The market remained indifferent to U.K. inflation, which remained unchanged at 6.7%. However, the pound eventually retreated. What's interesting is that this movement started several hours after the release of the U.K. CPI report. Stubborn UK inflation raises the possibility of more tightening for the Bank of England, which should strengthen the pound. Equally intriguing is the fact that the dollar started to broadly rise in the absence of economic releases or other news capable of influencing market sentiment. Therefore, it raises questions about possible speculations or excessive emotions. Such possibilities shouldn't be dismissed, but they cannot be confirmed or refuted either. Therefore, these speculations remain purely speculative.

In any case, the dollar is rising. Today's unemployment claims report will not impact the situation since the overall figure is expected to increase by just 8,000, which is a negligible change not even worth considering. Therefore, it's necessary to monitor the situation. Either the dollar will continue to rise due to momentum, or it may start returning to the values it held before yesterday's rise before the start of the U.S. trading session.

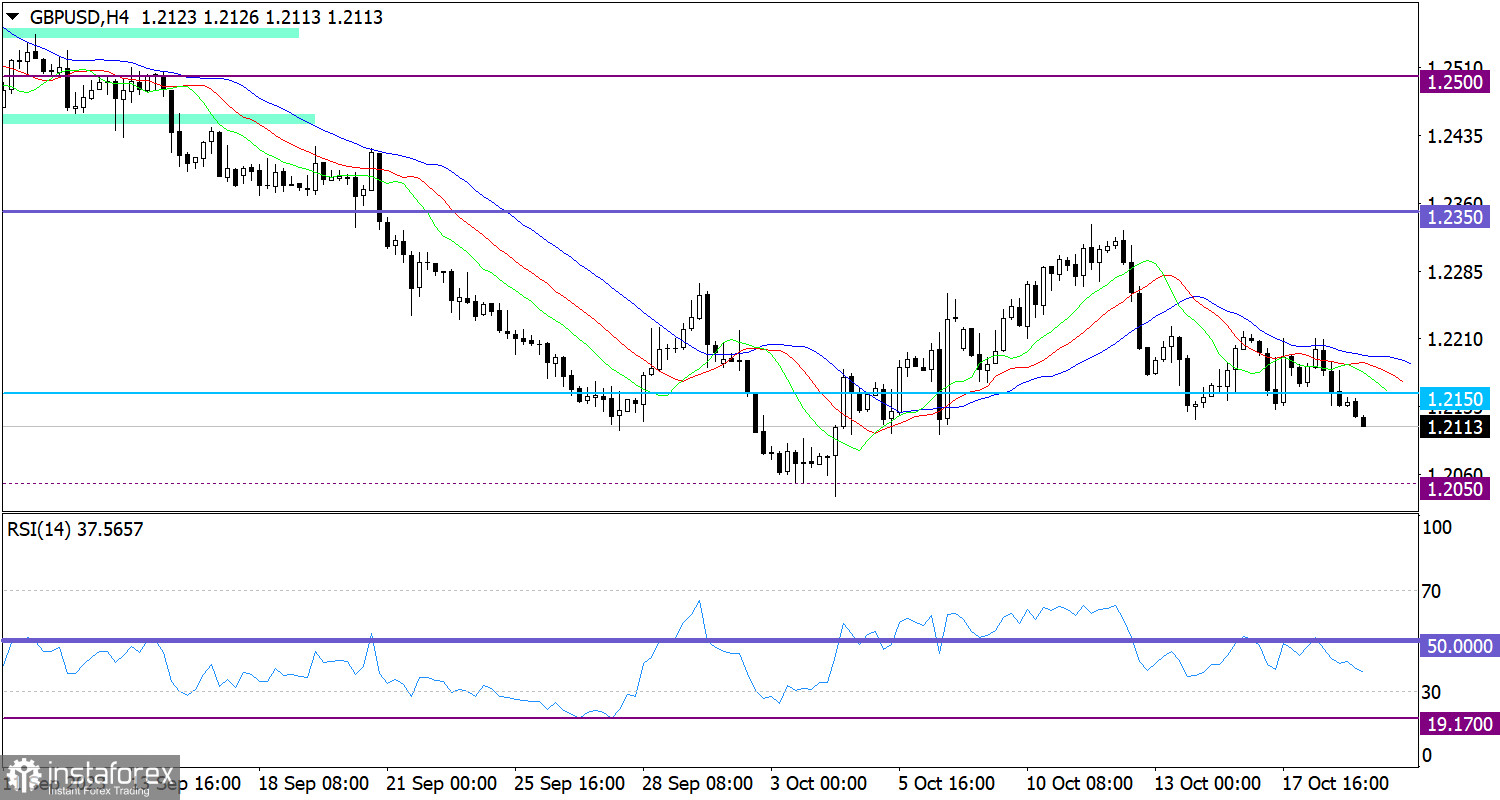

The GBP/USD pair not only managed to stay below the 1.2150 level but extended its previously set downward cycle. The increase in the volume of short positions indicates the possibility of a subsequent decline.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, indicating an increase in selling volumes.

On the same chart, the Alligator's MAs are headed downwards, corresponding to the price's direction.

Outlook

In case the price follows the current momentum, we expect the pair to move towards the upper psychological level of 1.2000/1.2050. This could extend the medium-term trend.

Complex indicator analysis indicates a downward cycle in the short-term and intraday periods.