EUR/USD

Higher Timeframes

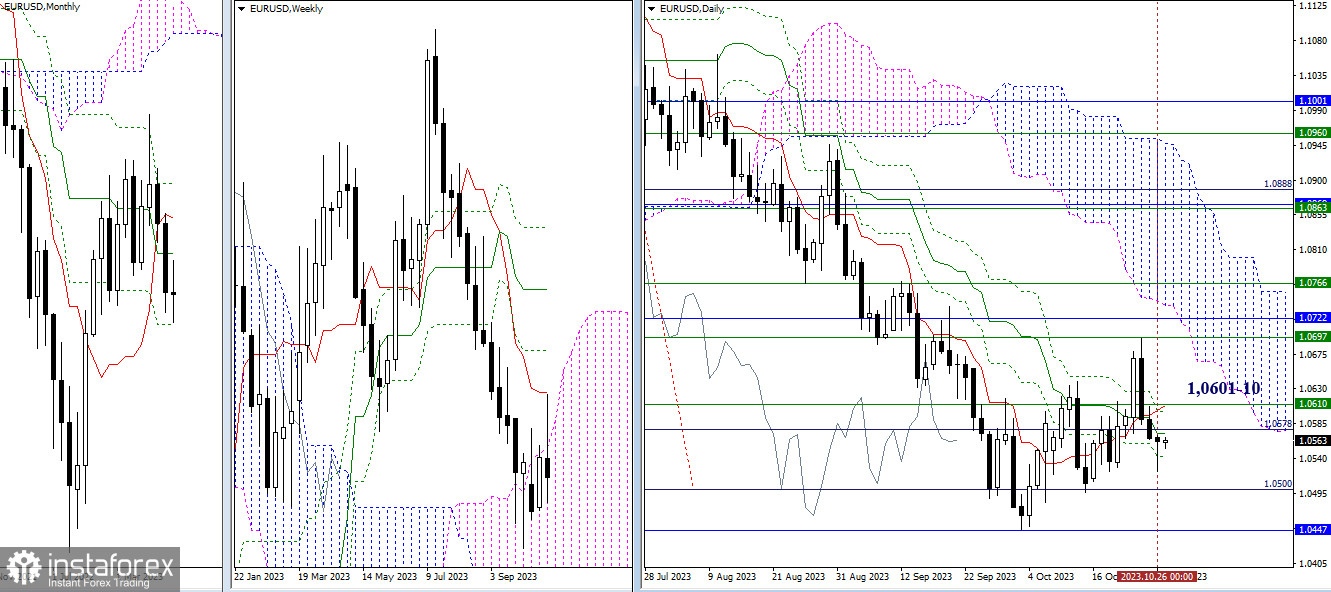

Yesterday, the bears couldn't hold their ground. As a result, by the end of the working week, the market arrived with a looming lower shadow, the size of which could influence the overall sentiment and market possibilities. It is worth noting that the daily cross has changed. If the bulls can now take control of the range 1.0601 - 1.0610 (daily short-term trend + weekly cloud boundary), they can use it as a basis for a new attempt to rise. Failures and market uncertainty at this moment may lead to the formation of consolidation.

H4 - H1

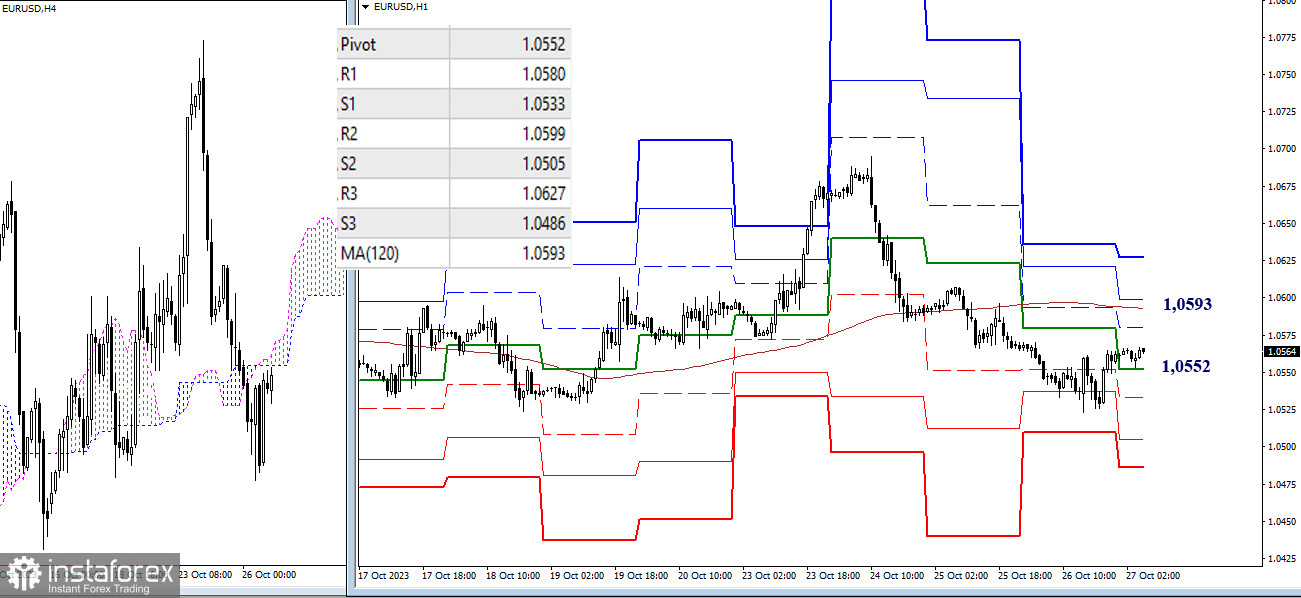

On the lower timeframes, the decline has stopped. At this moment, the bulls have already managed to reclaim the central pivot point of the day (1.0552). Their next target is the weekly long-term trend (1.0593). Consolidation above and a reversal of the moving average will allow for a change in the current balance of power towards further bullish sentiment. Additional intraday targets can be marked at the resistances (1.0580 - 1.0599 - 1.0627) and supports (1.0533 - 1.0505 - 1.0486) of the classic pivot points.

***

GBP/USD

Higher Timeframes

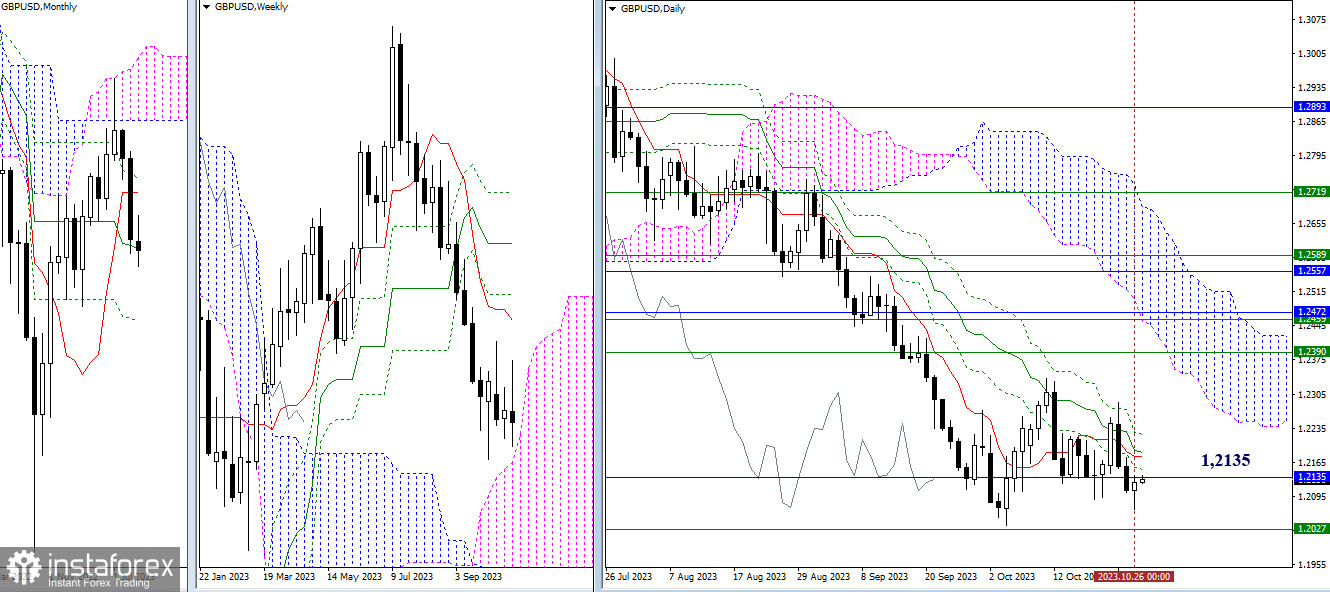

Over the past day, there have been no significant changes. The monthly medium-term trend (1.2135) continues to hold the market in its attraction zone, and the tasks facing market participants remain relevant. In the current situation, bulls need to eliminate the daily Ichimoku cross (1.2186 - 1.2221) and update the highs of the current correction (1.2287 - 1.2336). For bears, it is important to exit the zone of weekly and daily correction (1.2036) and enter the weekly cloud (1.2027).

H4 - H1

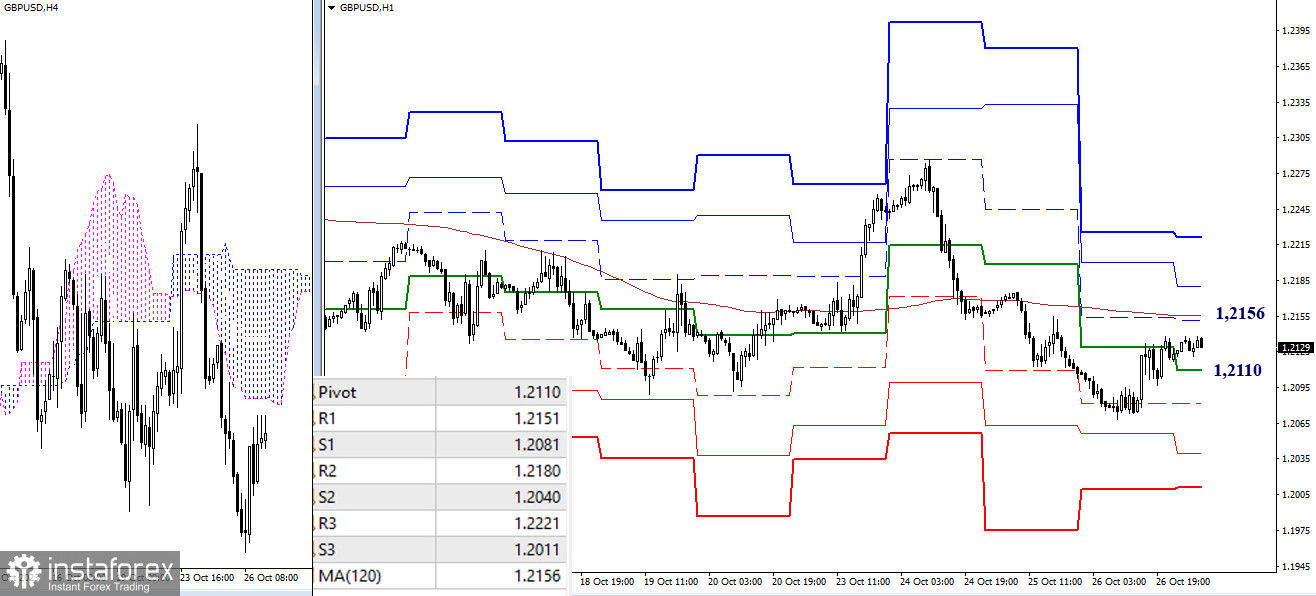

The decline has stopped. The market is again aiming for the weekly long-term trend (1.2156). Possessing the trend provides some advantage. Further strengthening of bullish sentiment within the day is possible upon overcoming the resistances (1.2180 - 1.2221) of the classic pivot points. The strengthening of bearish sentiment will occur by breaking through the supports (1.2110 - 1.2081 - 1.2040 - 1.2011) of the classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)