For three consecutive days, we have witnessed significant movements in the market that can't be explained through logic. For instance, on Tuesday, the dollar suddenly strengthened even before the preliminary flash readings on business activity indices were published. And yesterday, the greenback continued to advance in the absence of news and economic releases. It appears that all of this was a massive buildup to today's European Central Bank meeting. Although it's hard to believe it because it lasted for an unusually long time. Usually such things happen just a day before such a significant event.

It's been three days. However, if the market stands still even after the ECB leaves the rate unchanged, and ECB President Christine Lagarde announces an indefinite pause, then yes, we can confirm that all of this was in preparation for the ECB's meeting. This is the outcome that the market is expecting. But if, on the other hand, for the past three days, the market has simply been under the control of speculators, with no anticipation of upcoming results or speeches, then the dollar will continue to rise. Moreover, it could move sharply higher. In this case, the scale of its growth could be comparable to what we witnessed on Tuesday.

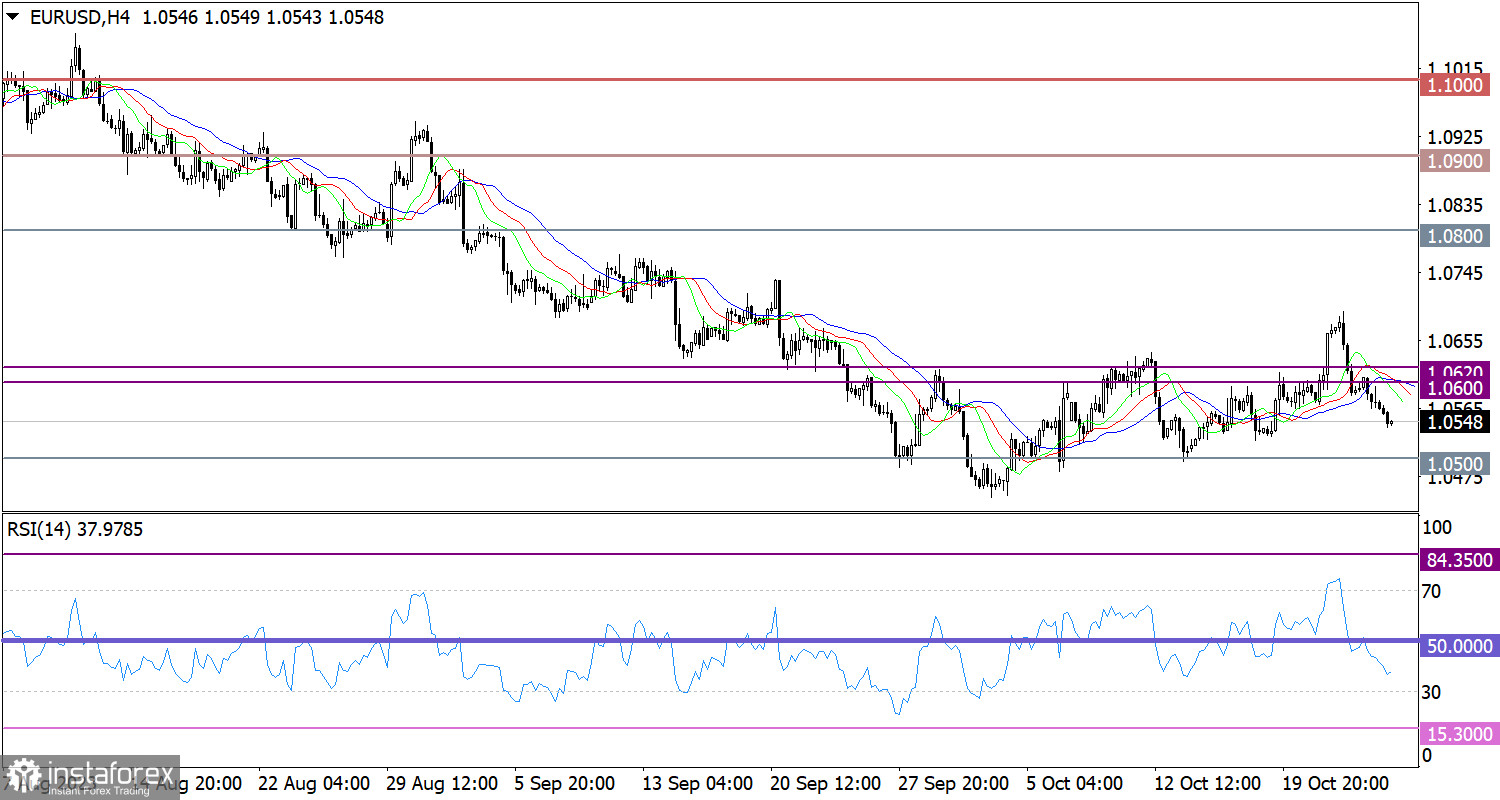

The EUR/USD pair settled below the 1.0600 level and this increased the volume of short positions. As a result, the downward cycle was extended.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, indicating an increase in selling volumes.

On the same time frame, the Alligator's MAs are headed downwards, aligning with the price direction.

Outlook

Under current market conditions, the euro may fall towards the 1.0500 level. This mark could signify a potential end to the corrective cycle. However, traders also consider this level as a support, citing a bounce that occurred on October 13. Therefore, in order to support the bearish scenario, the price needs to stay below the reference level. In this case, we can confirm the signal for the end of the corrective cycle.

The complex indicator analysis points to a bearish trend in the short-term and intraday periods.