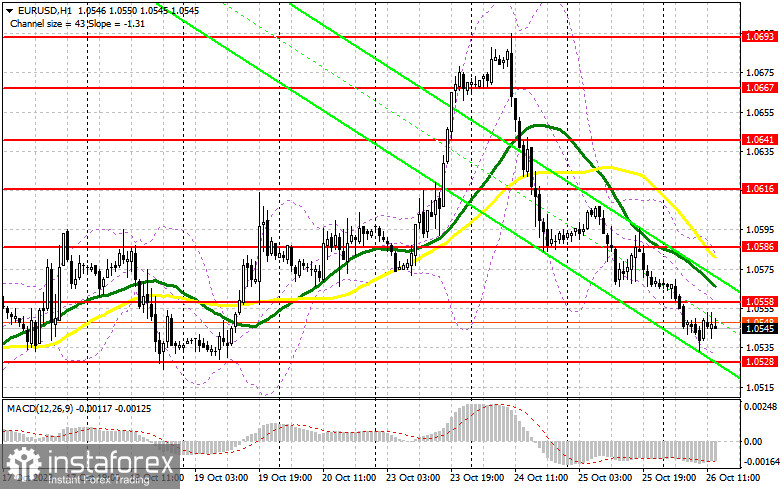

In the previous forecast, I drew your attention to the level of 1.0528 and recommended entering the market from it. Looking at the 5-minute chart, the euro/dollar pair did decline in the morning, almost testing 1.0528. The absence of significant data and the European Central Bank's (ECB) anticipated interest rate decision impacted the pair's volatility in the morning. The technical outlook remained unchanged for the afternoon.

Long positions on EUR/USD:

While markets expect the ECB's decision, upcoming US data may exert even more influence on the pair. Economists anticipate a near-doubling of the Q3 GDP growth figures. If actual figures surpass expectations, it will likely add downward pressure on the euro/dollar pair. Unemployment claims and durable goods order changes will unlikely sway the pair. It is better to buy on dips after a false breakout near the support of 1.0528. This approach offers a good entry point for long positions targeting the next resistance at 1.0558. Breaching this range could trigger a surge to 1.0586, where the moving averages favor sellers. The next profit-taking point is around 1.0616. However, if the pair declines and we see dull trading near 1.0528, pressure on the euro will increase, possibly pushing it towards last week's lows. In such cases, only a false breakout around 1.0497 signals a market entry. One may open long positions on a bounce from 1.0474, allowing an intraday upward correction of 30-35 pips.

Short positions on EUR/USD:

Bears should protect the level of 1.0558 to prevent a major bullish correction. A false breakout after the ECB data or before US economic growth indications will give a sell signal, targeting the support of 1.0528. If the pair consolidates below this level amid dovish ECB president remarks, we can anticipate another sell signal targeting 1.0497. The next target is at the low of 1.0474, where traders may book profits. Conversely, if the pair rises during the US session and we see a lack of bearish activity at 1.0558, bulls might return to the market. In this scenario, it would be better to postpone short positions until the pair reaches the resistance of 1.0586. At this level, one may sell the euro after an unsuccessful consolidation. In addition, you may open short positions on a bounce from the high of 1.0616, allowing an intraday downward correction of 30-35 pips.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, suggesting the euro might continue to fall.

Note: The author reviews the averages on an H1 hourly chart, which differs from the standard daily interpretation on a D1 chart.

Bollinger Bands:

If there is a decline, the lower band of the indicator around 1.0535 will act as support.

Descriptions of indicators:

- Moving Average identifies the current trend by smoothing out volatility and market noise. The 50-period is marked in yellow, and the 30-period is in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA 12, Slow EMA 26, and SMA 9.

- Bollinger Bands: Period 20.

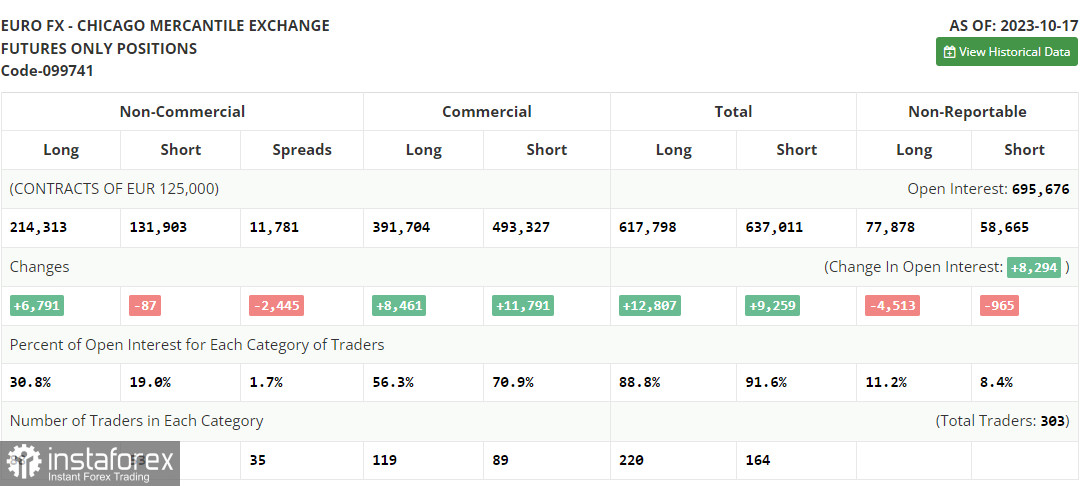

- Non-commercial traders are speculators like individual traders, hedge funds, and major institutions who use the futures market for speculative purposes, meeting certain requirements.

- Non-commercial long positions represent the total long open positions of non-commercial traders.

- Non-commercial short positions represent the total short open positions of non-commercial traders.

- Total non-commercial net position represents the difference between the short and long positions of non-commercial traders.