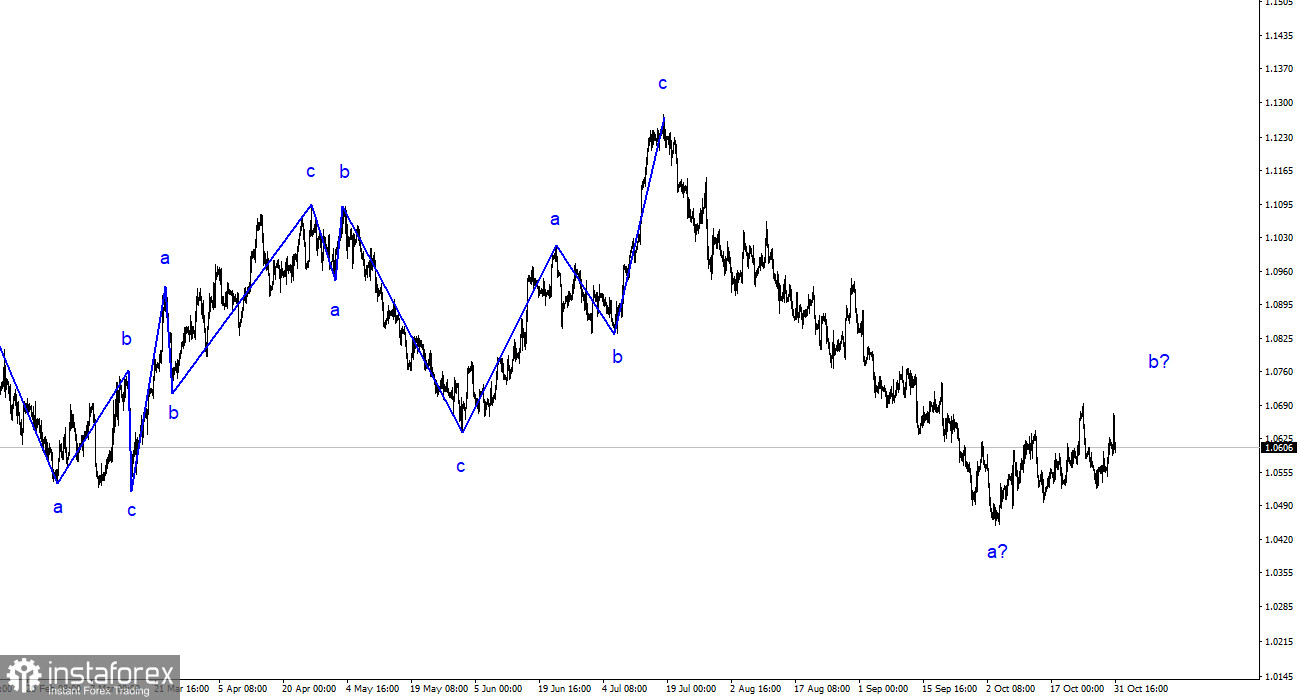

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have only seen three wave structures that alternate with each other. For the past few months, I have regularly mentioned that I expect the pair to reach around 1.20, where the construction of the last upward three-wave pattern began. This target was reached after a two-month decline. After reaching this target, the construction of a corrective wave 2 or b began, which has taken a clear three-wave form but may also take a five-wave form.

Regardless of whether wave 2 or b turns out to be, the overall decline in the European currency will not be completed, as a third wave construction is still required in any case. Within the first wave, five internal waves are evident, indicating its completion. Inside the second wave, three waves are evident, suggesting it may also be completed, but it can also take the form of a-b-c-d-e.

The euro/dollar pair's exchange rate remained unchanged on Tuesday. However, this lack of change has nothing to do with a flat or sideways movement. In other words, the pair was traded very actively throughout the day but returned to the opening levels at the time of writing this article. This is why there are no currency rate changes. During the day, the European currency first rose by 80 basis points and then lost the same amount. Clearly, the morning demand for the euro was based on wave labeling, which currently allows for the construction of the fifth corrective wave e. However, a plunge occurred later due to European statistics, which, although not catastrophic, left a bitter aftertaste.

First and foremost, the report on retail trade in Germany should be noted. Volumes decreased by 0.8% on a monthly basis in September, while the market expected an increase of 0.5%. This report was enough to start reducing demand for the euro. However, the market did not rush to conclusions and preferred to wait for European reports on GDP and inflation. The economy shrank by 0.1% in the third quarter, just like the German economy. However, the market expected 0%, so the report was disappointing. On the other hand, inflation decreased to 2.9% from 4.1%. The slowdown was quite significant, and honestly, the market could have paid more attention to this report. I believe that the strengthening of the European currency is not yet complete, but this week the market may be in an excited state due to a large number of important events. This state may be reflected in the charts with sharp mood swings.

General Conclusions

Based on the analysis conducted, I conclude that the construction of a downward wave set continues. The targets around the 1.0463 level have been ideally worked out, and an unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. A successful attempt to break the 1.0637 level, which corresponds to 100.0% according to Fibonacci, indicated the market's readiness to complete the construction of wave 2 or b. However, this wave may take on a more complex form, so if selling is considered, it should be done in small volumes. The main decline may start a little later.

On a larger wave scale, the upward trend structure has taken on an extended form but is likely completed. We saw five upward waves, which are most likely structured as a-b-c-d-e. Afterward, the pair constructed four three-wave patterns: two downward and two upward. Currently, it has likely transitioned to the stage of building another extended downward three-wave structure.