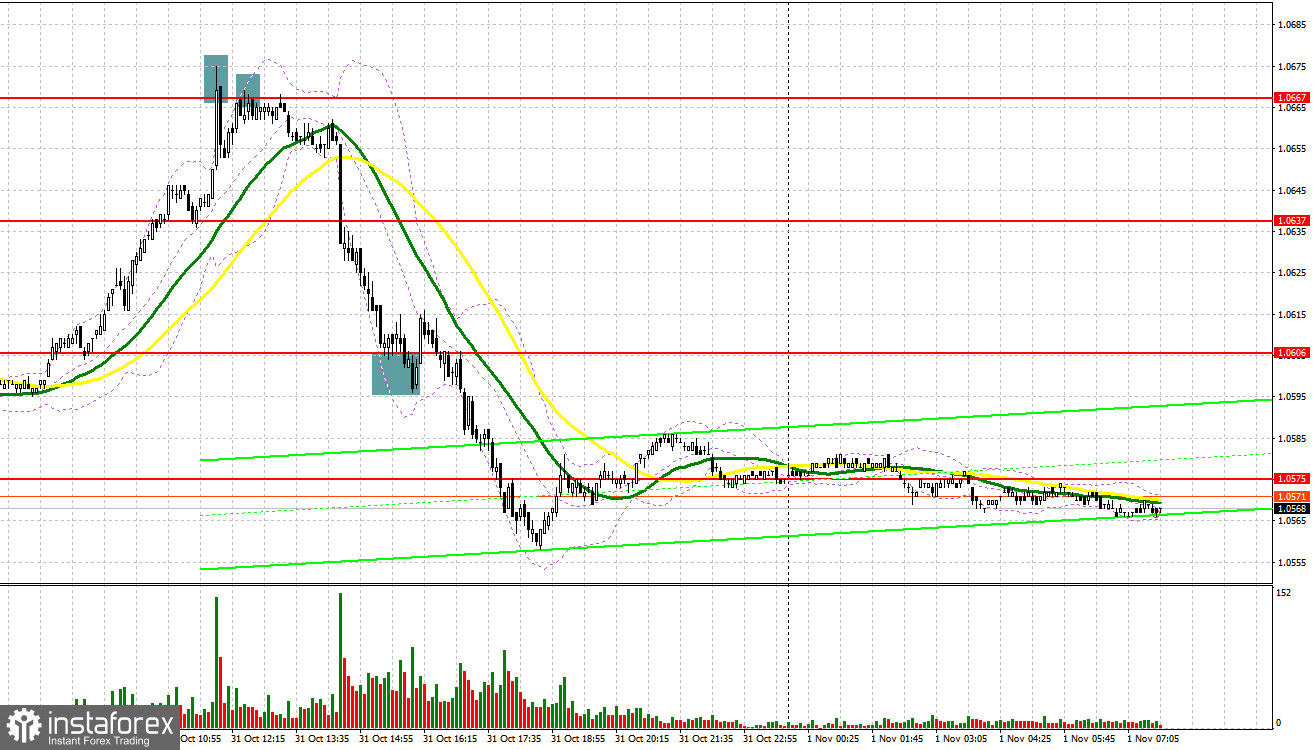

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0611 as a possible entry point. A rise and a false breakout near this mark generated a sell signal, but the pair failed to move sharply lower. As a result, we marked losses on the trade. However, selling on a rebound from 1.0667 made it possible to recoup losses. In the afternoon, a false breakout at 1.0667 produced a good sell signal. As a result, the pair fell by more than 70 pips. The bulls failed to protect the 1.0606 level and after the pair was up by 10 pips, it came under pressure again.

For long positions on EUR/USD:

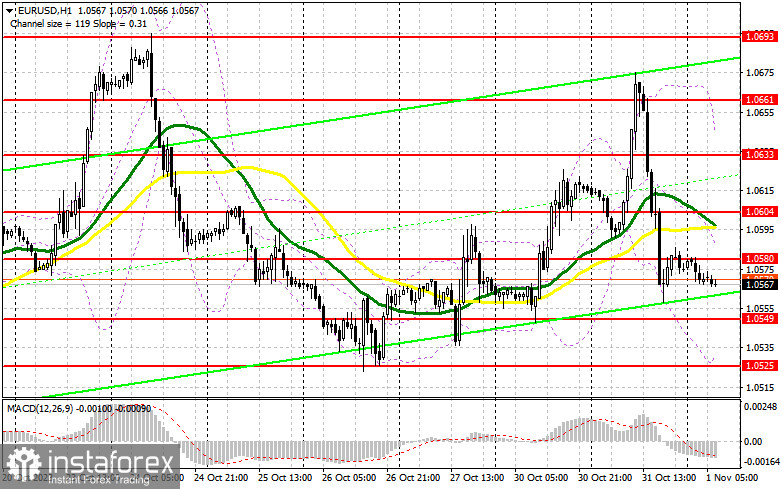

Strong US data and the news that the eurozone's GDP shrank in the third quarter were a great reason for a market reversal during Tuesday's US session. In the absence of reports in the eurozone, the pair may trade sideways with the bears holding the advantage as they aim to continue yesterday's trend. We will talk more about the Federal Reserve meeting in the afternoon forecast. In case the pair falls during the European session, a false breakout near the support level at 1.0549 will serve as a confirmation of an entry point for long positions in hopes of maintaining market equilibrium and a test of the resistance level at 1.0580. A breakout and a downward retest of this range can pave the way for a surge up to 1.0604, which is in line with the bearish moving averages. The ultimate target is found at 1.0633 where I plan to take profits. But don't expect a test of this mark. If EUR/USD declines and shows a lack of activity at 1.0549, the pressure on the euro will increase, which will push the pair down to the area of last week's lows of 1.0525. In such a scenario, only a false breakout at this mark would provide an entry signal. I would immediately go long on a bounce from 1.0497, aiming for an intraday upward correction of 30-35 pips.

For short positions on EUR/USD:

Yesterday, the bears completed their tasks, and we witnessed a major sell-off and a rebalancing of the market ahead of the next Federal Reserve meeting. In the absence of economic reports, we can expect the sellers to defend the nearest resistance level at 1.0580. A false breakout at this mark will generate a good sell signal, with a prospect of a decline towards the 1.0549 support. A breakout and consolidation below this range, as well as its upward retest, will give another sell signal with the target at 1.0525. The ultimate target will be 1.0497 where I will take profits. If EUR/USD rises during the European session and bears are absent at 1.0580, the bulls will surely try to return to the market, although it is unlikely. In this scenario, I will delay going short until the price hits the resistance at 1.0604. I may consider selling there but only after a failed consolidation. I will go short immediately on a rebound from the high of 1.0633, aiming for a downward correction of 30-35 pips.

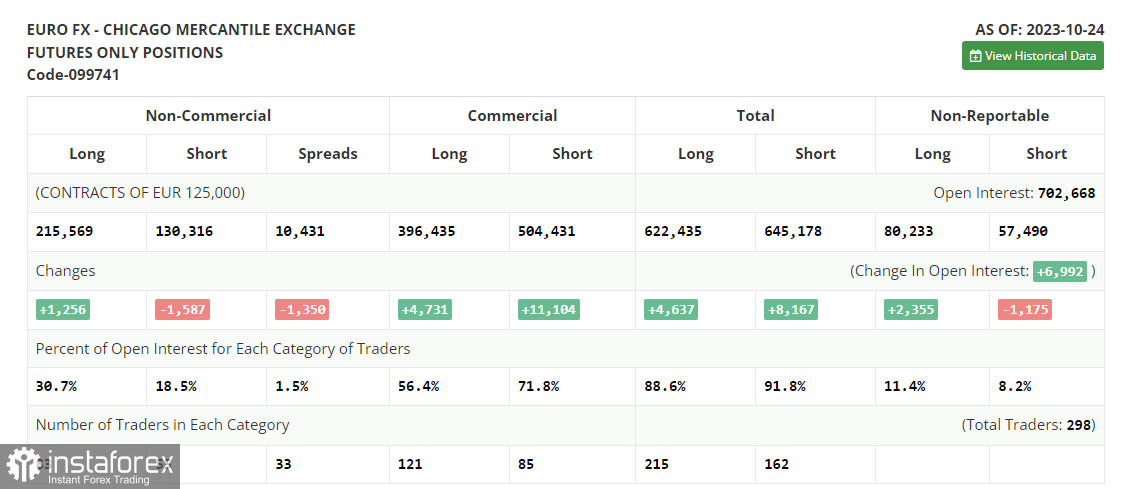

COT report:

The Commitments of Traders report for October 24 showed an increase in long positions and a decrease in short ones. Considering that everyone expected the European Central Bank to stop the cycle of interest rate hikes, its decision did not affect the balance of forces in the market, and as we see it, it actually helped the euro to recover its positions against the dollar. This week, the US Federal Reserve will likely leave interest rates unchanged at the upcoming policy announcement. But given the post US data, it is possible that the committee members will hint at the possibility of the last rate hike in December this year, which will push the dollar higher. The COT report reveals that non-commercial long positions increased by 1,256 to 215,569, while non-commercial short positions declined by 1,587 to 130,316. This resulted in the spread between long and short positions shrinking by 1,350. The closing price rose to 1.0613 compared to 1.0596, confirming the euro's bullish correction.

Indicator signals:

Moving averages:

The instrument is trading below the 30 and 50-day moving averages. It indicates that EUR/USD is likely to decline lower.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0540 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.