GBP/USD

The British pound closed the day with a black candle as it awaits today's inflation data, piercing the embedded price channel support line. Such pessimism is linked to the expectations of today's UK inflation report for September.

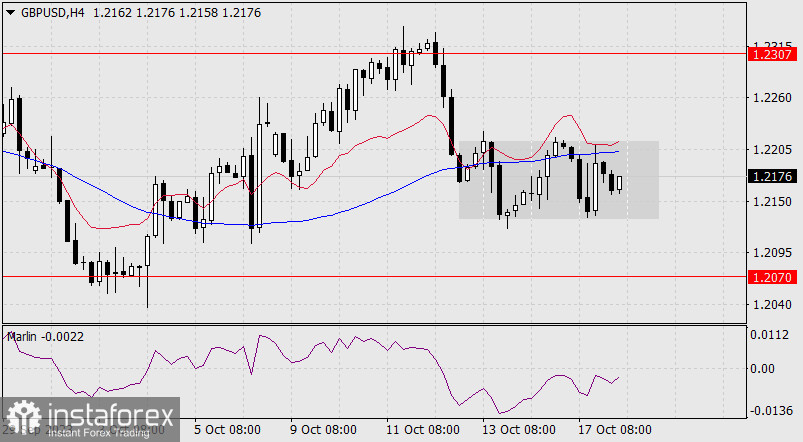

The core CPI is expected to drop from 6.2% YoY to 6.0% YoY, and the CPI is expected to decrease from 6.7% YoY to 6.5% YoY. If the forecasts are realized, it may lead to a breakout towards 1.2070, and breaching this nearest support level could push the price back into a bearish trend with a target around 1.1900. A positive scenario would be confirmed once the price breaches yesterday's high at 1.2215. The nearest bullish target would be the level of 1.2307. The Marlin oscillator is in the positive territory, favoring the main scenario of an upward movement.

On the 4-hour chart, the price has not yet been able to surpass the resistance indicator lines. Marlin is in downtrend territory, and on this chart, the situation is bearish. It's clear that the pound is generally moving within a range, clearly awaiting the inflation data. It's worth noting that the break above the MACD line and the balance line coincides with the price breaching yesterday's high. We are awaiting further developments.