Analysis of transactions and tips for trading the Japanese yen

Today, the Bank of Japan has decided to keep its current monetary policy unchanged, which has led to the expected weakening of the Japanese yen and another upward surge in the USD/JPY pair. The regulator's current policy is aimed at stimulating economic growth, and rising inflation does not pose a threat to the state of affairs, unlike several other countries struggling with high prices. Now, the focus will shift to U.S. statistics, and only they will be able to push the yen above the 150 level. Data on consumer confidence, along with good indicators for the housing price index and the Chicago PMI index, are expected to lead to another attempt to consolidate above 150. As for the intraday prospects, I will act based on the implementation of Scenario #1.

Buy Signal

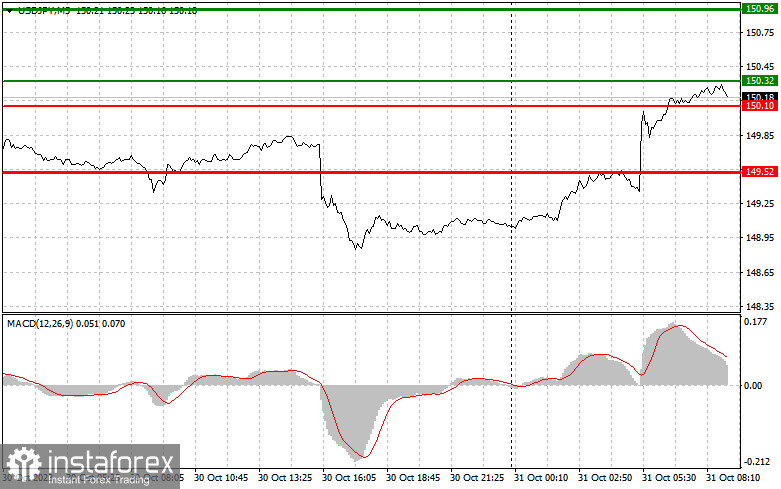

Scenario #1: Today, buying USD/JPY can be considered once the entry point is reached around 150.32 (the green line on the chart), with a target of rising to the level of 150.96 (the thicker green line on the chart). Around 150.96, it is recommended to exit long positions and open short positions in the opposite direction (anticipating a movement of 30-35 points in the opposite direction from the level). Expect the pair to rise today after strong U.S. statistics to continue the morning bullish trend. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: Buying USD/JPY today is also possible if there are two consecutive price tests at 150.10 at a time when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to a reverse market turn upward. Expect a rise to the opposite levels of 150.32 and 150.96.

Sell Signal

Scenario #1: Selling USD/JPY can be considered only after updating the 150.10 level (the red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the level of 149.52, where it is recommended to exit short positions and also open long positions in the opposite direction (anticipating a movement of 20–25 points in the opposite direction from the level). The return below 150 could happen in the near future, restoring hope for more active downward movement of the pair. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting its decline from it.

Scenario #2: Selling USD/JPY today is also possible if there are two consecutive price tests at 150.32 at a time when the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a reverse market turn downward. Expect a drop to the opposite levels of 150.10 and 149.52.

On the chart:

Thin green line - entry price for buying the trading instrument.

Thick green line - the expected price level where you can set Take Profit or fix profits on your own, as further growth above this level is unlikely.

Thin red line - entry price for selling the trading instrument.

Thick red line - the expected price level where you can set Take Profit or fix profits on your own, as further decline below this level is unlikely.

MACD indicator. When entering the market, it is important to follow the overbought and oversold zones.

Important. For novice forex traders, it is essential to make decisions about entering the market very carefully. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.