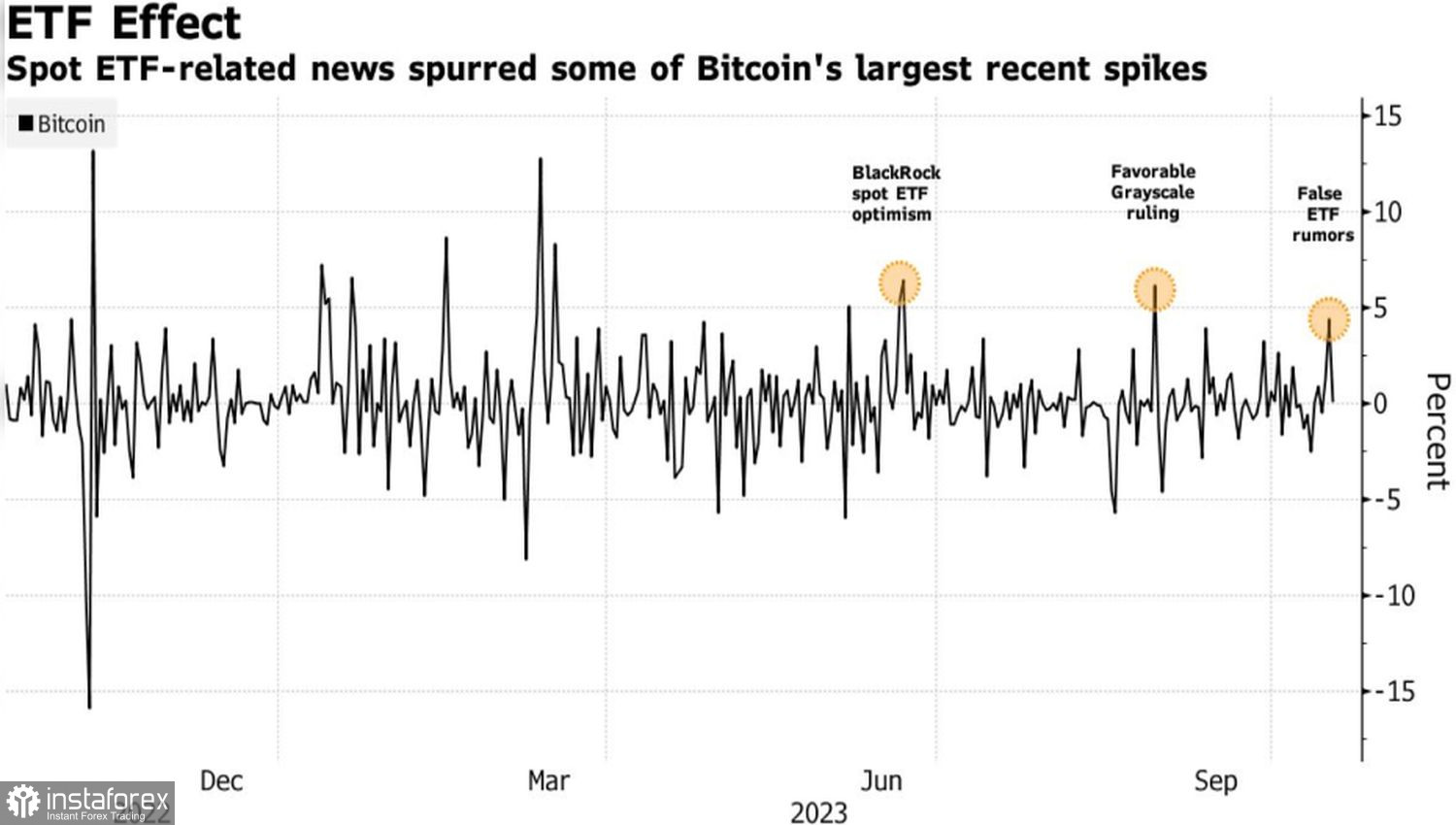

A viral message on social media claiming that the Securities and Exchange Commission (SEC) had approved BlackRock's application to create an ETF with Bitcoin as the underlying asset stirred up the cryptocurrency market. BTC/USD quotes immediately surged by 10%, triggering the closure of short positions worth $95 billion. The information turned out to be false, but the money lost was real, and someone suffered a loss.

Those were exciting moments during which Bitcoin soared above $30,000, once again proving that the higher you climb, the harder you fall. After months of reduced volatility and waning investor interest in crypto assets, this surge in BTC/USD prices was a soothing balm for its enthusiasts.

No matter how rapid Bitcoin's rollercoaster ride may seem, the key is to draw the right conclusions. There are two main takeaways. Firstly, there isn't a lot of money in the crypto market right now, and even relatively small speculations can lead to significant price spikes in tokens. Secondly, news about the potential approval of an ETF application by BlackRock or another major investment company is still not factored into BTC/USD quotes.

Bitcoin's Reaction on ETF News

The market's reaction to the ETF news was essentially a rehearsal. Thanks to the false message on social media, investors received a guide on how to act if the SEC makes a positive decision. Predictions about the timing of this decision vary widely, but January seems the most likely month.

The rehearsal of the market's response to the news about BlackRock's ETF approval disrupted Bitcoin's attempts to regain a strong connection with U.S. stock indices. The leader of the cryptocurrency sector remains a risky asset, and willingly or not, it reacts to the dynamics of the S&P 500 and Nasdaq 100. Nevertheless, when you see the chaos in financial markets, you begin to understand why the BTC/USD correlation with stocks has diminished.

Indeed, the crisis in the Middle East has disrupted many intermarket relationships. The rally in the yield of U.S. 10-year Treasury bonds above 4.9%, the highest level since 2007, is no longer causing U.S. stock indices to fall but is causing the U.S. dollar to rise. Investors are paying attention to the strength of the economy and slowing inflation. In other words, it's a Goldilocks scenario, favorable for stocks. Bitcoin gets its slice of the pie as well.

The outcome of events in Israel is uncertain, which adds extra unpredictability and could benefit cryptocurrencies. However, while they wait for the fate of BlackRock's ETF application to unfold, the digital asset market may experience consolidation once again.

Technically, on the daily BTC/USD chart, an Adam and Eve pattern has formed. Traditional trading in a narrow range after this pattern allows traders not to rush and assess Bitcoin's prospects. A breakout above the $29,000 resistance will be a reason to buy, while a successful breach of the $28,100 support will be a signal to sell.