Recently, the determining factor has become geopolitics rather than macroeconomics or common sense. This makes it quite challenging to assess, let alone predict, the events on the markets. Take note that due to the continuous flow of news from the Middle East, something incredibly important may have been overlooked. It happened on a Wednesday, but the reports only surfaced on Thursday. What's interesting is that major media outlets barely covered this. The question of "Why?" is quite intriguing. This concerns the United States conducting experiments at its nuclear testing ground in Nevada. To be clear, these experiments did not involve detonating a nuclear bomb. As the U.S. Department of Energy reports, the tests included the "high explosive and radiographic indicators." The term "nuclear charge" is conspicuously absent from this announcement.

No official comments or statements have been made by government officials. What's even more striking is that this happened on the very same day when the State Duma of the Russian Federation decided to withdraw its ratification of the Treaty on the Comprehensive Nuclear-Test-Ban Treaty. By the way, the United States had no intention of ratifying this treaty in the first place. Reports about these tests started emerging on the night between Wednesday and Thursday. Even before the opening of the U.S. session, there were enough of these reports to merit attention. However, once again, this information wasn't prominently covered by major media outlets, and if they did mention it, it was only in the form of a brief news ticker. This event is shocking in and of itself. Amid escalating tensions and conflicts, in which the United States is somehow involved, this takes on a truly terrifying aspect. Apparently, this played a significant role in the U.S. dollar's broad weakness, which started during the European session.

It's difficult to predict how events will unfold from here. This will depend on statements by official figures, not only from the United States but also from the European Union, China, and Russia. If this leads to increased tension and mistrust, the U.S. dollar will likely fall. From an outsider's perspective, the United States seems to have done something incredibly dangerous and harmful. These tests served as a reminder of the real nuclear threat, and they bear the responsibility for that.

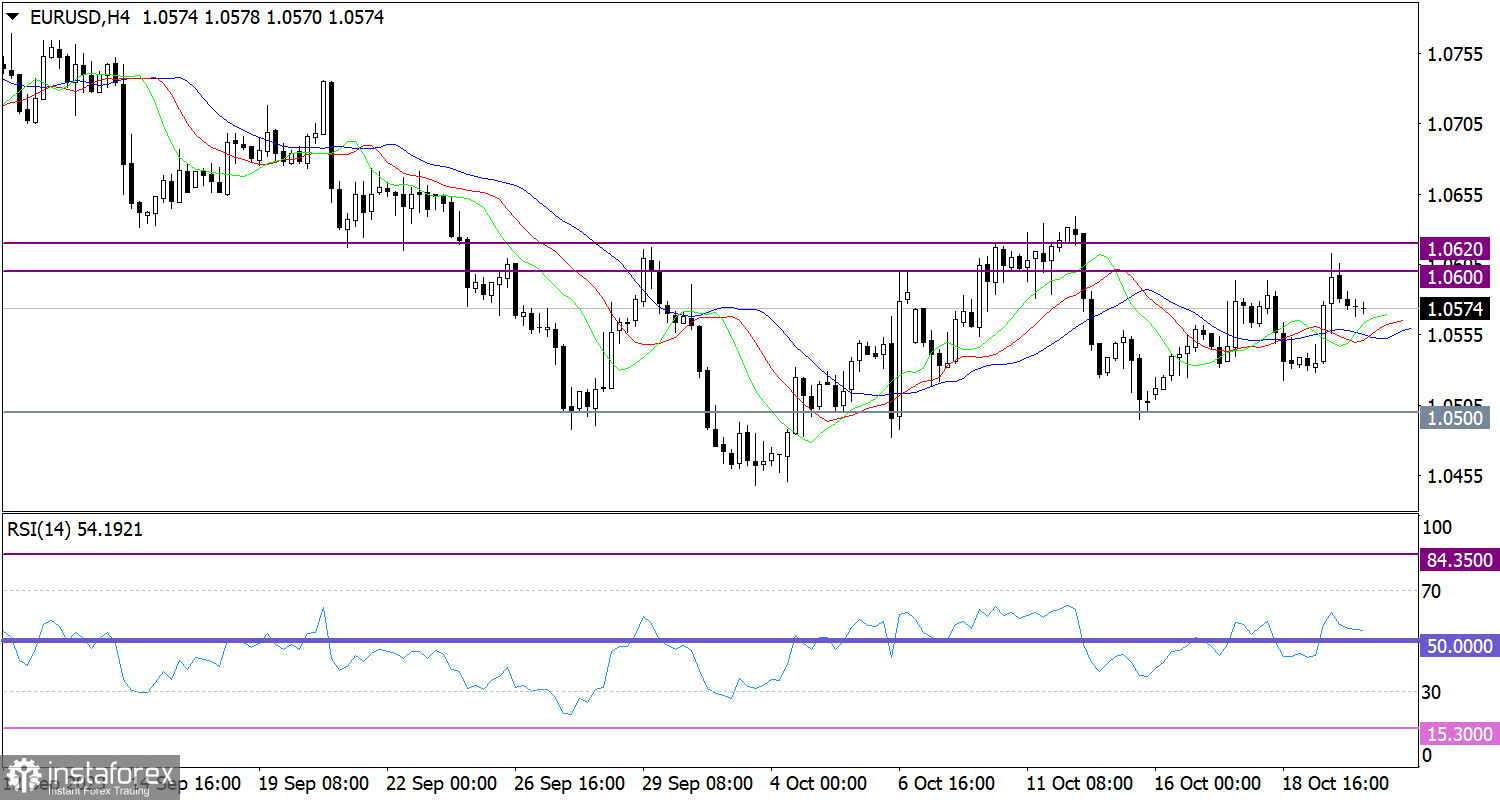

The volume of long positions fell around the 1.0600/1.0620 resistance area. As a result, the pair retreated, and the dollar managed to recover from its recent decline.

On the four-hour chart, the RSI indicator is moving in the upper area of 50/70. It crossed the 50 mid line while the euro rallied.

On the same chart, the Alligator's MAs are headed upwards, but the signal is not stable.

Outlook

To extend the bullish scenario, the price needs to consolidate above the resistance area of 1.0600/1.0620. Otherwise, the dollar will use the current rebound to climb towards the 1.0500 level.

In the short-term period, complex indicator analysis suggests a downward move as the price rebounds from the resistance level. In the intraday period, the indicators point to a residual upward signal due to the recent euro rally.