On Thursday, October 26, the European Central Bank will hold its regular meeting, which is the penultimate one this year. On one hand, the formal outcomes of this meeting are predetermined: the regulator will most likely maintain the parameters of its monetary policy as they are. On the other hand, the October meeting may provoke increased volatility in the EUR/USD pair if the rhetoric during the accompanying meeting and Christine Lagarde's comments significantly differ from those in September.

The main intrigue lies in the future of interest rates, which were raised by 25 basis points in September. How long is the central bank willing to keep them at the current level? Does the ECB allow for an additional round of monetary tightening? And when (under what conditions) will the central bank be ready to lower interest rates, given the deteriorating situation in the European region? These are the primary but not the only questions that are likely to be on the agenda. Events in recent weeks have adjusted the fundamental picture for the EUR/USD pair, so it is possible that ECB members will also adjust their position regarding the further actions of the European regulator.

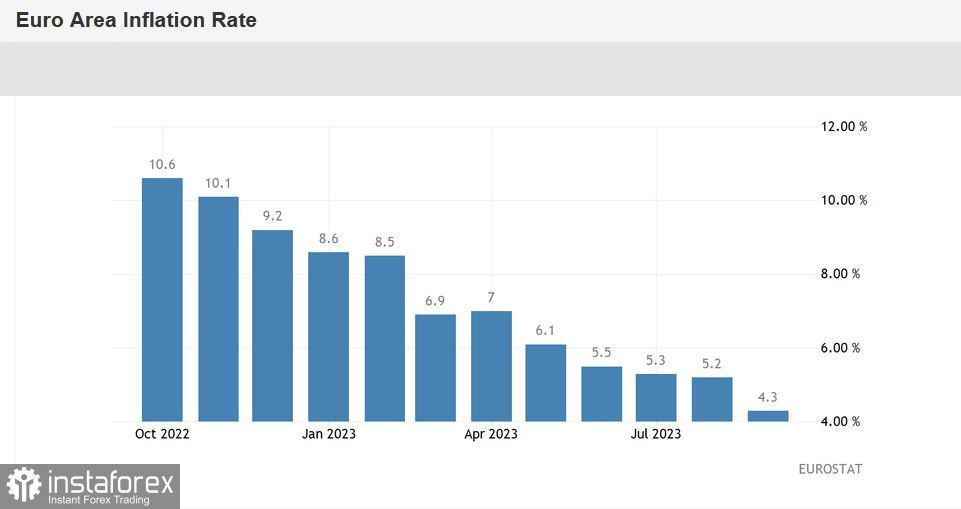

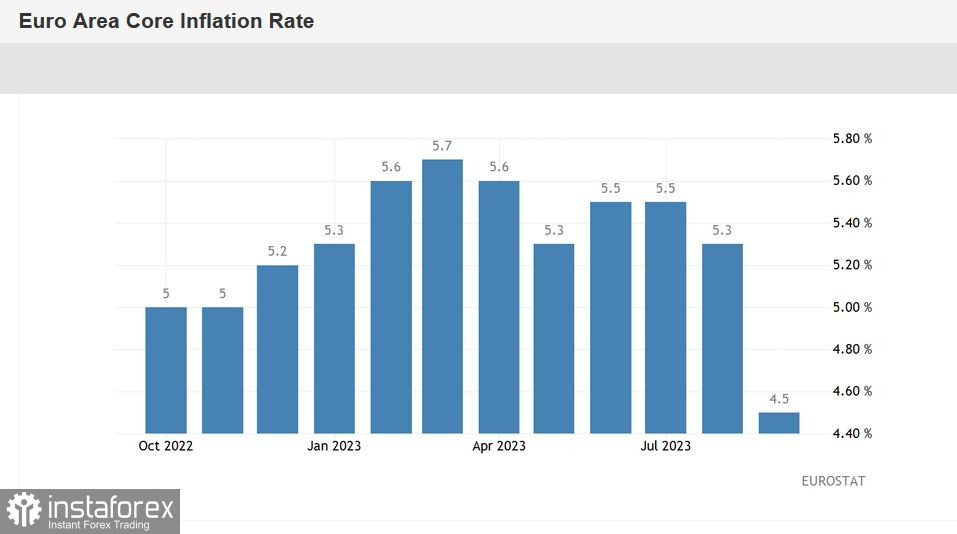

Overall, most currency strategists at major banks do not expect the ECB to raise interest rates within this year. Recent data on inflation growth in the Eurozone have only reinforced this confidence. The overall Consumer Price Index in September dropped to the lowest level in the last two years (4.3%). The core CPI also decreased to 4.5%, marking the smallest increase since August of the previous year. The structure of the September report indicates that inflation decreased in all price categories, and energy prices continued to fall for the fifth consecutive month.

This indicates that the previously implemented monetary measures are "working," and there is currently no need for additional tightening of monetary policy. Moreover, the dynamics of European economic growth leave much to be desired. Recall that the final assessment of Eurozone GDP growth was unexpectedly revised downward: according to the updated data, the region's economy only grew by 0.1% quarter-on-quarter in the second quarter (the initial estimate was 0.3%). The annual calculation was also revised downward (0.5% year-on-year instead of the previous 0.6%). Preliminary data for the third quarter will be published at the end of this month, which is after the ECB's October meeting.

The PMI indices published Tuesday also disappointed. The overall European indicators for the manufacturing sector and the services sector were in the "red zone," well below the key 50-point mark.

Another reason for concern is the weak growth in consumer lending in the Eurozone. In September, it increased by only 0.8% year-on-year, which is the lowest value since June 2015. Among the reasons for this weak dynamics are increased concerns about a recession in the Eurozone and high interest rates. It was also revealed that the money supply indicator (M3 aggregate) in the Eurozone decreased by 1.2% year-on-year last month (to €16.02 trillion). The indicator has been in the negative range for the third consecutive month (it dropped by 1.3% in August).

In other words, all indications point towards maintaining the status quo not only at the October meeting but also (at the very least) at the subsequent meeting in December, where the quarterly macroeconomic forecasts will be presented.

At the same time, it's unlikely that the central bank will raise the issue of reducing interest rates. Clearly, it's too early to talk about it at this point. Although inflation is showing a declining trend, it is still far from the target level. According to ECB Chief Economist Philip Lane, the European central bank will need additional time, "probably until the spring of 2024," before the ECB can ensure a reduction of inflation to target levels. Therefore, it is likely that the European Central Bank will not even discuss the topic of rate cuts hypothetically. This circumstance may indirectly support the European currency. Additionally, the ECB probably will not discuss speeding up quantitative tightening (QT).

Overall, the European regulator may not make any "sharp moves" at the October meeting. Monetary policy will remain as it is, along with the main formulations in the accompanying statement. Lagarde will reiterate the previously mentioned theses, including that interest rates will remain at the current level "for as long as necessary," and if needed, the central bank will consider additional monetary tightening.

In words, the regulator may express concern about recent fundamental events. In particular, the ECB may express concerns about the conflict in the Middle East, which has caused oil prices to rise again. Considering that this factor may drive inflation in the European region, the ECB will include it in the list of existing risks. The central bank may also comment on the increased deficit forecast for Italy, which led to an increase in the cost of servicing the national debt.

However, it is highly likely that these fundamental factors will not lead to any decisions or significant changes in formulations. The European Central Bank will "verbally" express concerns about possible consequences, but "in practice," it will continue to adhere to the wait-and-see approach declared in September.

It is worth noting that even the "neutral" outcomes of the October meeting may provide some modest, but still support for the euro. After the release of September's Eurozone inflation data and following the weak economic growth data in Europe, many expect the ECB to signal a dovish stance or at least veiled hints of a reduction in quantitative easing in the first half of 2024. Therefore, if the ECB merely reiterates the main theses from the September meeting, the EUR/USD pair may attempt to return to the 1.6 level and even approach the 1.7 level. But not beyond that: the October meeting, in any case, will not be a "springboard" for the euro.