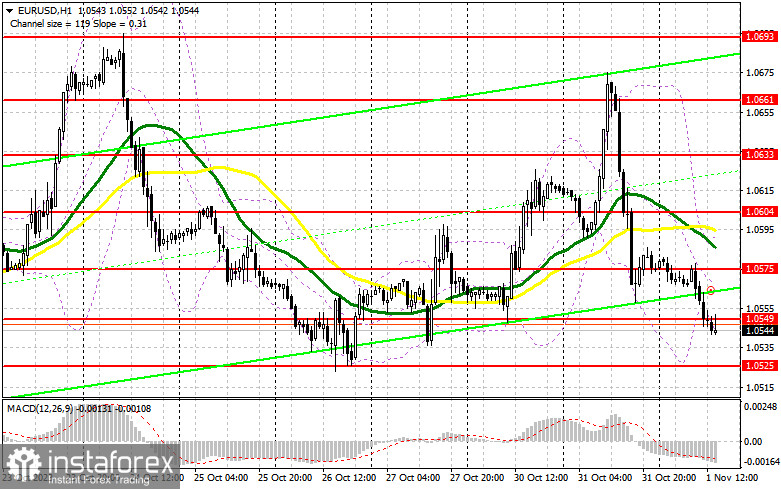

In my morning forecast, I drew attention to the level of 1.0580 and recommended making entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. There was an upward movement, but it did not reach the level of 1.0580 due to a false breakout, as it fell just a couple of points short of reaching it. For this reason, I was unable to enter short positions. The technical picture was slightly reconsidered for the second half of the day.

To open long positions on EUR/USD, the following conditions are required:

Today, the Federal Reserve's decision will be the key moment. It's not just the decision itself; it's the regulator's interest rate forecasts that will matter. If it is announced that no one intends to raise rates further, the dollar will weaken against the euro. However, if they leave the door open for further rate hikes by a quarter of a percentage point, as most expect, the pair may decline, but the downside movement is unlikely to be significant. Only drastic changes in policy can affect the balance of power. Before the Fed's decision, I recommend paying attention to the change in non-farm employment from ADP and the ISM Manufacturing Index. In the event of a further pair's decline, a false breakout at 1.0525 would provide a good entry point for long positions with the target of returning to 1.0549. A breakthrough and an update of this range from top to bottom would provide an opportunity for another upward move to renew the maximum at 1.0575, where I would take a profit. Only a very dovish Fed position would trigger a euro rally to 1.0604. In the event of a decline in EUR/USD and no activity at 1.0525, which is quite likely, especially after the U.S. labor market data, pressure on the euro will increase, leading to a larger downward movement towards 1.0525. Only a false breakout will signal an entry point. I will consider opening long positions upon a rebound from 1.0497 with the target of an intraday upward correction of 30-35 points.

To open short positions on EUR/USD, the following conditions are required:

Sellers protected their positions, continuing the pair's decline. There is currently an active battle for the level of 1.0549, which can lead to losing control of the market. Therefore, only a false breakout there, combined with strong U.S. labor market data, would signal a sell-off with a downward movement towards the nearest support at 1.0525. After breaking and securing below this range, as well as a bottom-up retest, I expect another sell signal with a target of 1.0497. The furthest target will be the minimum at 1.0474, where I would take a profit. However, updating this level will only happen with a very hawkish Fed position, hinting at rate hikes even next year. In the event of an upward movement of EUR/USD during the US session and no bears at 1.0549, which is the current scenario, buyers are likely to try to reach the resistance at 1.0575. There, you can sell, but only after an unsuccessful or false breakout. I will consider opening short positions upon a rebound from the maximum at 1.0604 with the target of a downward correction of 30-35 points.

Indicator Signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating the possibility of a further decline in the euro.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator around 1.0549 will act as support.

Description of indicators

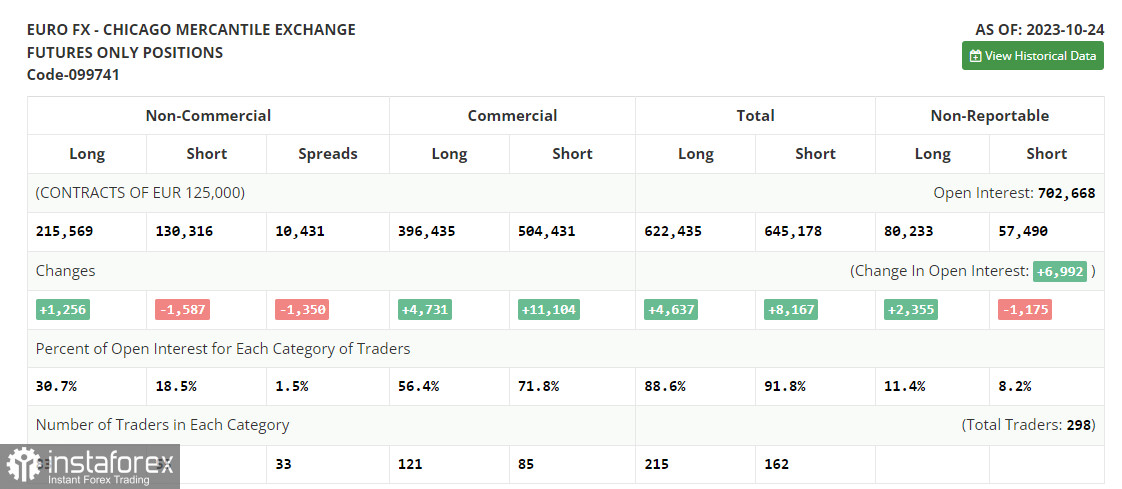

Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.Bollinger Bands. Period 20.Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The total non-commercial net position is the difference between the short and long positions of non-commercial traders.