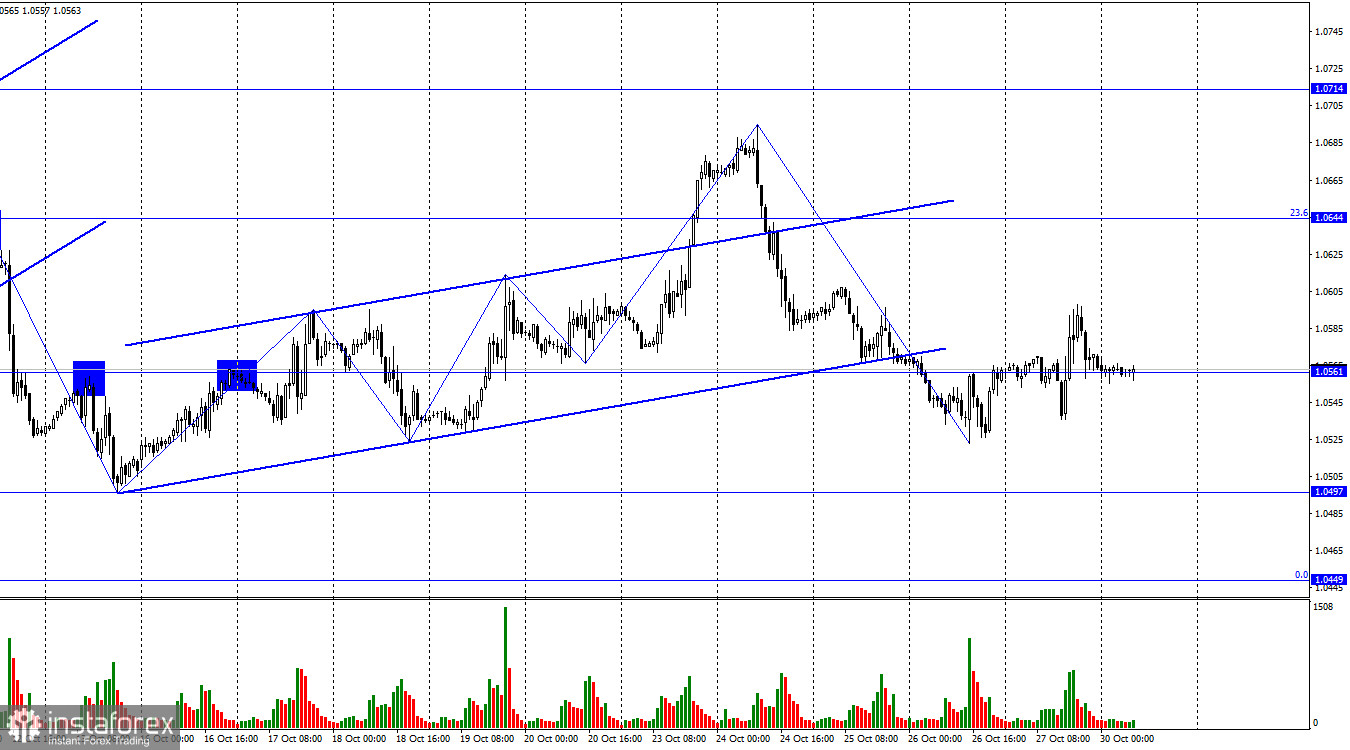

On Friday, the EUR/USD pair continued a modest upward move and closed above the level of 1.0561, which suggests the possibility of further growth towards the Fibonacci level of 23.6% (1.0644). If the pair closes below the level of 1.0561, it will favor the US dollar and signal a resumption of the decline towards the level of 1.0497. The pair has closed below the ascending trend corridor, indicating a potential trend change to the bearish side.

The wave situation has become a bit clearer. If a bullish trend was forming over the past week, the last downward wave broke the low of the previous one. Thus, we have the first sign of a trend change to bearish. Combined with the closure below the trend corridor, it's safe to say that the pair has excellent prospects for further declines. The first downward wave of the new trend turned out to be quite significant, so I expect an upward wave to form in the first half of the week.

Today, all the most interesting events of the day are in Germany. I want to note right away that they are considered important only today when there are no other events or news in the US or the European Union. Therefore, traders will have to focus their attention on the reports on GDP and inflation in Germany. It is expected that the German economy will contract by 0.3% in the 3rd quarter, but it also saw negative growth in the last two quarters. Another decline in GDP won't be a major disappointment. However, the consumer price index may show a decrease to 4% y/y. But for the euro, such numbers are more likely to be negative than positive. Now the ECB will have even less reason to tighten monetary policy. At the same time, the FOMC may raise the interest rate in December, as inflation in the US has been rising in recent months.

On the 4-hour chart, the pair has closed below the corrective level of 100.0% (1.0639), which suggests the potential for a decline towards the corrective level of 127.2% (1.0466). A further drop below this level would increase the chances of continuing the decline towards the next Fibonacci level at 161.8% (1.0245). The pair has closed below the trend corridor, but it is almost the same as on the hourly chart. There are no imminent divergences observed in any of the indicators today.

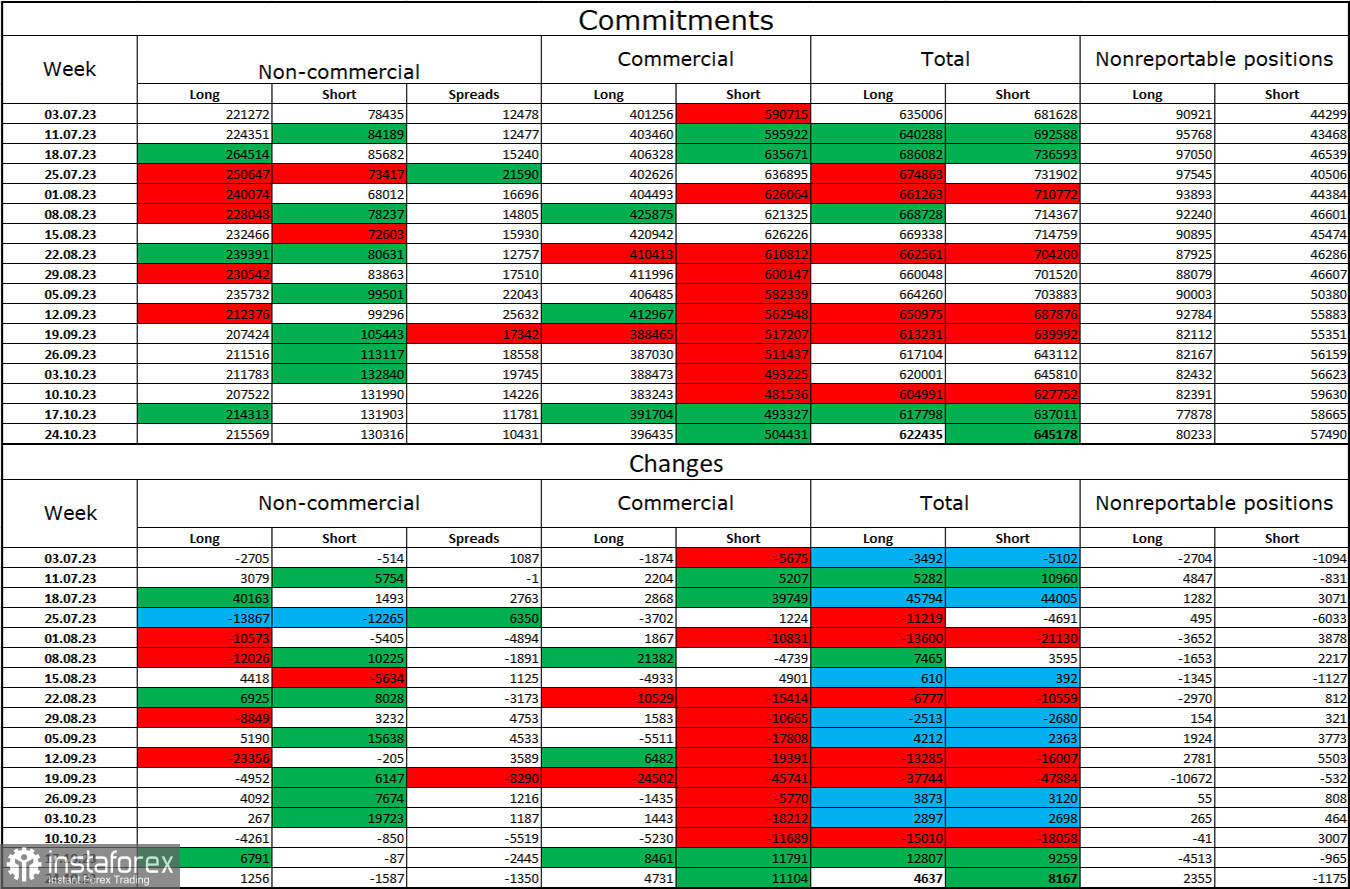

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 1,256 long contracts and closed 1,587 short contracts. The sentiment of major traders remains bullish, but it has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators is now 215,000, while short contracts amount to 130,000. The difference is now less than double, although a few months ago, the gap was threefold. I believe the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to start a new bullish trend. Such a background is currently lacking. Professional traders may continue to close their long positions in the near future. I believe the current numbers allow for the continuation of the euro's decline in the coming months.

Economic Calendar for the US and the European Union:

European Union - GDP in the third quarter (09:00 UTC).

European Union - Consumer Price Index in Germany (13:00 UTC).

On October 30, the economic events calendar contains only two entries, which are hardly considered important. The impact of the information background on traders' sentiment on Monday may be weak.

EUR/USD Forecast and Trader Recommendations:

Today, buying the pair is possible with a rebound on the hourly chart from the level of 1.0497 to a target of 1.0561. I recommend selling today if there is a close below the level of 1.0561 on the hourly chart with a target of 1.0497.