The currency pair EUR/USD showed absolutely no movements on Thursday—no reaction to important events. In our previous articles, we've already mentioned that people can have different opinions about what happened yesterday. On one hand, it's not uncommon to see meetings where no significant decisions are made, but the pair starts moving in different directions afterward. On the other hand, there were no significant decisions made yesterday, and Christine Lagarde's rhetoric was maximally bland and uninteresting. Therefore, the market had nothing to react to, and it all seems logical. However, this week, there is very little logic in the pair's movements. On Monday and Tuesday, there were movements of such strength that it feels like the ECB meeting actually happened on Monday, not on Thursday. In other words, the market considered business activity indices much more important than the ECB meeting and the US GDP report.

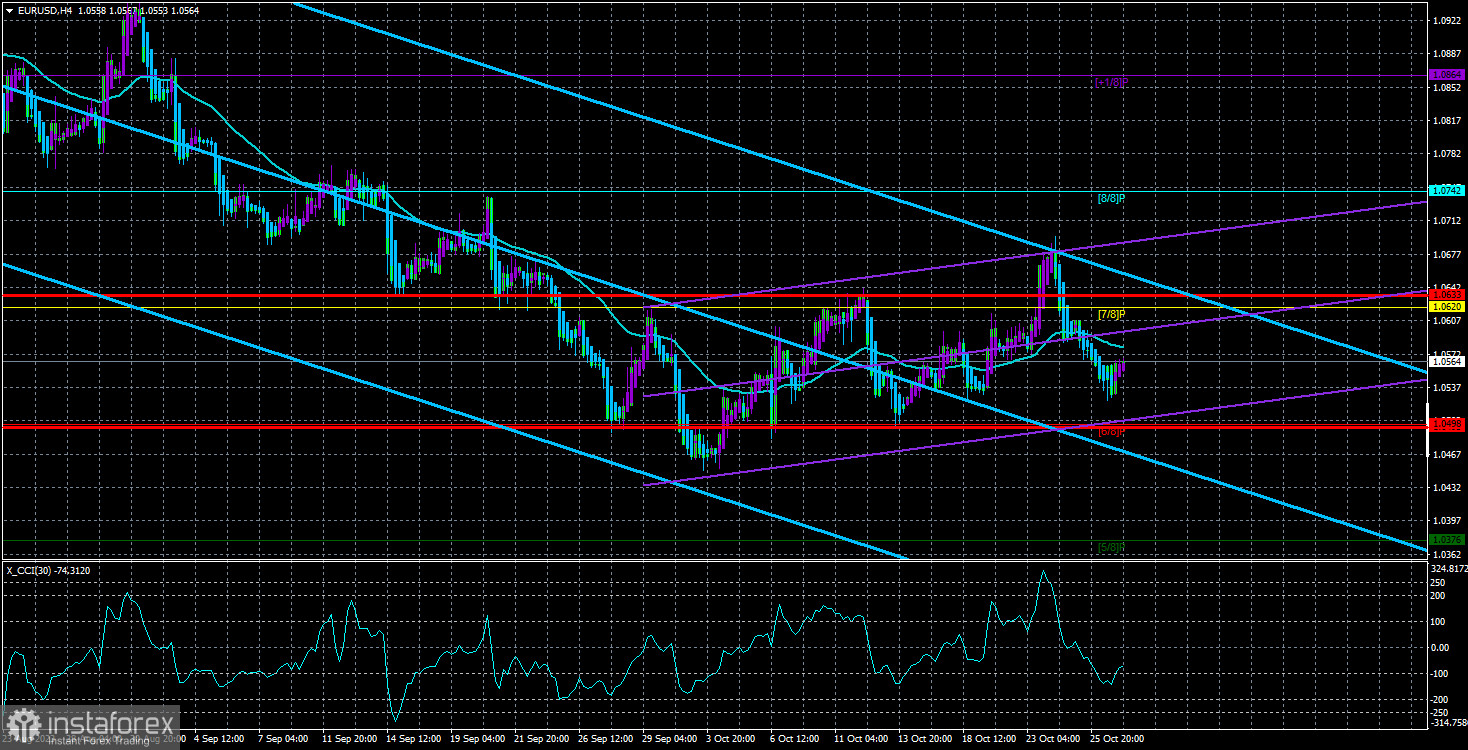

The technical picture over the past day, of course, has not changed. How could it change when there were essentially no movements? The price is once again below the moving average, but that doesn't stop it from resuming its rise today and forming a third corrective wave. The fact that we didn't see further depreciation of the pair on strong statistics from across the ocean could indicate the market's mood for a new corrective wave.

However, we want to note that the current area where the pair is located is quite dangerous for traders. Both buy and sell signals are forming in this area. The pair seems like it should be falling, but it may correct a bit more. On the 24-hour time frame, the price is "dancing" around the important level of 1.0609 and the critical line. On the 4-hour time frame, it crosses the moving average about once a day. All of this just confuses traders.

The ECB didn't evoke any emotions in the market. In principle, there was no intrigue regarding the ECB meeting. Market participants were 100% sure that the key rate wouldn't change, and therefore, the other two rates wouldn't change either. Expecting strong statements from Christine Lagarde, who spoke twice this week, was very difficult. What could Lagarde say? "We are tightening monetary policy again!"? Or "We are lowering the key rate!"? Neither the first nor the second option had anything to do with reality.

In the end, Ms. Lagarde stated that "rate cuts were not discussed at the meeting," and in the future, rate decisions will be made based on incoming information. The ECB will continue to closely monitor GDP, inflation, and core inflation indicators and regularly assess the impact of current monetary measures on the economy. In essence, we didn't hear anything new. The market already knew all of Lagarde's statements by heart. And the statement about not considering rate cuts sounds like mockery. How can there be any easing when inflation exceeds the target level by more than double?

As for the market's reaction, it could have provided insights into how the market perceives the received information. However, the reaction was practically non-existent, so we can't draw any conclusions here either. We believe that the strengthening of the dollar will continue in the medium term, especially after yesterday's strong package of statistics from across the ocean. We believe that the Federal Reserve has a much better chance and real opportunities to raise rates one or two more times than the ECB. Perhaps the market is not yet ready to resume selling the pair, and it may require one or even two more correction cycles, but we don't even consider the scenario of a new upward trend at the moment. We expect the dollar to rise to 1.0200.

The average volatility of the EUR/USD currency pair over the past 5 trading days as of October 27th is 69 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0495 and 1.0633 on Friday. A reversal of the Heiken Ashi indicator upwards may indicate a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has resumed its southward movement and settled below the moving average. Therefore, new short positions can be considered now, with targets at 1.0498 and 1.0376 in the case of a Heiken Ashi indicator reversal downward. Long positions can be considered only after the price re-establishes itself above the moving average, with targets at 1.0677 and 1.0742.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) signifies an approaching trend reversal in the opposite direction.