I previously discussed the situation regarding inflation and interest rates and concluded that it is necessary for another Federal Reserve rate hike. However, economists at Radobank believe that an additional rate hike is no longer required because the bond market will do the Fed's work. To briefly recap, the yield on the benchmark 10-year U.S. Treasury note rose above 5.0%, which significantly increased investors' appetite. Investment flows are being redirected into bonds (or bank deposits, which is also profitable now) from the real economy. As a result, the economy starts to slow down because the money is being invested in passive income sources rather than businesses and companies.

If the economy slows down, inflation also begins to decelerate. Currently, it stands at 3.7%, and core inflation is slightly higher. In my opinion, one bond market alone cannot achieve the goal of bringing inflation back to 2%. However, Fed Chair Jerome Powell has tried to convey to the market that the tightening cycle is not definitively over. Radobank experts have concluded that employment growth, low unemployment, and strong GDP growth are likely to keep the door open to further hikes, but "today's neutral performance does not suggest that we are going to see a hike on November 1. But that option is still open for the December meeting".

Instead, the rate may rise at the December meeting as a final move in the entire tightening cycle. Radobank still expects the bond market to do the Fed's work, but if economic data remain strong, sooner or later the FOMC will have to resume its hiking cycle.

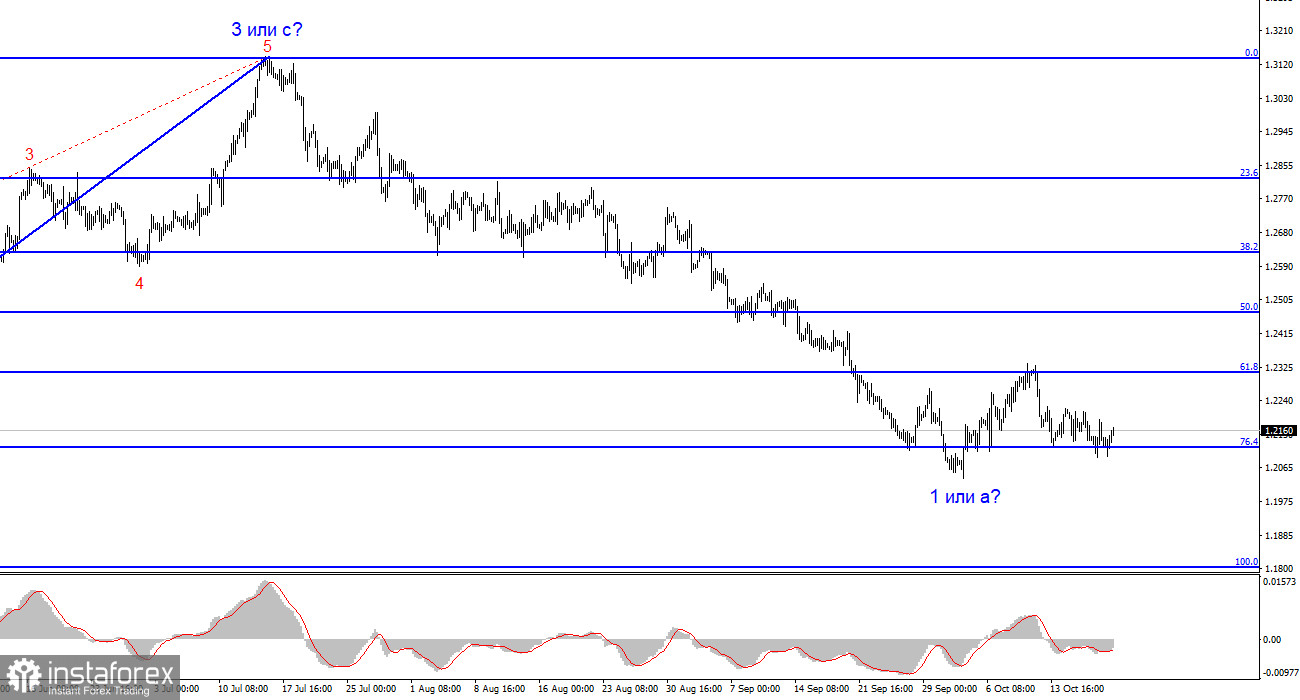

In my opinion, such information will support the US dollar. The first factor playing in its favor is the wave layout, which continues to suggest the formation of a downtrend. The second factor is the "relatively hawkish" stance. The third factor is the market's lack of belief in further tightening of the Bank of England's policy. Take note that BoE officials have also started to hint at keeping the rate at its current level for an extended period, abandoning statements about further increases.

Based on what I mentioned, it seems that both currencies (the pound and the euro) don't have any reasons to rally in the near future. I believe that everything will proceed according to the scenario that I have been consistently describing lately. Corrective waves 2 or b will be constructed, followed by a resumption of the decline for both instruments.

Based on the analysis conducted, I conclude that a bearish wave pattern is currently being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to break through this level indicates that the market is ready to build a corrective wave. In my recent reviews, I warned you that it is worth considering closing short positions because there is currently a high probability of forming an upward wave. Since the pair has not breached the 1.0637 level, corresponding to 100.0% according to Fibonacci, this could indicate that the market is ready to resume the downward movement, but I believe that Wave 2 or b will turn out to be three-wave.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can expect from the pound in the near future is the formation of Wave 2 or b. However, there are currently significant issues, even with the corrective wave. At this time, I would not recommend new short positions, but I also do not recommend longs because the corrective wave appears to be quite weak.