The GBP/USD currency pair didn't show any interesting movements on Friday. The chances of a renewed downward trend for the British pound are much higher than for the euro. However, the local minimum from October 4th hasn't been broken yet, indicating that the correction may still continue. The correction, though, appears weak and awkward, but there's not much that can be done about it.

There were no significant events in the UK on Friday, and the American reports were of a distinctly secondary nature. Consequently, volatility remained rather moderate. The price corrected towards the moving average again, but for the past two to three weeks, it has been moving mostly sideways rather than upward or downward. We would prefer to see another turn in the correction before a new decline begins, but the upcoming week is so saturated with important events that by the end of it, the pair could be anywhere.

It's clear that predicting the pair's movements next week is practically impossible. We can only speculate on two possible scenarios. If the overall macroeconomic data and the results of two central bank meetings favor the pound, a new phase of correction would be logical. If sentiment swings in favor of the dollar again, there's nothing to prevent the market from continuing to actively sell the pair, which would also be quite logical.

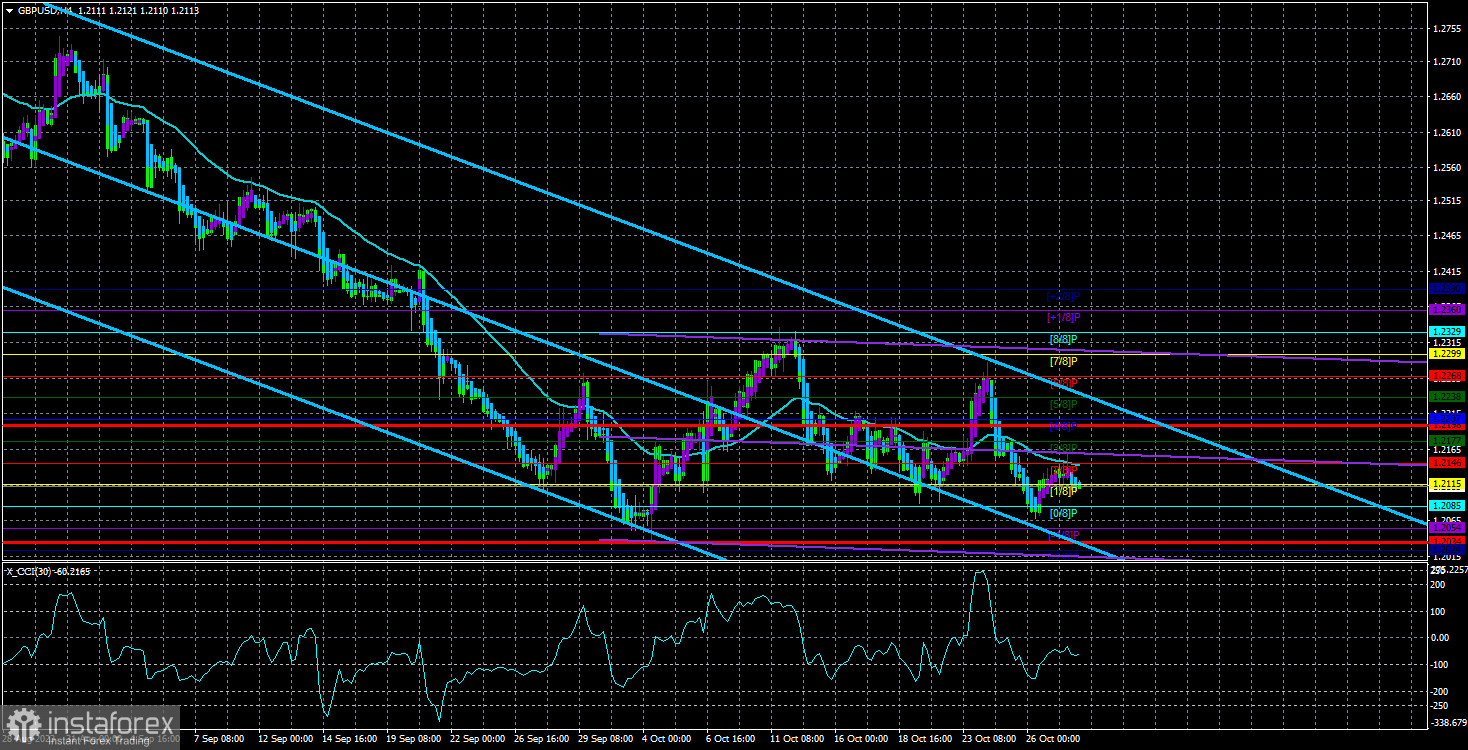

How can we determine if a new phase of correction is beginning? Unfortunately, we will have to rely solely on the moving average. Closing above it would increase the chances of a new rise toward 1.2268-1.2329. If no closure above it occurs, we should expect a new decline in the British pound.

Central bank meetings are always important and interesting. Even if there is nothing to expect from the central bank at the moment, there may still be information that the market does not anticipate. However, there are also situations when the market hardly reacts to the meeting results because there is nothing to react to. A clear example is the European Central Bank (ECB) meeting last week. Lagarde did not provide any new information during the press conference and did not signal changes in the regulator's sentiment or upcoming changes, and the key rates remained unchanged. Therefore, we did witness some emotional reactions, but the overall response did not exceed 25 points.

We may very well see something similar this week. The Federal Reserve (Fed) does not plan to raise rates on November 1st. Perhaps Jerome Powell will hint at tightening during the last meeting of this year, which would lead to a rise in the dollar. However, as experience shows, such events occur quite rarely. The same applies to the Bank of England. The rate is unlikely to be raised, but Andrew Bailey and his team have not yet indicated that the cycle of tightening monetary policy has ended. This means that the rate could still rise in the coming months. The question is when this will happen. The UK still has high inflation, and in the United States, it has been increasing over the past three months. We would say that the probability of additional tightening in both cases is quite high. However, there are no changes expected in the November meetings.

So, we have a situation where a very interesting and important week could turn out to be rather dull and gloomy. Of course, the market cannot ignore the non-farm payroll data or the unemployment rate, and the ISM indices will likely not leave them indifferent either. However, all these events and publications may have a rather weak impact on the movement of major currency pairs. Everything will depend on their nature and the deviation of actual values from forecasts.

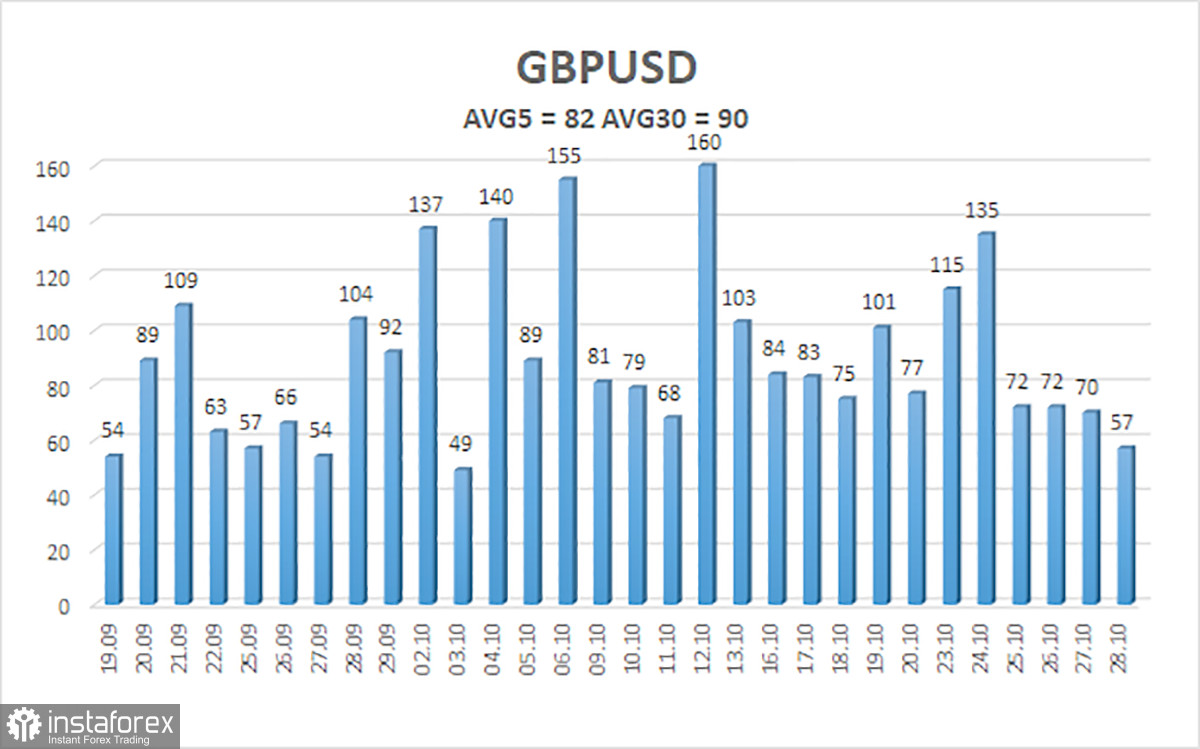

The average volatility of the GBP/USD pair over the last 5 trading days is 82 points. For the GBP/USD pair, this value is considered "average." As a result, we anticipate movement on Monday, October 30th, between the levels of 1.2034 and 1.2198. A reversal of the Heiken Ashi indicator downward will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2115

S2 – 1.2085

S3 – 1.2054

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2177

R3 – 1.2207

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair may have completed its sluggish correction attempts. Therefore, it is possible to remain in short positions with targets at 1.2054 and 1.2034 in case the price bounces off the moving average. In the event of the price closing above the moving average, long positions with targets at 1.2198 and 1.2238 may become relevant.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are pointing in the same direction, it indicates a strong current trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted at the moment.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel within which the pair will move in the next day based on current volatility indicators.

CCI indicator - its entry into the oversold territory (below -250) or overbought territory (above +250) signals an approaching trend reversal in the opposite direction.