EUR/USD

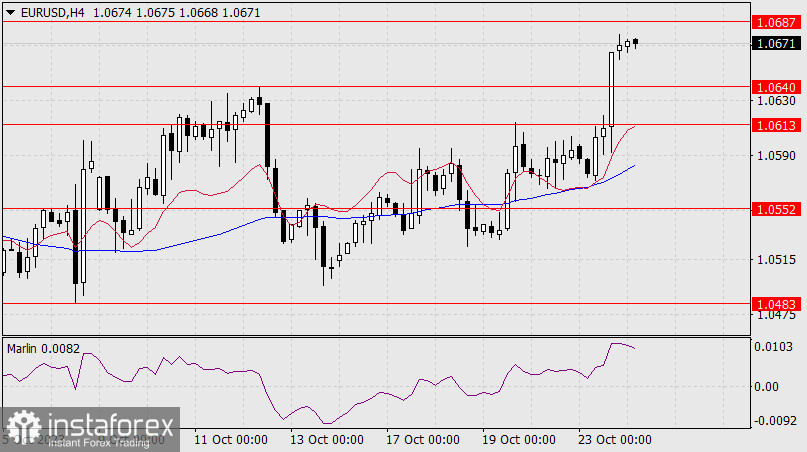

Yesterday's wait-and-see approach yielded a positive result – late in the evening, the euro broke above the Fibonacci ray and the resistance range at 1.0613/1.0640, suggesting the possibility of growth in the medium-term. To confirm this, the price needs to break above the MACD indicator line around the 1.0714 mark.

The rise in U.S. bond yields boosted the euro. Today, PMIs for October will be released for the eurozone and the United States. The eurozone Manufacturing PMI may increase from 43.4 to 43.7, while the U.S. Manufacturing PMI is expected to weaken from 49.8 to 49.5. This also presents a risk for the U.S. dollar.

The target level at 1.0687 acts as resistance, which corresponds to the September 7th low. The prospective bullish target is the peak from August 30th at 1.0946, which is close to the 61.8% Fibonacci retracement level.

On the 4-hour chart, the price has consolidated above the 1.0640 level. It continues to rise above both indicator lines. The Marlin oscillator is also in an upward position. We expect the price to advance toward the nearest levels at 1.0687 and 1.0714.