PMIs from Europe, the UK, and the US indicate that the global economy continues to slow down. The HCOB's flash eurozone Composite Purchasing Managers' Index fell to 46.5 in October from September's 47.2, showing a negative trend. The UK PMI Composite Output Index came in at 48.6 in October, rising 0.1 points compared to September but still in negative territory. Earlier, PMIs for Australia and Japan were published, both of which also showed weak results.

Only the US reported a positive change, with the Composite PMI improving to 51 from 50.2, which worked in the US dollar's favor. Of course, market participants pay more attention to ISM indices, but nonetheless, the US economy is holding back from sliding into a recession, while inflation is slowing down faster, so it is quite natural to see an uptrend for the US dollar.

NZD/USD

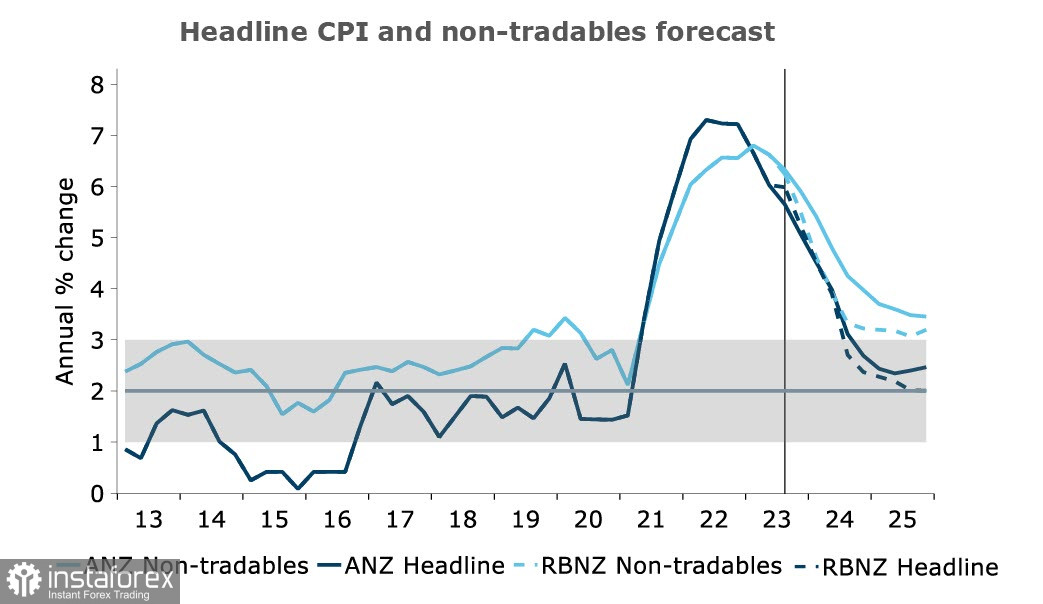

New Zealand inflation slowed more than expected, as the annual inflation rate fell to 5.6% from 6% in the second quarter. This called for a revision of forecasts for the RBNZ interest rate. Market forecasts now suggest that the Reserve Bank of New Zealand will still raise the rate, but not in November, as previously expected, but in February instead. This is a negative factor for the New Zealand dollar.

ANZ Bank has kept its inflation forecast unchanged, despite the good dynamics in the third quarter, as the rapid normalization of external inflation will significantly offset stagnant domestic inflation. ANZ expects 5.1% YoY inflation. Domestic inflation is very strong, driven by rapid labor market growth, which, in turn, pushes up wage indicators. For now, the RBNZ assumes that internal inflation will naturally decline, starting from the next quarter, following weak external factors. Only time will tell how optimistic this view is, but based on this position, we should not expect a rate hike before the end of the year.

The situation for NZD is not too optimistic. Inflation is still high, and the probability of an RBNZ rate hike has decreased. Accordingly, the prospects for the kiwi have become less attractive compared to other currencies. This might prevent the currency from reversing its bearish trend against the dollar.

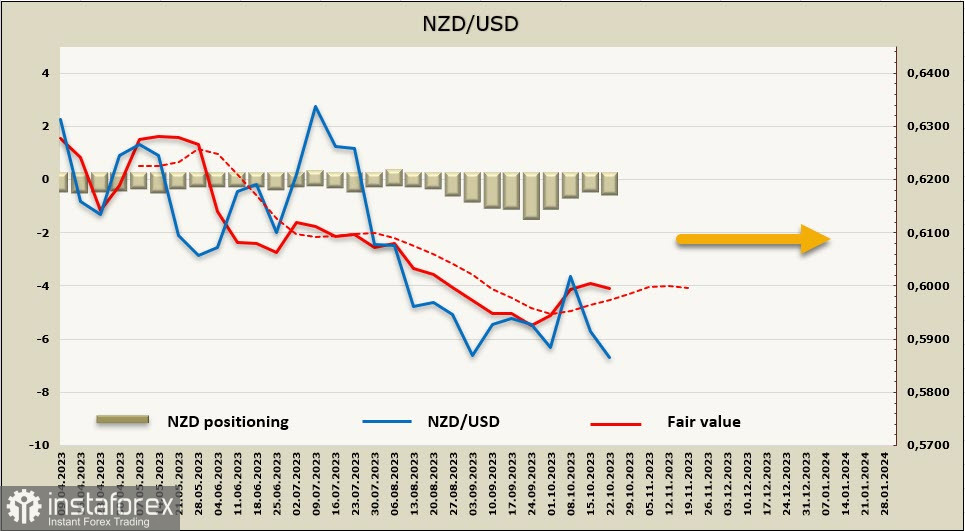

The net short NZD position increased by 101 million to -348 million over the reporting week. Speculative positioning is neutral with a slight bearish bias. The price is above the long-term average, but has lost momentum.

A week earlier, we said that the inflation report reduced the chances of a corrective rise. After a brief pause, NZD renewed its local low, hitting the lower band of the channel. Currently, there are two main scenarios that both have a good opportunity. Either the price will test the channel's boundary at 0.5775/85 with an attempt to break below, or correct higher towards the middle of the channel at 0.5970/90. Since the internal impetus for growth has noticeably diminished, the only thing that could prevent a bearish breakthrough from the channel is the dollar's weakness, which is unlikely in current conditions.

AUD/USD

The minutes of the Reserve Bank of Australia's October meeting turned out to be more aggressive. The key statement was: "The Board has a low tolerance for a slower return of inflation to target than currently expected."

NAB Bank expects the RBA to raise rates by 25 basis points to 4.35, and there was no mention of active QT in the minutes. RBA Governor Lowe will deliver a speech, after which the crucial Consumer Price Index (CPI) report for the third quarter will be released. On Thursday, Lowe will testify before the Senate Committee and is likely to comment on the inflation data.

Regarding inflation, a slowdown from 5.9% YoY to 5.0% is expected, largely due to base effects. It is likely that the CPI and Lowe's comments will cause a brief spike in AUD volatility, after which the further direction can be assessed more objectively.

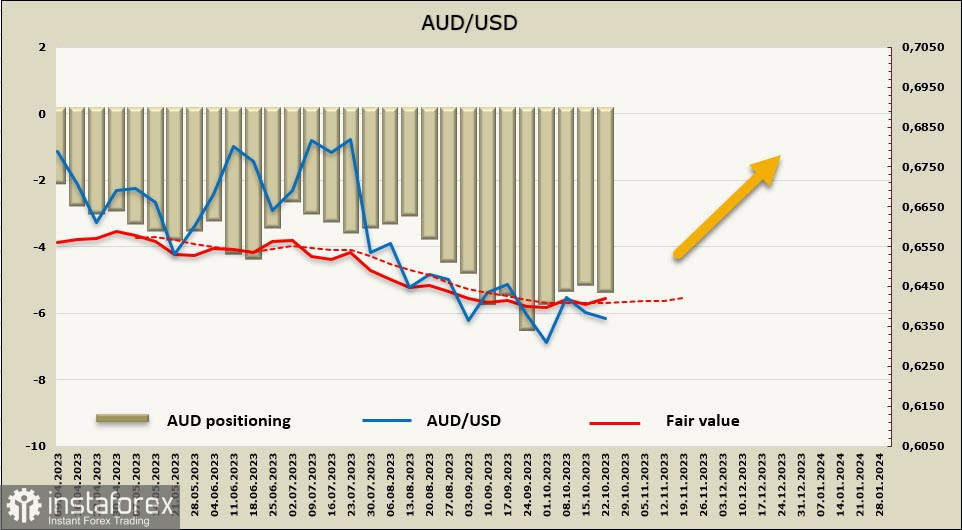

After three weeks of decline, the net short AUD position increased with a weekly change of -214 million, resulting in a net balance of -5.139 billion. Speculative positioning remains consistently bearish, which means that attempts at growth still have a corrective nature. The price is above the long-term average and is headed upward, indicating that the possibility of a corrective rise still exists.

AUD/USD continues to trade above the support level at 0.6288, as it trades in a sideways range. From a technical perspective, it is more likely for the pair to correct higher towards the middle of the 0.6490/6500 channel. This will happen if there is no significant escalation in the Middle East and no panic-driven rush into safe-haven assets. In case the price breaks below the support level at 0.6288, it could rapidly move towards 0.6170.