Despite receiving decent economic reports, the dollar continued to lose ground due to the escalating Palestinian-Israeli conflict.

The recent data initially strengthened the US dollar. The forecasts were entirely negative, but retail sales, which were expected to slow from 2.5% to 1.9%, increased from 2.9% to 3.8%. So, the data itself is great, and the previous results were even revised upwards. However, the previous data on industrial output was revised from 0.2% to 0.1%. Instead of falling by 0.8%, it remained unchanged. So, the industrial data is somewhat worse than expected but still better than anticipated.

However, the dollar's growth was short-lived. The greenback started to lose ground even after receiving positive US data. This was due to reports from the Gaza Strip. In the evening, a bomb or rocket hit a hospital. According to the Gaza Health Ministry, hundreds of people died. Israel blamed Palestinian terrorist organizations, while the entire Arab world blamed Tel Aviv for the incident. Mass demonstrations with calls for revenge have erupted all over the Middle East. So, the Palestinian-Israeli conflict could escalate and engulf the entire region. For the United States, the situation is further complicated by the fact that this happened just before US President Joseph Biden's visit to Israel, which is scheduled for today. After that, he was supposed to go to Jordan and conduct negotiations, including with representatives of Palestine and the Gaza Strip. But after the hospital incident, the King of Jordan canceled the meeting. The United States is genuinely involved in this conflict, and given the existing tensions in the world, this could lead to a strain of forces. This is why the dollar weakened. In fact, it started to lose its position immediately after the Hamas attack on Israel.

Take note that EUR/USD saw little volatility on Tuesday. This is due to the mixed nature of the news background. The economic reports were excellent, while the geopolitical background is rather bleak.

Nevertheless, it seems that there is a clear trend towards a deteriorating foreign policy backdrop for the United States. This could be used as a reason for the dollar's corrective move, especially in the absence of significant economic reports. We don't anticipate any significant surprises from European inflation, as these are final figures intended to confirm the preliminary assessment, which the market has already factored in.

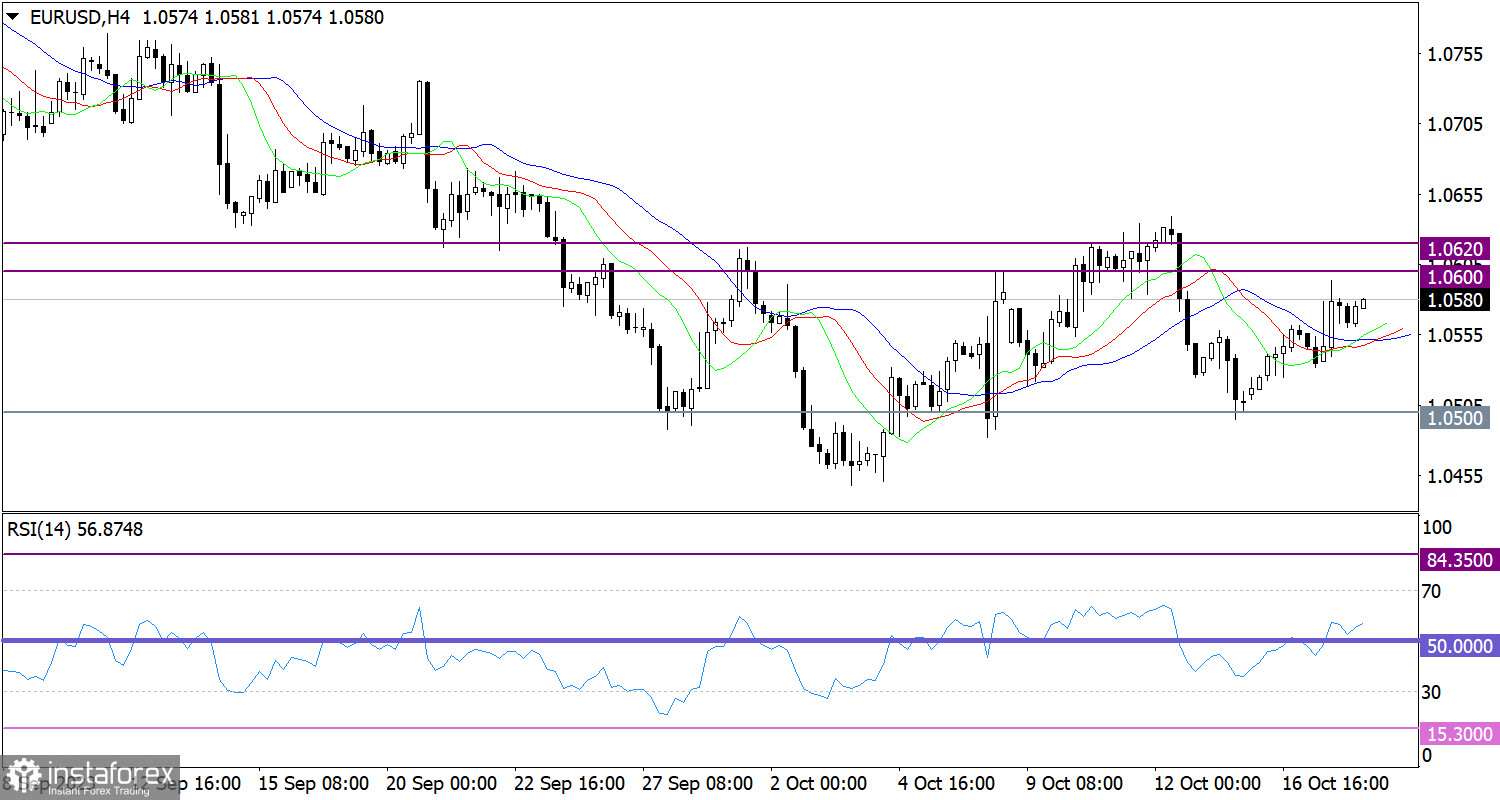

EUR/USD is in an upward phase, having nearly reached the level of 1.0600 from the support level of 1.0500, which points to the fall in the volume of long positions.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the bullish sentiment.

On the same chart, the Alligator's MAs changed direction from a downtrend to an upward cycle.

Outlook

Keeping the price above the 1.0620 level may eventually lead to further growth. Until then, the 1.0600/1.0620 area will act as resistance.

Complex indicator analysis indicates a bullish phase in the short-term and intraday periods.