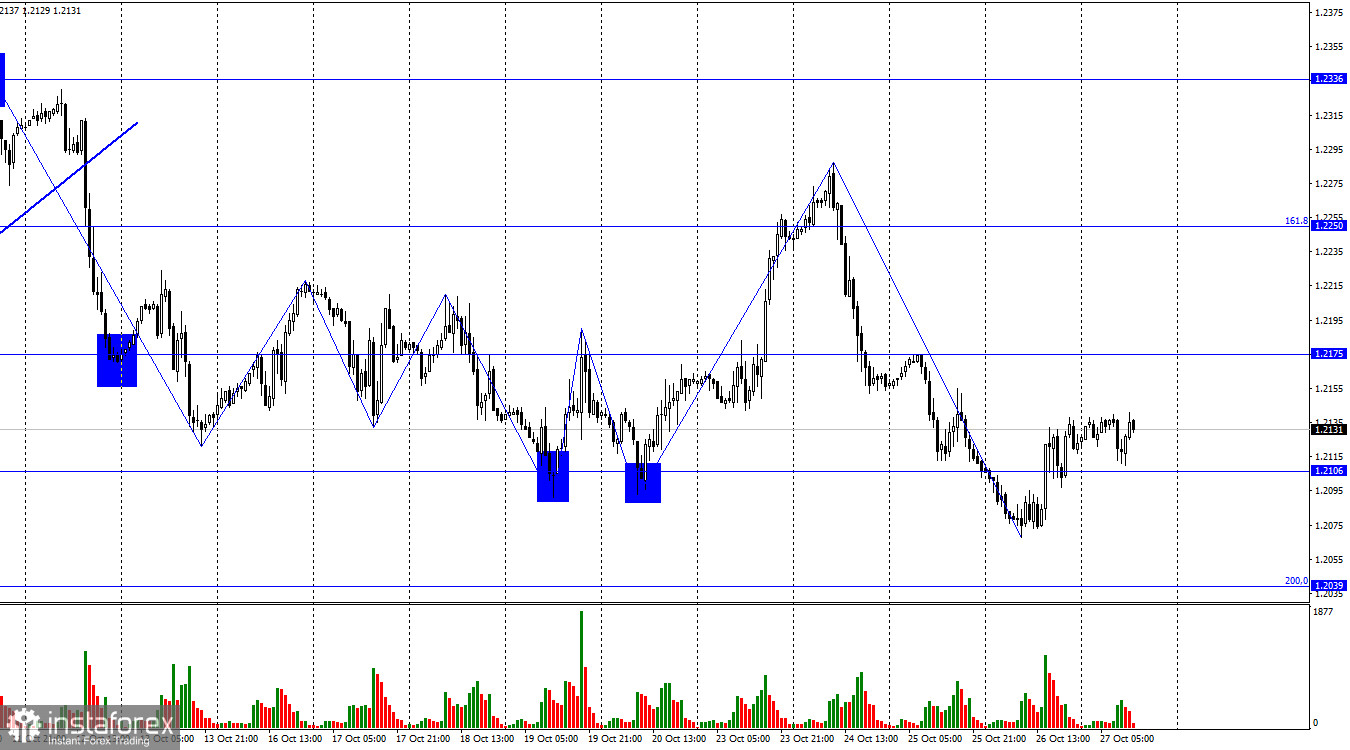

Hello, dear traders! On the 10-hour chart, the GBP/USD pair completed a reversal in favor of the pound sterling on Thursday and consolidated above the 1.2106 level. Thus, the instrument may continue its growth towards the next level of 1.2175, where the upward wave might conclude. Today, I'm not expecting a strong rise for the pound. Most likely, it will take 2-3 days to develop this wave. If GBP/USD closes below 1.2106, it will benefit the US currency, signalling a new bearish sequence towards the correctional level of 200.0%: 1.2039.

The wave situation cleared up after Monday's rise, but after the declines on Tuesday and Wednesday, it changed. The latest downward wave broke through the last four lows. This enables the sole conclusion that the bullish trend ended almost as soon as it began. After a 220-pip decline in GBP/USD, I'm anticipating an upward wave. This wave might turn out to be quite weak. For a trend reversal back to bullish, the instrument has to grow to 1.2286, which is unlikely to happen today.

Yesterday's US GDP reports and durable goods orders were overshadowed by the European Central Bank's meeting and Christine Lagarde's speech. It turned out that the ECB president didn't announce anything significant, and the rates remained unchanged. However, the market was entirely focused on these events. Market participants took no notice of the 4.9% expansion of the US economy in Q3 2023. Remarkably, this growth wasn't just above traders' expectations; it was 2.5 times higher than GDP in the second quarter. I reckon such data could have triggered a new rise for the dollar, but some experts think that such economic growth will dent the risk-on mood in the market, push down Treasury yields, and consequently, weigh on the US dollar. I have a different opinion and believe that, in the future, this report and the report on durable goods orders (which also significantly exceeded forecasts) will allow the US dollar to assert its strength.

On the 4-hour chart, GBP/USD rebounded from the 50.0% correction level of 1.2289 and turned in favor of the US currency. A new decline towards the 1.2008 level is already underway. The instrument closed above the descending trend corridor, but it is complicated for the sterling to develop a further rally. No divergences are observed today for any indicator.

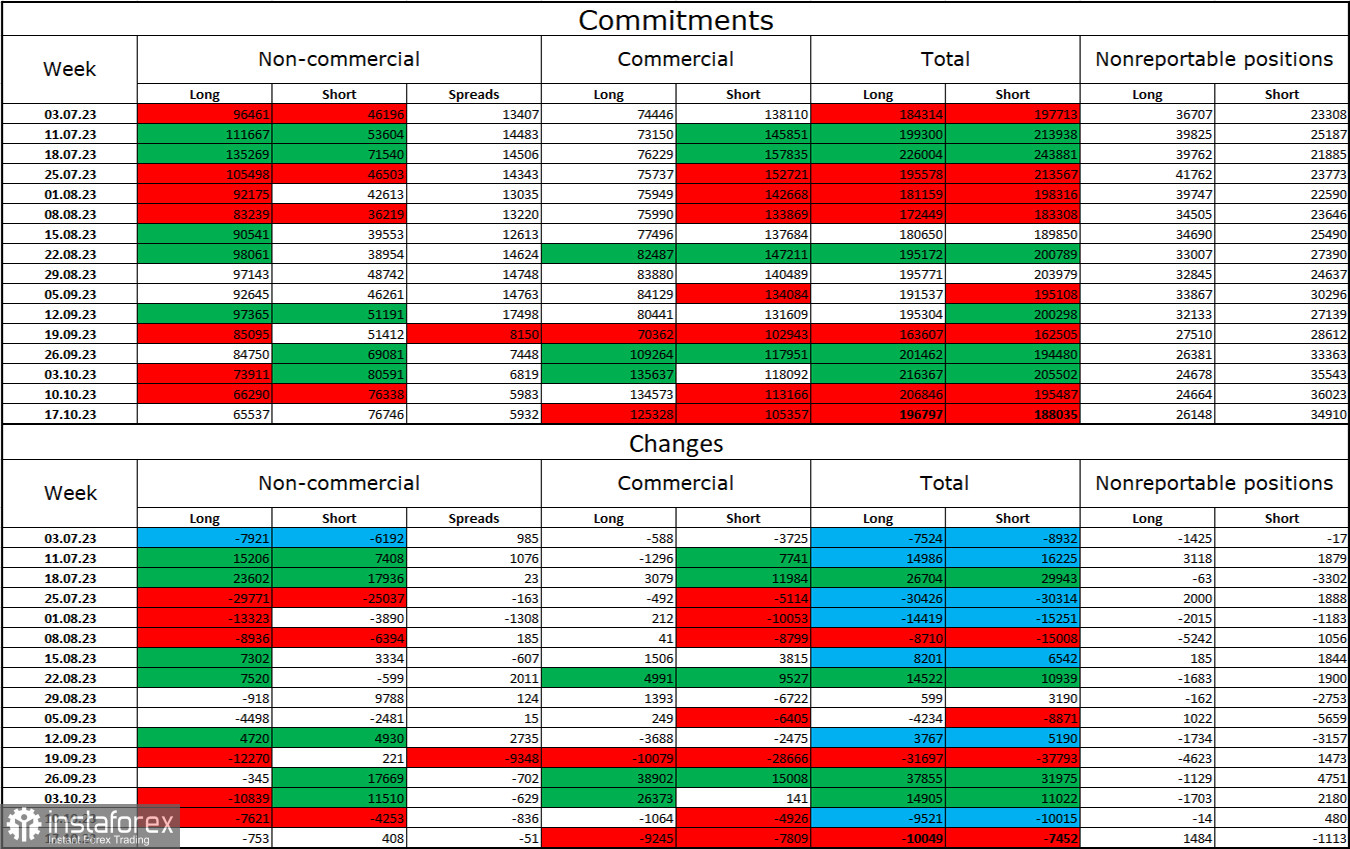

Commitments of Traders

The sentiment of the Non-commercial trader category has remained unchanged over the last reporting period. The number of Long contracts held by speculators decreased by 753, while the number of Short contracts increased by 408. The overall sentiment of major players shifted to bearish, and the gap between the number of Long and Short contracts is widening, but now in the opposite direction: 65,000 against 76,000. In my view, the outlook for the pound sterling is apparently bearish. I do not anticipate a strong rise in the British pound in the near future. I believe that over time, traders will continue to get rid of their buy positions, similar to the case with the single European currency.

Economic calendar for US and UK

US: core PCE price index due at 12-30 UTC

US: personal spending and income due at 12-30 UTC

US: consumer sentiment index by University of Michigan due at 12-30 UTC

On Friday, the economic calendar contains three reports of secondary importance for the US. The information background is going to make a minor impact on market sentiment until the weekend.

Outlook and trading tips on GBP/USD

Traders could go short on GBP/USD because the price had dipped from 1.2289 on the 4-hour chart with downward targets at 1.2250, 1.2175, and 1.2106. All targets have been hit. New sell positions could be opened on the condition the instrument closes below 1.2106 or dips from 1.2175. Buy positions could be planned in case the price rebounds off 1.2008 or 1.2039 with upward targets at 1.2106 and 1.2175.