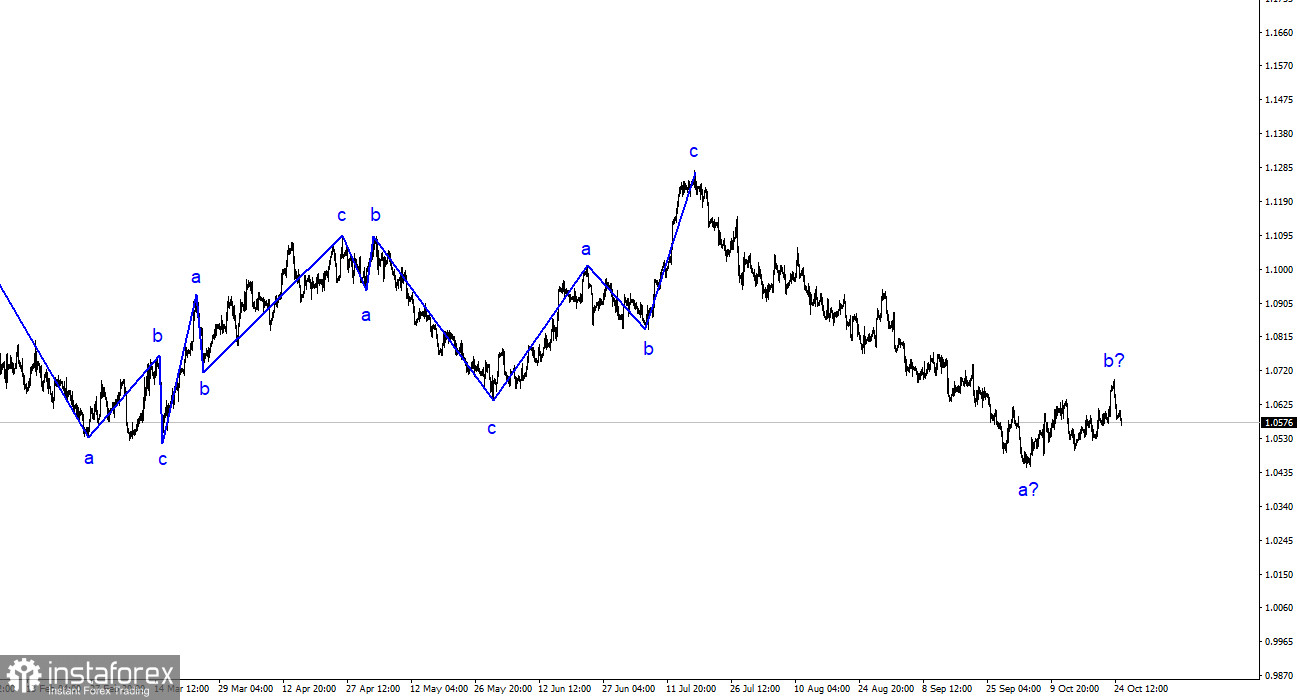

The wave analysis on the 4-hour chart for the EUR/USD currency pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. For the past few months, I have regularly mentioned that I expect the instrument to approach the 1.5-figure, from which the construction of the last rising three-wave structure began. This target was reached after a two-month decline. Predictably, after achieving this target, the construction of a corrective wave 2 or b began, which has already taken on a clear three-wave shape.

None of the recent price increases resembled a complete wave 2 or b. Therefore, all of these were internal corrective waves within wave 1 or a. However, the overall decline of the European currency will not be completed because, in any case, the construction of a third wave is still required. Inside the first wave, five internal waves are visible, so it is complete. Inside the second wave, three waves are visible, so it may also be completed. However, it may take the form of a-b-c-d-e.

On Tuesday, the EUR/USD currency pair fell by an additional 15 basis points. Losses for Wednesday are minor, but tomorrow the ECB meeting will conclude and its results will be announced. Demand for the European currency is decreasing in anticipation of this significant event, which will be discussed in more detail in the fundamental review. Today, the news background was absent, and yet the European currency continues to slide. The main decline occurred on Wednesday, when weak business activity indices were released in the European Union and fairly strong ones in the United States. However, in my opinion, it was not the business activity indices that caused the decline of the euro. The wave analysis looks very convincing and even perfect at the moment. The decline may continue down to the level of 1.0522, where the descending wave may complete its construction. But this will only happen if the corrective structure takes on a five-wave form.

Therefore, I recommend paying close attention to the behavior of the instrument around the level of 1.0522. A descent to the level of 1.0462, where the construction of the rising wave b began, almost guarantees the beginning of the construction of a wave from the downward trend. In this case, the wave b for the pound will be very weak and unconvincing, but the euro will pull down the British pound. This evening, Jerome Powell will speak in the United States, and I would like to remind you that last week his speech made the market nervous. Tonight, the dollar may well fall if the Federal Reserve Chairman speaks more about keeping the rate at its current level than about the need to raise it once or several times more.

General Conclusions.

Based on the analysis conducted, I conclude that the construction of a downward wave set is continuing. The targets near the level of 1.0463 have been ideally achieved, and the unsuccessful attempt to break through this level indicated the transition to the construction of a corrective wave. I recommended sales, but they should be cautious at first, as wave 2 or b may take on a more complex form, and tomorrow the ECB meeting will take place.

On the larger wave scale, the wave analysis of the rising segment of the trend has taken on an extended form but is likely completed. We saw five upward waves, which most likely represent a structure a-b-c-d-e. Then the instrument built four three-wave structures: two downward and two upward. Currently, it has likely entered the stage of constructing another extended three-wave downward structure.