Analyzing Wednesday's trades:

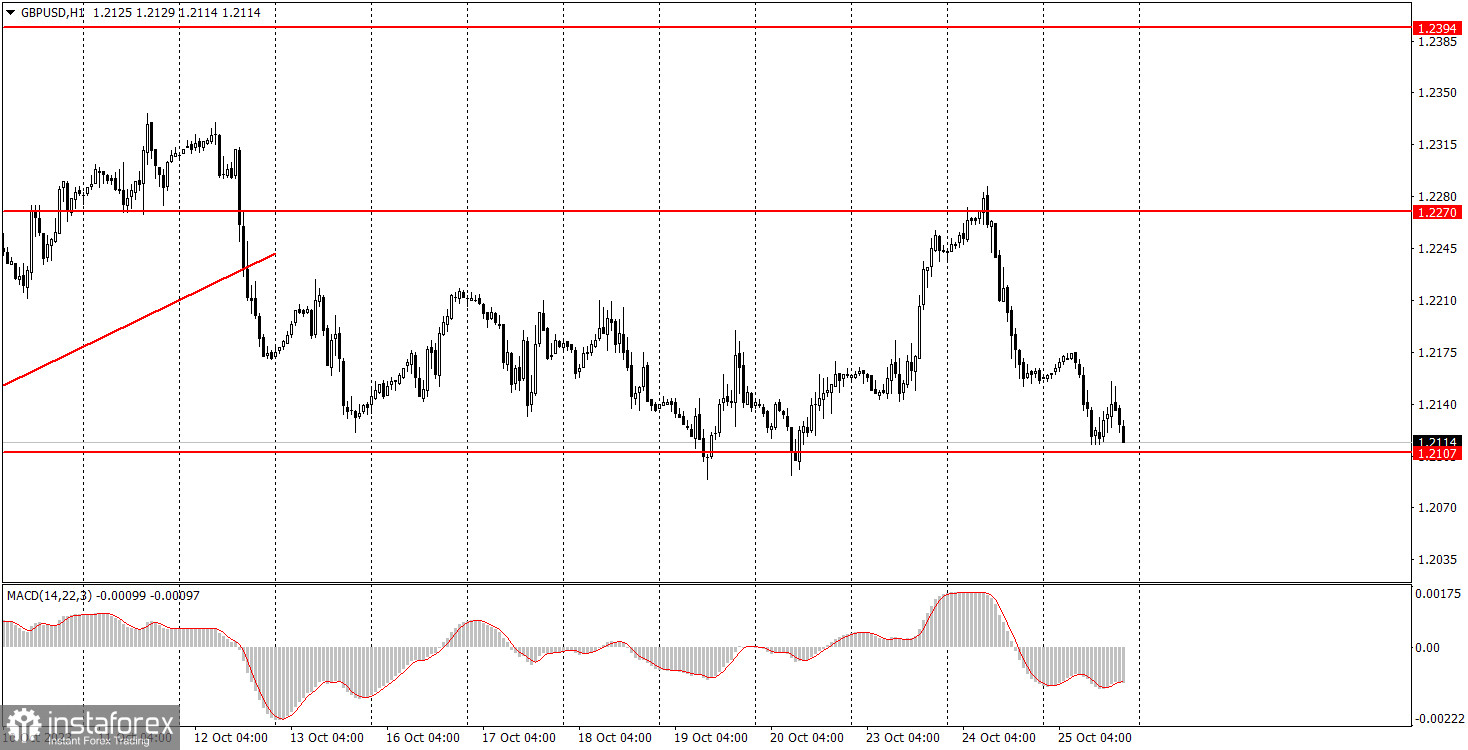

GBP/USD on 30M chart

GBP/USD prolonged its losses on Wednesday, albeit less steeply than the day before. Movements were weak in the absence of significant fundamental or economic reports, and volatility was 65 points, which is relatively low for the pound. The pair was approaching the level of 1.2107, from which it rebounded four times before. It's possible that we might see a fifth rebound, which could trigger another bullish correction, especially since we haven't seen a proper correction yet. There's a good chance that once the pair breaches this level, the downtrend will resume.

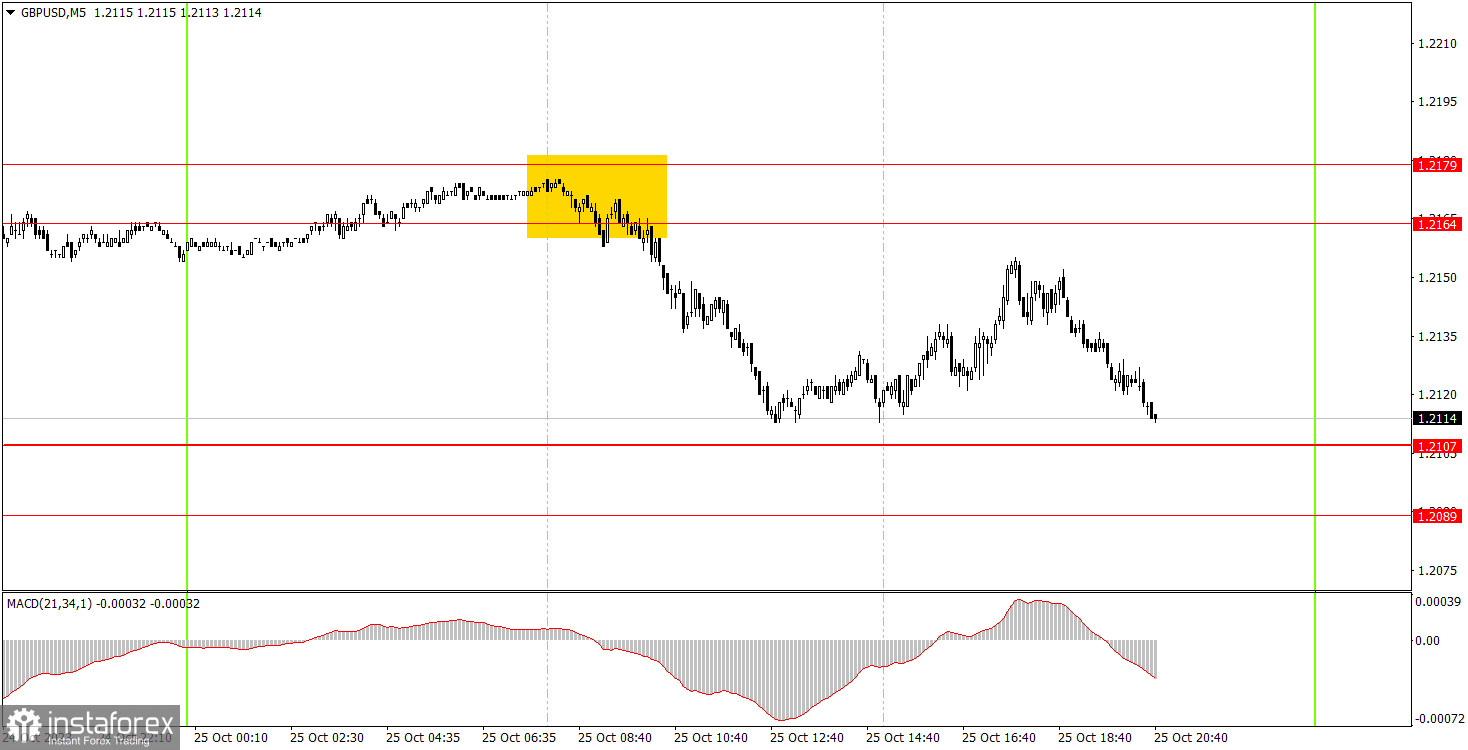

GBP/USD on 5M chart

On the 5-minute chart, only one trading signal was generated. At the beginning of the European session, the price rebounded from the 1.2164-1.2179 area, then it nearly dropped to the 1.2107 level. However, it didn't reach that mark, so there was no buy signal. Therefore, short positions should be closed manually, with a profit of at least 35 pips, which is quite good.

Trading tips on Thursday:

On the 30-minute chart, we were expecting a new leg of the upward correction, but it ended too soon. Of course, the pair can recommence the downtrend right now, but it still seems incomplete. Therefore, the 1.2107 level may keep the pair from falling for the fourth time in the last five days and trigger a new upward move. The key levels on the 5M chart are 1.1992-1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2179, 1.2235, 1.2270, 1.2372-1.2394, 1.2457-1.2488, 1.2544, 1.2605-1.2620, 1.2653, 1.2688. Once the price moves 20 pips in the right direction after opening a trade, you can set the stop-loss at breakeven. There are no significant events lined up in the UK. From the US, traders can focus on reports on the quarterly GDP and orders for durable goods. Therefore, we can expect quite a volatile day. These two reports can lead to strong movements. In addition, the European Central Bank meeting can also influence market sentiment.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.