics Canada released data on the national labor market: in September, the unemployment rate decreased by 0.1% to 5.5%, and the number of employed persons increased by 63,800 (versus a forecast of an increase of 20,000 and 39,900 a month earlier).

The next Bank of Canada meeting will take place on October 25, and the tense national labor market and ongoing high inflation are intensifying discussions about the possibility of another interest rate hike by the Bank of Canada. This is a fundamental bullish factor for the Canadian currency.

At the same time, the recent dovish comments from Federal Reserve officials are having a negative impact on the U.S. dollar. For example, Federal Reserve Bank of Philadelphia President Patrick Harker recently stated that the Fed could halt its monetary policy tightening despite the increase in employment and relatively high inflation. In his opinion, to reduce inflation in the United States, it is sufficient to maintain interest rates at their current high levels, while the September Consumer Price Index does not indicate new risks of inflation acceleration.

By the way, at the same time today (at 12:30 GMT), retail sales data for September will be presented, and a little later, industrial production data in the United States. It is expected that the sales dynamics will slow down from 0.6% to 0.3%, and industrial production volumes will decrease from 0.4% to 0.0%. These data could be negative for the USD.

Taken together with the data from Canada, today's macro statistics from the United States may put pressure on the USD/CAD pair towards its corrective decline. However, the overall risk balance still leans the pair towards its rise.

From a technical perspective, USD/CAD is developing, as noted, an upward trend, trading in the zone of medium-term (above the 1.3440 support level), long-term (above the 1.3145 support level), and global (above the 1.2700 support level) bullish markets.