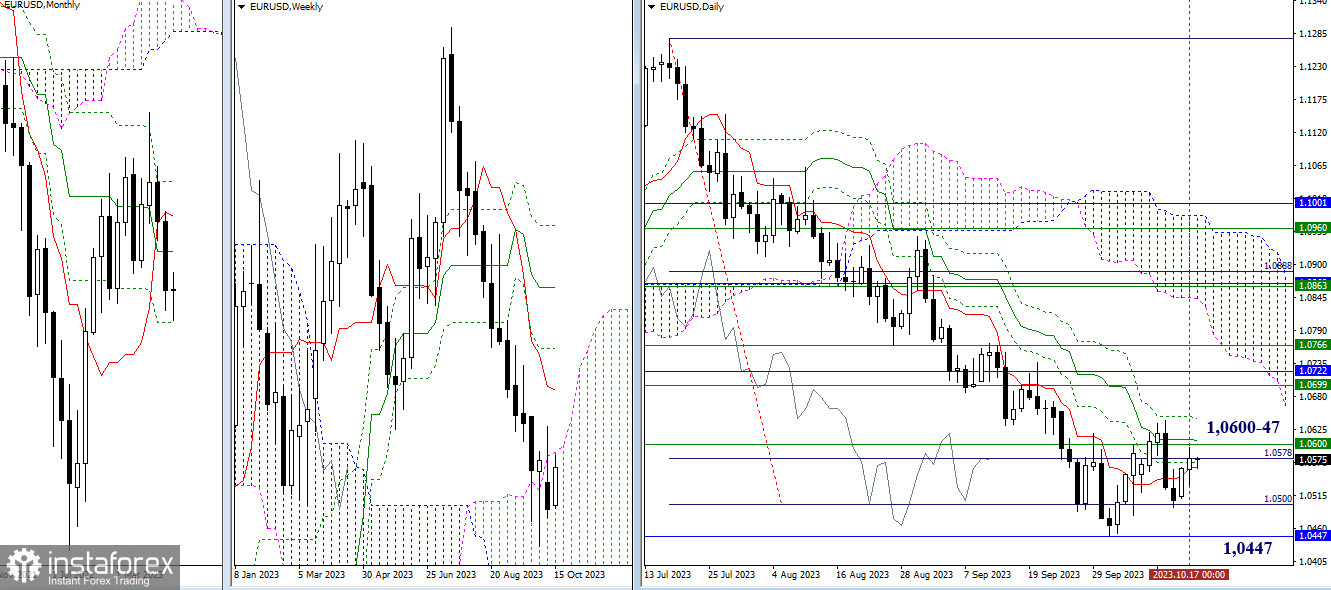

EUR/USD

Higher Timeframes

Yesterday, bulls continued to maintain their initiative; however, significant results are still lacking. The center of attraction, at the moment, is the daily short-term trend (1.0562), while other nearby reference points retain their significance and positions. Bullish players still face the daily Ichimoku cross (1.0571 - 1.0609 - 1.0647), reinforced by the weekly short-term trend (1.0600). Meanwhile, bearish players can only consider new prospects after the recovery of the downward trend (1.0449) and breaking through the monthly support (1.0447).

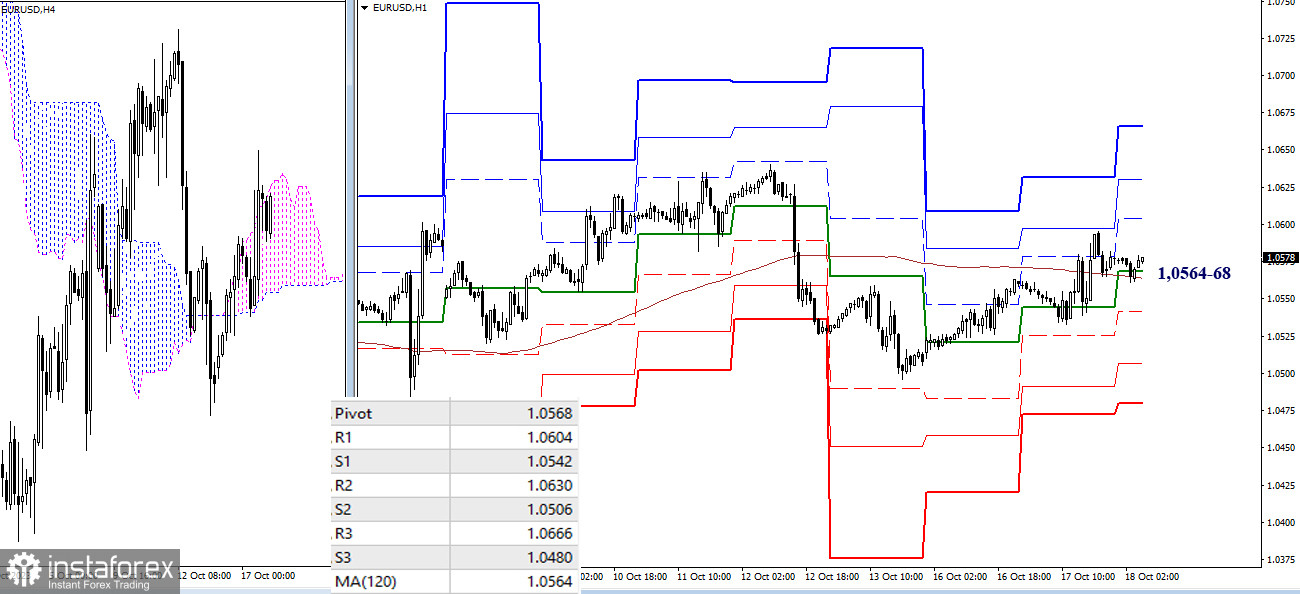

H4 - H1

On lower timeframes, the weekly long-term trend has taken on an almost horizontal position in recent days, indicating a lack of a strongly directional movement. Today, key levels have merged in the range of 1.0564-68 (weekly long-term trend + central pivot point of the day). Maintaining positions above these key levels will support the overall advantage for the bullish players, creating opportunities for strengthening the bullish sentiment. The reference points for intraday upward movement today can be noted at 1.0604 - 1.0630 - 1.0666 (resistances of classic pivot points). Bearish reference points will become relevant after the pair firmly consolidates below the key levels (1.0564-68), and they may come into play during a decline. Currently, bearish reference points are at 1.0542 - 1.0506 - 1.0480 (supports of classic pivot points).

***

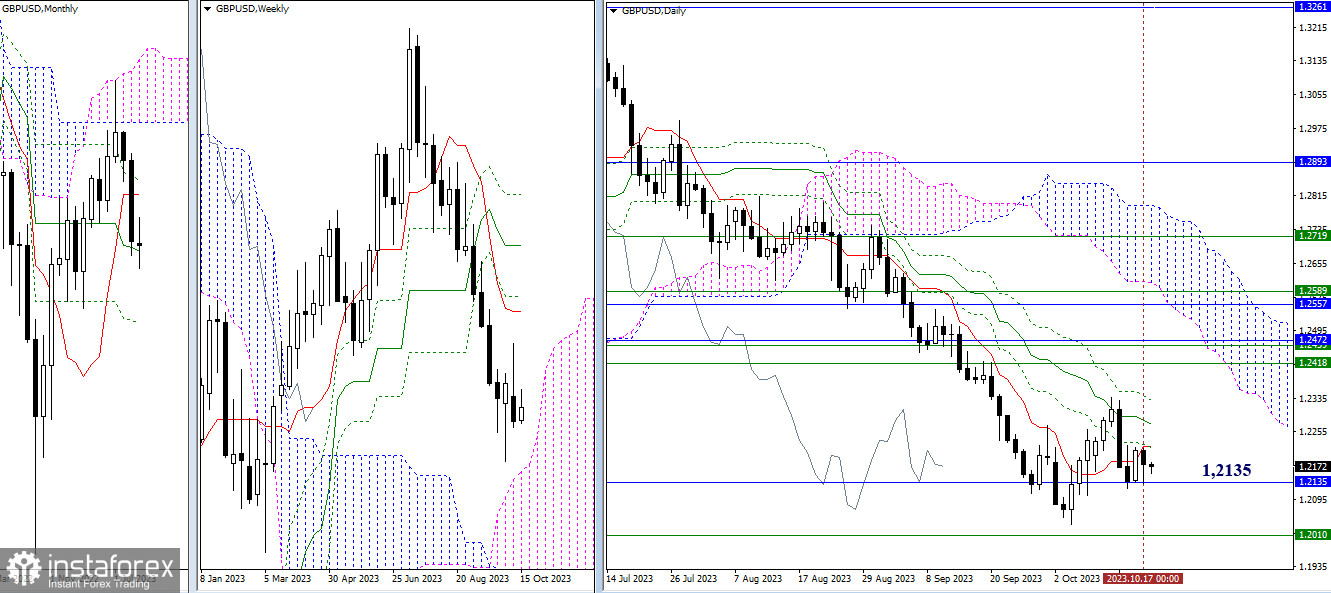

GBP/USD

Higher Timeframes

After another slowdown in the range of the monthly medium-term trend (1.2135), the pair prefers to consolidate, and the development of a directional movement is currently absent. This situation aligns with the earlier conclusions and expectations. For bullish players, it is crucial to eliminate the death cross of the daily Ichimoku cloud (1.2283 - 1.2341), only then can they turn their attention to the zone of the next resistances at 1.2418 - 1.2472 (weekly and monthly levels). To open up new perspectives in this market segment, bearish players need to move out of the influence zone of the monthly medium-term trend (1.2135), restore the downward trend (1.2036), and secure a position in the weekly cloud (1.2010).

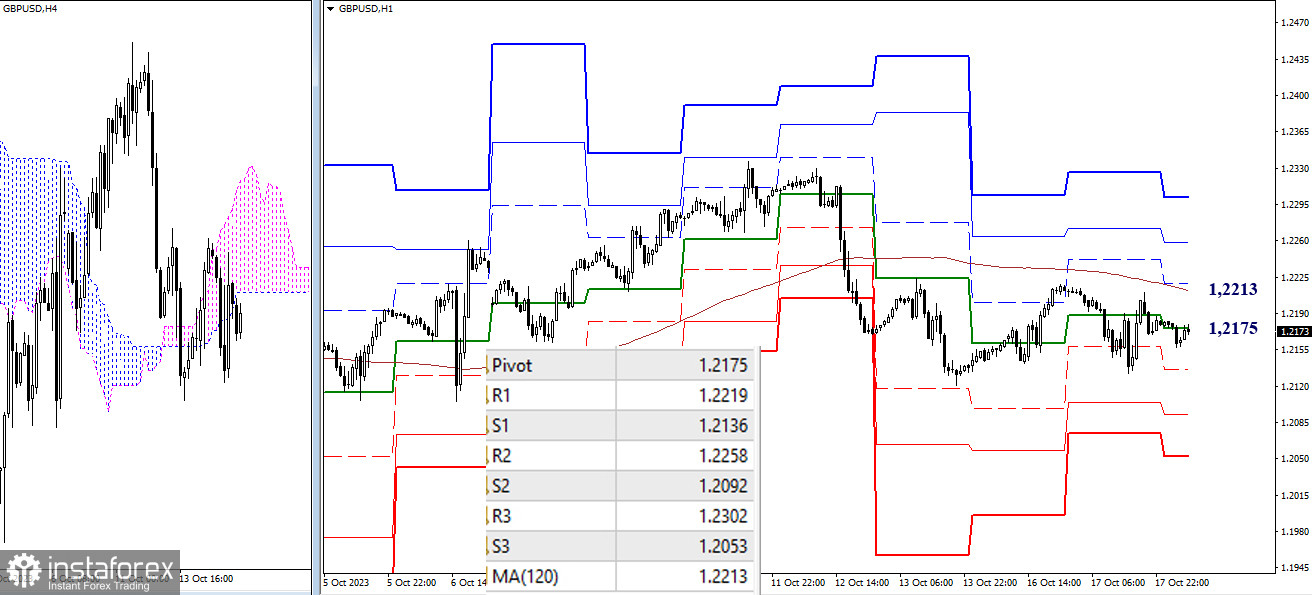

H4 - H1

On lower timeframes, the pair is trading sideways, with the main advantage still on the side of bearish players. In case a new phase of decline unfolds, the supports of the classic pivot points (1.2136 - 1.2092 - 1.2053) may come into play during intraday trading today. To change the current balance of power, it is important to overcome and firmly consolidate above the weekly long-term trend (1.2213). In subsequent position recoveries, the bullish players on the intraday scale can utilize the resistances of the classic pivot points (1.2219 - 1.2258 - 1.2302).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)