EUR/USD

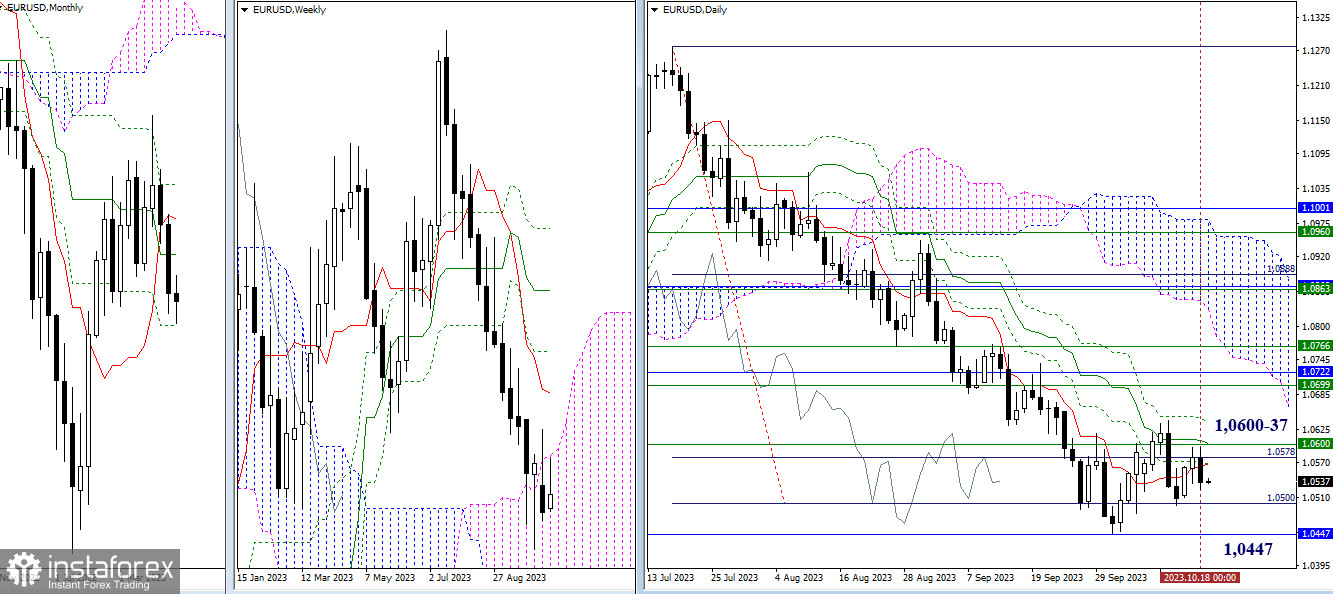

Higher Timeframes

Bearish players had the initiative yesterday, but this did not change the general situation. The market remains within the daily short-term trend's attraction zone (1.0562). The reference points for bullish players continue to be the levels of the death cross of the daily Ichimoku cloud (1.0601 - 1.0637), reinforced by the upper boundary of the weekly cloud (1.0600). In the current situation, the support levels of the daily target (1.0500) and the final level of the monthly Ichimoku cross (1.0447) continue to be relevant for the bears. Breaking through these supports with a secure consolidation below can restore the downward trend and indicate new prospects.

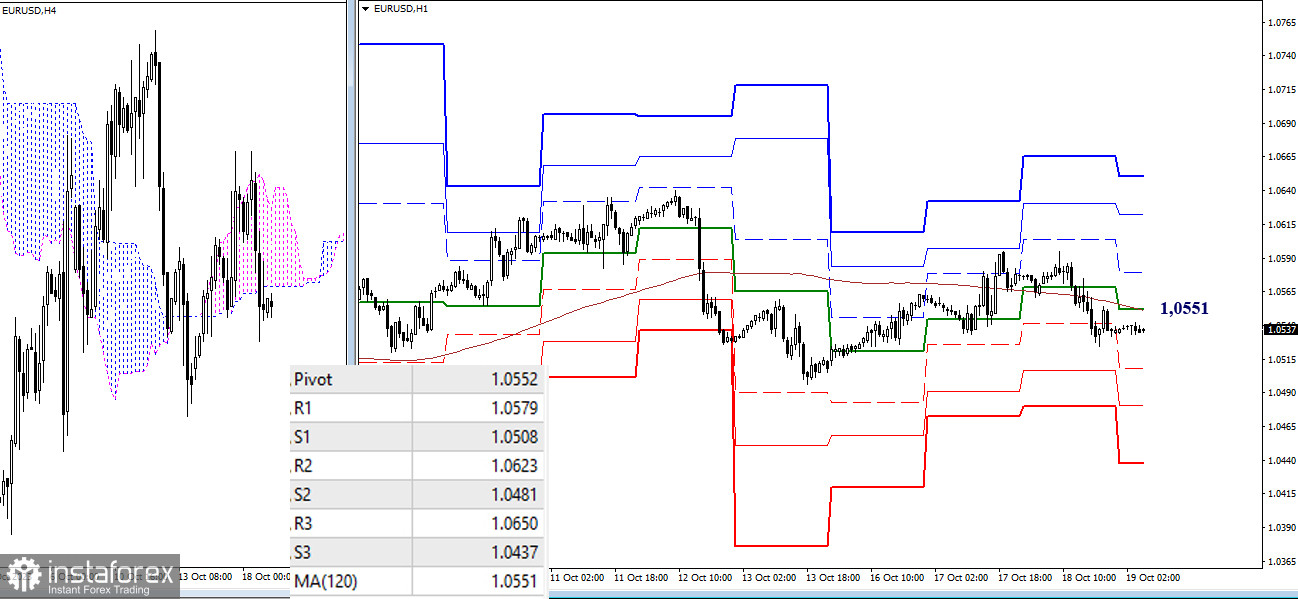

H4 - H1

On the lower timeframes, the market has returned to the resistance of the weekly long-term trend (1.0551) and the bearish zone relative to the H4 Ichimoku cloud. As a result, the advantage has shifted back to the bears' side, with targets for intraday decline at the classic pivot points (1.0508 - 1.0481 - 1.0437). Breaking through the most significant levels, which have combined at the 1.0551 level (weekly long-term trend + central pivot point of the day), and consolidating above will impact the current balance of power, creating opportunities for strengthening bullish sentiments once again. In this case, the reference points for an upward move within the day will be 1.0579 - 1.0623 - 1.0650 (resistance levels of the classic pivot points).

***

GBP/USD

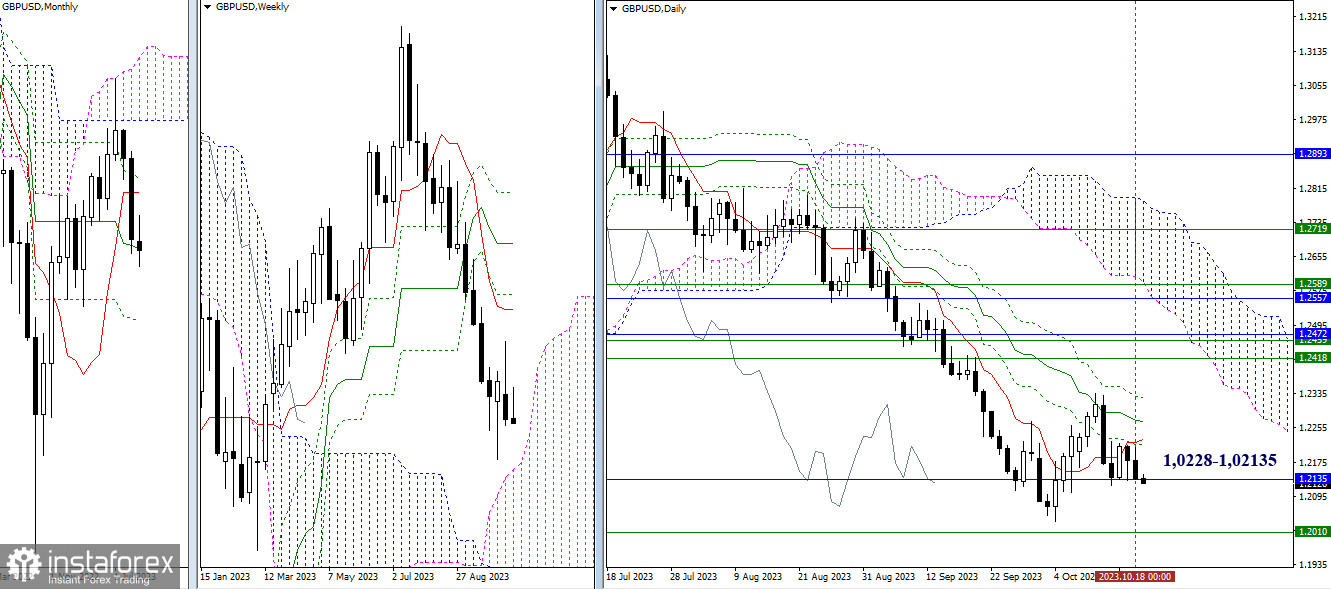

Higher Timeframes

On the daily timeframe, consolidation continues to develop, currently confined within the range of the daily short-term trend (1.0228) and the monthly medium-term trend (1.02135). Trading within these boundaries maintains uncertainty. To change sentiments and create new opportunities, the market must move beyond the consolidation, preferably surpassing the following reference points. For bulls, it's crucial to eliminate the death cross of the daily Ichimoku cloud (1.2283 - 1.2341), and for bears, restoring the downward trend (1.2036) and consolidation in the weekly cloud (1.2010) is a must.

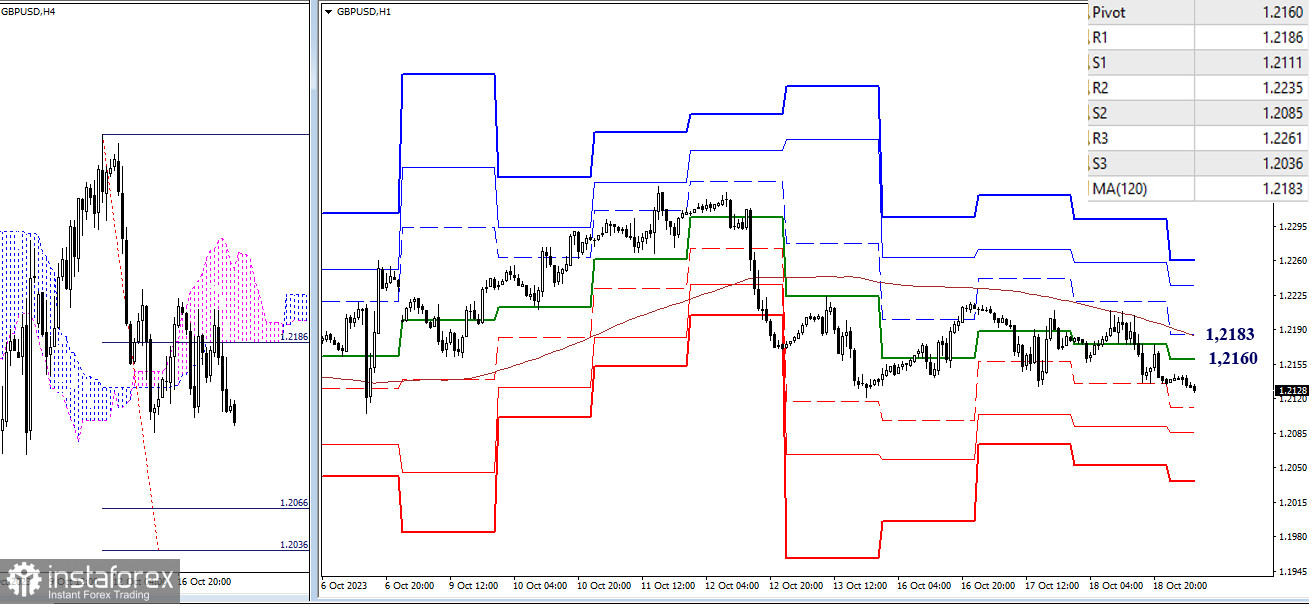

H4 - H1

On the lower timeframes, bears maintain their advantage despite the sideways movement. Key levels still act as resistance, which today are located at 1.2160 - 1.2183 (central pivot point of the day + weekly long-term trend). Consolidation above and a reversal of the moving average could change the current balance of power. Next, attention within the day will be on testing and breaking through R2 (1.2235) and R3 (1.2261). If the decline develops and bearish sentiments strengthen, interest in the current conditions will shift towards passing through the support levels of the classic pivot points (1.2111 - 1.2085 - 1.2036) and targeting the breakout of the H4 cloud (1.2066 - 1.2036). Breaking the H4 target would allow the restoration of the downward trend on higher timeframes.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)