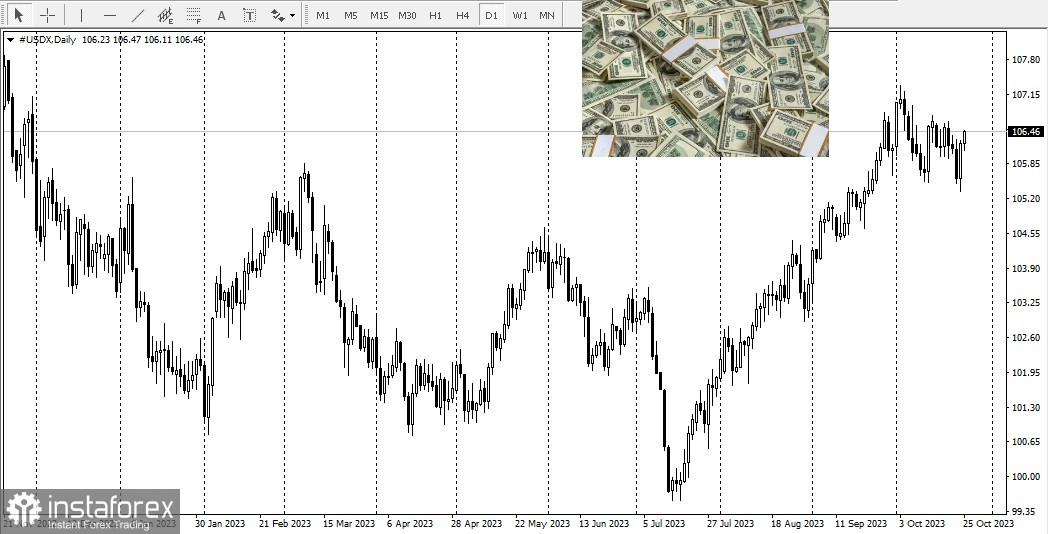

The new rise in US Treasury bond yields and increasing dollar demand, supported by hawkish expectations from the Fed, pushed USD up against other world currencies.

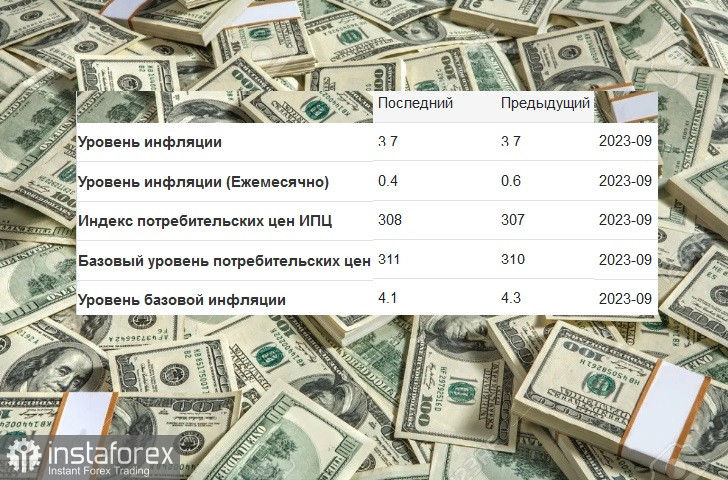

Today, there will be a series of news related to the US, followed by a speech from Fed Chairman Jerome Powell. Then, on Thursday, there will be reports, including the US GDP for the third quarter and the PCE index for September. The current forecast for the core PCE suggests inflation will increase from 0.1% to 0.3%.

The US manufacturing sector emerged from a five-month decline, as indicated by data released on Tuesday. The business activity in the US reportedly increased in October, and activity in the services sector accelerated, indicating economic resilience. However, the Fed will likely keep the rate unchanged at the November meeting, even though the markets anticipate another 25-basis point increase by the end of the year.

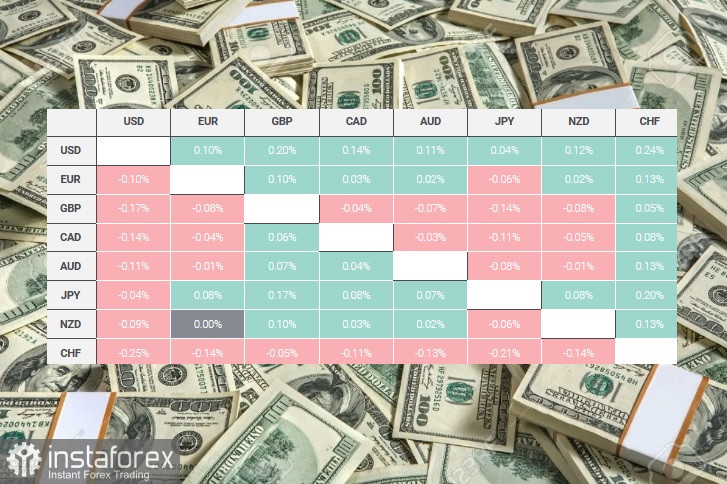

The table below shows the percentage change in the US dollar exchange rate against major currencies listed for the day.

The numbers suggest USD/JPY to be the weakest.