In recent weeks, the Federal Reserve has transformed from one of the most pragmatic central banks into one of the most unpredictable. It all started when several FOMC members stated that additional interest rate hikes were no longer needed. I do not know why these statements were made when inflation was rising in July and August and reached 3.7% in September. Perhaps the Fed understands that every rate hike is bringing the U.S. economy closer to a recession, but the latest GDP data clearly show that there is no need to fear a recession in the near future. The Fed has the ability to continue tightening, but for some reason, it refuses to do so.

Furthermore, Fed Chair Jerome Powell didn't close the door to the central bank hiking interest rates again, but it will depend on economic data. Powell merely reiterated the rhetoric he had consistently voiced before. However, his comments had a significant effect, especially against the backdrop of his colleagues' dovish comments.

Rate hike odds for the Fed at the November meeting dropped to nearly zero. This means that the market is not expecting a tightening at the next meeting, which is scheduled in about two weeks. On Friday, Raphael Bostic, the President of the Federal Reserve Bank of Atlanta, said that the central bank does not plan to lower interest rates before the middle of next year, at the earliest. He also mentioned that inflation has come down a lot and should continue, while the economy continues to show excellent resilience. However, Bostic's comments refer to the situation three months ago. Currently, inflation is not decreasing; in fact, it is increasing. To slow down inflation, it would be necessary to continue raising interest rates.

Furthermore, Bostic said that the US will not see a recession, and inflation will decrease to 2%. "Policymakers need to be cautious. The Fed may not cut interest rates until late 2024. The Fed will fulfill its mandate of promoting maximum employment and stable prices," believes one of the members of the Fed Board of Governors.

Based on everything mentioned above, I can personally conclude that the Federal Open Market Committee (FOMC) does not have a unanimous opinion, and each of its members is not certain about the prospects for lowering inflation. Therefore, despite the dovish statements by Bostic, Logan, and their colleagues, I still expect a new rate hike and the dollar to rise further.

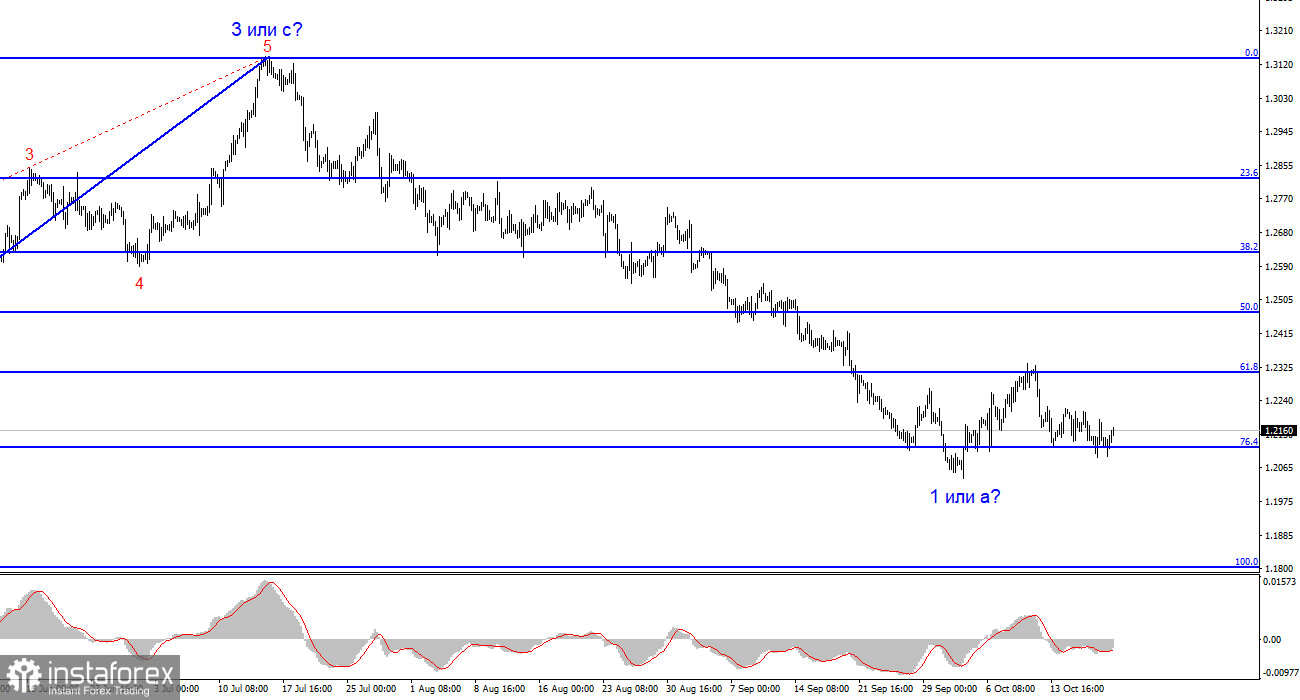

Based on the analysis conducted, I conclude that a bearish wave pattern is currently being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to break through this level indicates that the market is ready to build a corrective wave. In my recent reviews, I warned you that it is worth considering closing short positions because there is currently a high probability of forming an upward wave. Since the pair has not breached the 1.0637 level, corresponding to 100.0% according to Fibonacci, this could indicate that the market is ready to resume the downward movement, but I believe that Wave 2 or b will turn out to be three-wave.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can expect from the pound in the near future is the formation of Wave 2 or b. However, there are currently significant issues, even with the corrective wave. At this time, I would not recommend new short positions, but I also do not recommend longs because the corrective wave appears to be quite weak.