The EUR/USD currency pair sharply and significantly decreased on Tuesday. We've already mentioned in our previous articles that the euro currency saw an unjustified increase on Monday, but this rise was logical within a technical framework, as the correction was very weak at that time. Yesterday, we witnessed another "restoration of fairness." The market almost started to get rid of the European currency, although the macroeconomic statistics in the European Union were not so bad as to provoke such a drop. More precisely, it has been poor for a year or more. We mean that there haven't been any significant deteriorations compared to September.

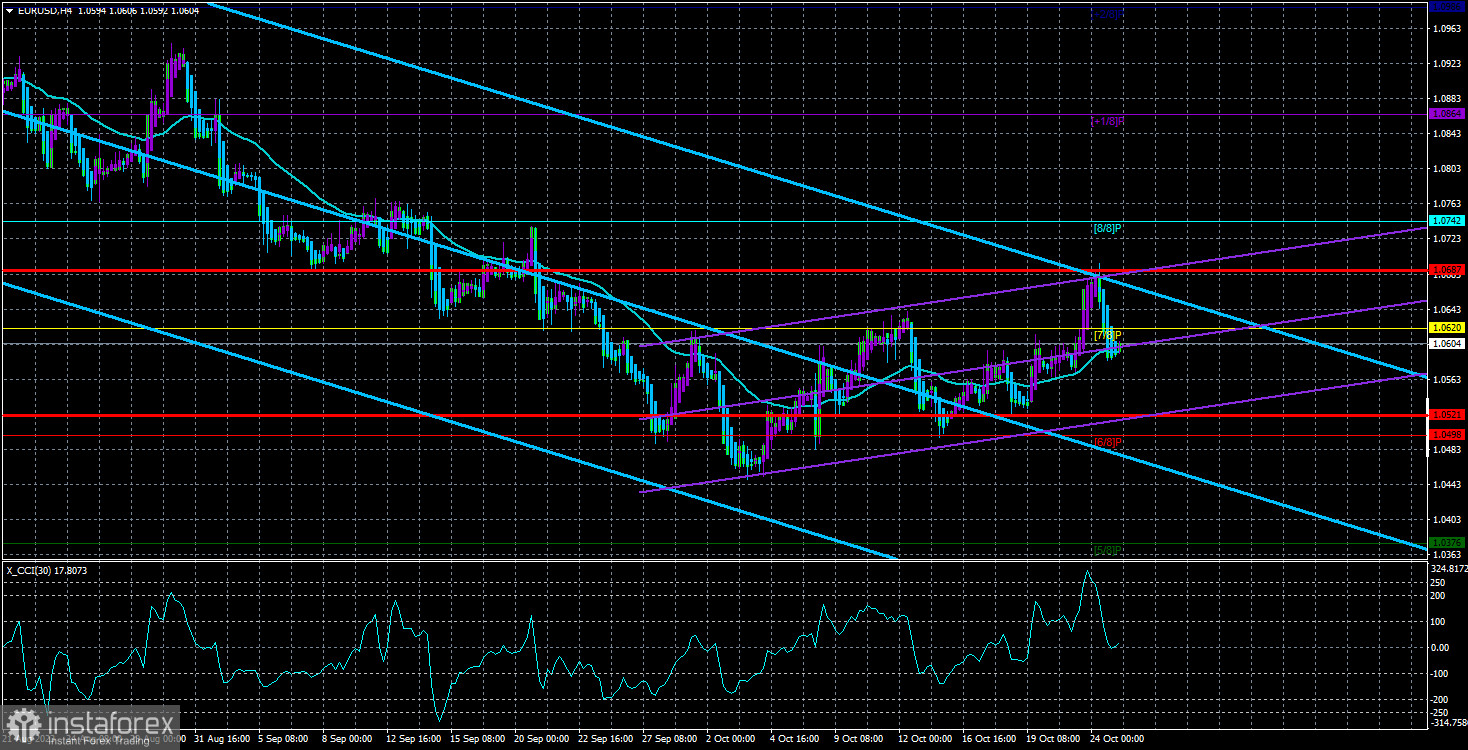

However, most analysts concluded that it was the business activity indices in the EU and Germany that triggered the euro's decline. Perhaps that's the case, but we'd like to remind you that the euro does not always move 100 points a day, even during ECB meetings or GDP and inflation publications. Business activity indices are much less significant indicators than the aforementioned ones. Thus, we consider yesterday's drop to be technical. It's quite possible that the upward correction is now complete. However, the price did not manage to stay below the moving average line, so we may see a third upward correction. It's worth noting that this week will host the ECB meeting and, next week, the Bank of England and the Federal Reserve meetings. There will be plenty of important information, and this information may strengthen the US dollar.

In the 24-hour time frame, yesterday's drop did not clarify the situation. The Kijun-sen line is still crossed. If the quotes of the pair continue to fall today, then consolidation below the critical line may occur, leading to a resumption of the medium-term downtrend. However, to do that, the moving average in the 4-hour time frame must first be overcome.

The prospects for the euro remain negative. Although we don't consider the business activity indices for October to be disastrous, we must acknowledge that they have been weak for quite some time. If business activity in the United States, according to S&P's agency, were to recover above 50, both indices in the European Union would remain firmly below the "waterline." Therefore, each subsequent report only confirms what we have been saying since the beginning of the year: the European economy, if not weak, is in a much worse condition than the American economy. This was one of the reasons we wondered why the European currency was so high in the first half of the year.

Now, many other analysts are predicting a recession in the European economy in the second half of the year and are expressing concerns about it. For us, the weak state of the EU economy is an obvious fact. The ECB failed to raise the key rate above 4.5%, and it probably won't do so anymore. If a recession starts in the second half of the year, in 2024, there will be talk of rate cuts regardless of the inflation level at that time. It's obvious that inflation will not drop to 2% anytime soon with a 4.5% rate. But if the European economy starts to contract, the ECB will have to make very difficult decisions again and choose between inflation and economic growth. After all, if the EU economy goes into a recession, it will have to be stimulated later. Rates will need to be lowered to zero again, which will stoke inflation.

In general, the euro's prospects remain quite unclear. More precisely, the euro has not had a solid argument in its favor in the ongoing dispute with the US dollar for a long time, but from time to time, it still shows growth, as no currency can fall forever. Therefore, today's key point is overcoming or failing to overcome the moving average. The further movement of the pair this week may depend on this.

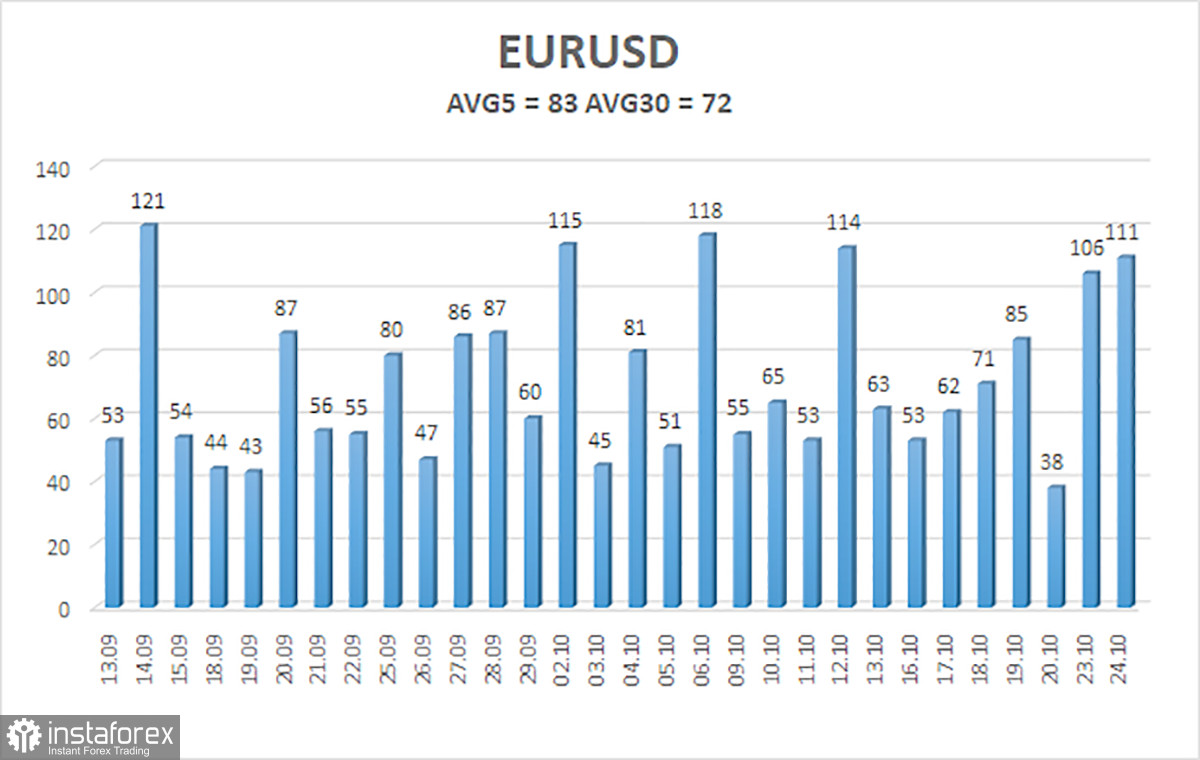

The average volatility of the Euro/USD currency pair for the last 5 trading days as of October 25 is 83 points and is characterized as "medium." Thus, we expect the pair to move between the levels of 1.0521 and 1.0687 on Wednesday. A reversal of the Heiken Ashi indicator upward will indicate a new stage of correction.

The nearest support levels:

S1 - 1.0498

S2 - 1.0376

S3 - 1.0254

Nearest resistance levels:

R1 - 1.0620

R2 - 1.0742

R3 - 1.0864

Trading recommendations:

The EUR/USD pair has resumed its upward movement. Therefore, new long positions can be considered, with targets at 1.0687 and 1.0742 in case of a rebound from the moving average. However, it should be noted that we are dealing with a correction that can end at any moment. Short positions can be considered only after the price is fixed below the moving average with a target of 1.0498.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price range in which the pair will trade over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates an approaching trend reversal in the opposite direction.