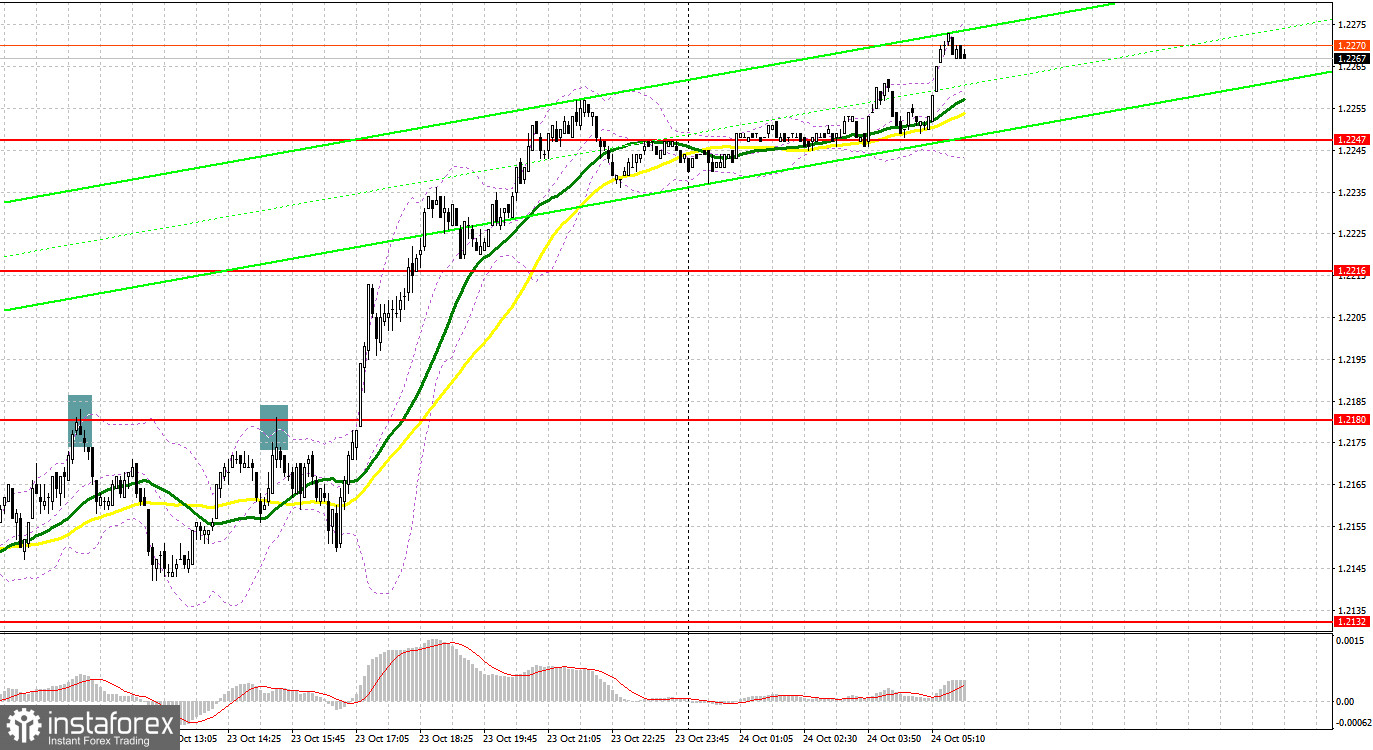

Yesterday, the pair formed some great market entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2180 as a possible entry point. A rise and false breakout at this mark produced a great sell signal, sending the pair down by more than 35 pips. A similar sell signal was formed in the second half of the day, which led to a drop in the price by 25 pips.

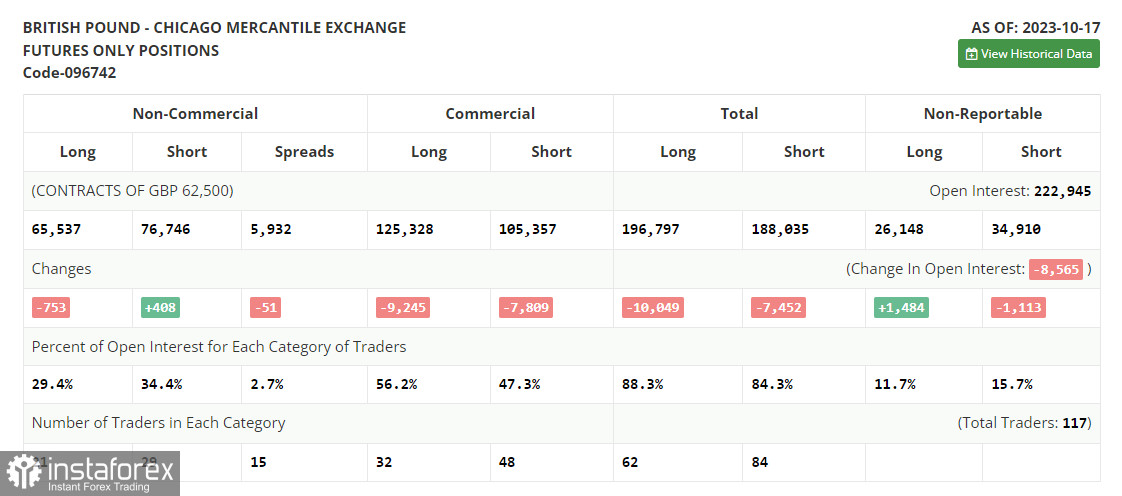

COT report:

Before delving into the technical outlook for the pound, let's take a look at what happened in the futures market. In the COT (Commitment of Traders) report for October 17, we see a decrease in long positions and a slight increase in short ones. However, this didn't have a significant impact on the net positioning. Given that UK inflation data signaled a sustained pace of growth, and Fed officials continued to emphasize that interest rates would not be raised anytime soon, this exerted pressure on the dollar and the pound traded higher. It appears that the trend toward strengthening risk assets will persist in the near term leading up to the November FOMC meeting. The latest COT report said that long non-commercial positions fell by 753 to 65,537, while short non-commercial positions increased by 408 to 76,746. As a result, the spread between long and short positions narrowed by 51. The weekly price reached 1.2179, down from 1.2284.

For long positions on GBP/USD:

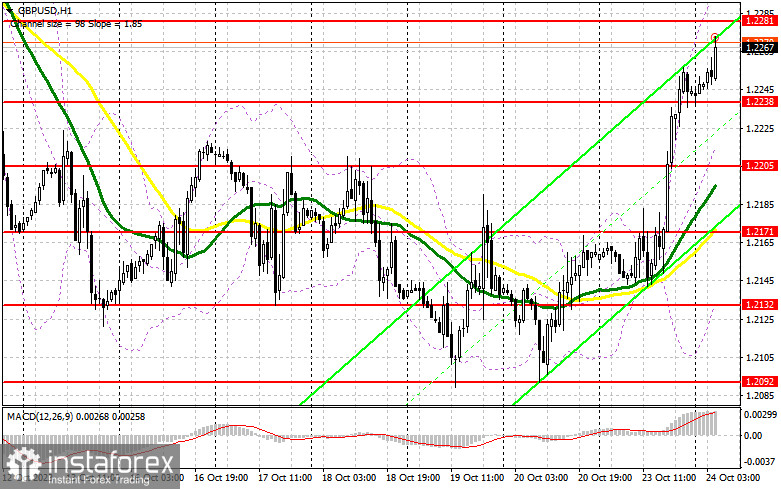

Today, traders may look to the release of PMI prints from the UK to support the uptrend. A decline in the number of unemployment benefit claims in the UK, as well as a decrease in the jobless rate, will be a reason to continue building long positions. The only thing that could possibly exert pressure on the pound are the Manufacturing and Services PMIs for the UK. In case the pair falls, I expect the bulls to emerge near the nearest support level at 1.2238. A false breakout around that mark will confirm the entry point for long positions, in hopes that the pair would climb to the resistance at 1.2281. A breakout and a downward test of this range will strengthen the possibility of a recovery, which will form a buy signal, providing a chance to reach the new resistance at 1.2310. In case the pair breaches this range, the pound could surge to this month's high at 1.2334 where I'd be taking profits. If the pair declines to 1.2238 without buyer activity, and the pair rapidly rises from this mark, the pressure on the pound will return. In such a case, I will postpone long positions to 1.2205, which is in line with the bullish moving averages. A false breakout on this mark will signal a buying opportunity. I will open long positions directly on a rebound from 1.2205, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD:

Yesterday, the bears repeatedly tried to sell the pound and exert pressure on it, but the buyers regained their positions during the US session. Today, it is crucial to defend the resistance level at 1.2281. A false breakout at this level will produce a sell signal and confirm the presence of large sellers, which could push the pair towards the support level at 1.2238. Breaching this level and an upward retest will strengthen the bears' advantage, providing a window to aim for 1.2205. This is where buyers may step in. The more distant target will be 1.2171, where I'd be taking profits. If GBP/USD grows and there are no bears at 1.2281, which seems to be where things are heading, the bulls will get a strong advantage, which will push the pair to the next resistance at 1.2310. Selling there is also an option, but only after a failed consolidation. If downward movement stalls there, one can sell the British pound on a bounce from 1.2334, bearing in mind a 30-35-pips downward intraday correction.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates an attempt to develop an uptrend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of growth, the indicator's upper border near 1.2300 will serve as resistance. If GBP/USD declines, the indicator's lower border near 1.2135 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.