Overview of trading and tips on EUR/USD

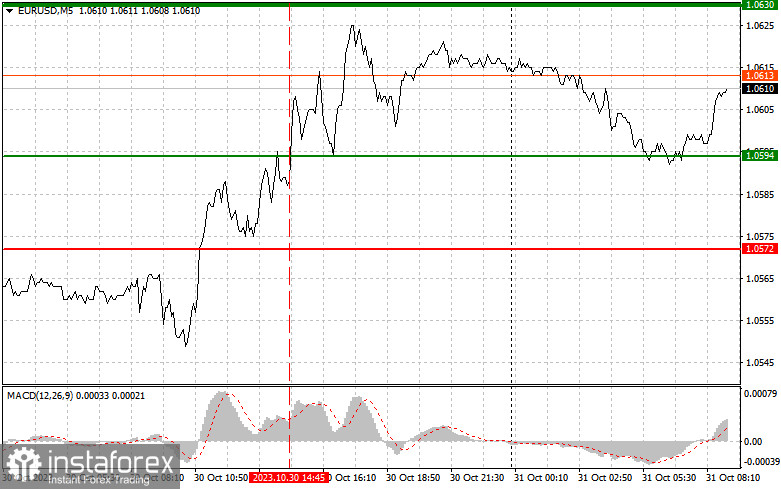

The level of 1.0594 was tested exactly at the moment when the MACD indicator had moved considerably higher from the zero mark. This capped the bullish momentum of EUR/USD. For this reason, I didn't go long on this instrument. Today the economic calendar contains a lot of important statistics. For a start, the market will get to know retail sales in Germany. However, much more attention will be focused on inflation in the eurozone. Market participants will have to digest the headline and core CPIs of the eurozone. If the CPIs decline as expected, the euro is likely to receive support and we will see another bullish sequence in EUR/USD. Along with these data, a downbeat report on GDP in the eurozone for the third quarter of 2023 has been published. So, on the flip side, weaker economic performance and slower GDP growth are bearish for the euro. As for intraday prospects, I will act more based on the implementation of scenarios No. 1 and No. 2.

Buy scenarios

Scenario No. 1. Today, you can buy the euro when EUR/USD reaches around 1.0624 plotted by the green line on the chart, aiming to grow to the level of 1.0665. At 1.0665, I recommend exiting the market and also selling the euro in the opposite direction, counting on a downward movement of 30-35 pips from the entry point. We are betting on the euro's growth today as the euro is expected to continue the upward correction after positive data on GDP and inflation. Importantly, before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2. You can also go long on the euro today in case of two consecutive tests of 1.0595 at the time when the MACD indicator is in the oversold area. This will put a lid on the downward potential of EUR/USD and will lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.0624 and 1.0665.

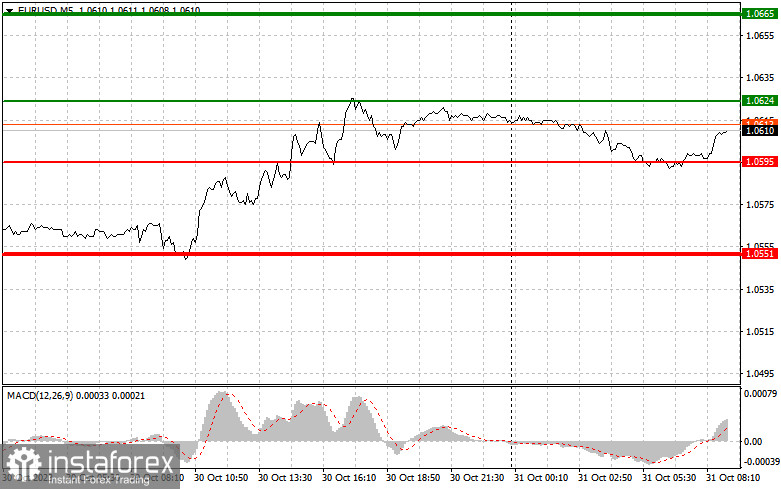

Sell scenarios

Scenario No. 1. We can open short positions on EUR/USD after the price reaches the level of 1.0595 plotted by the red line on the chart. The target will be the level of 1.0551, where I recommend exiting the market and buying immediately in the opposite direction, expecting a movement of 20-25 pips in the opposite direction from the level. EUR/USD will come under selling pressure in case of weak statistics, especially on GDP growth rates. Importantly, before selling, please check that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2. You can also sell EUR/USD today in case of two consecutive tests of 1.0624 at the time when the MACD indicator is in the overbought area. This will limit the upward potential and lead to a market reversal downwards. We can expect the instrument to decline to the opposite levels of 1.0595 and 1.0551.

What's on the chart:

Thin green line is the entry price at which you can buy the trading instrument.

Thick green line is the price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line is the entry price at which you can sell the trading instrument.

Thick red line is the price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line: it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders in the cryptocurrency market need to be very cautious when making decisions to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, for successful trading, it is necessary to have a clear trading plan, similar to the one I presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.