Analysis of Trades and Trading Tips for the European Currency

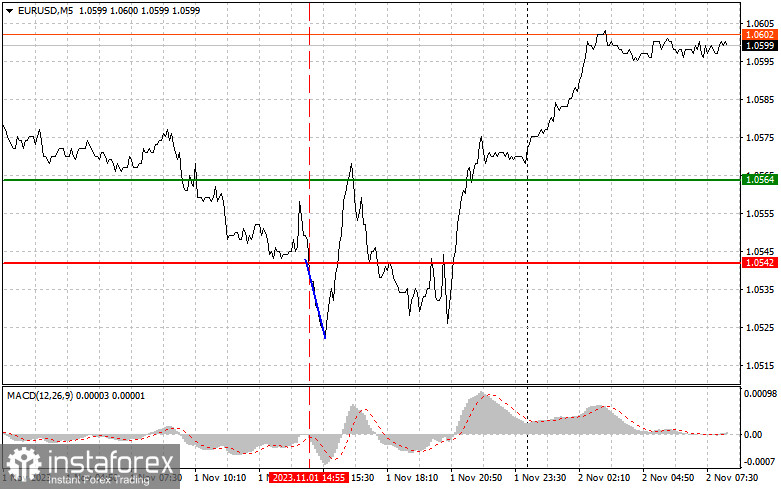

The test of the price at 1.0542 occurred when the MACD indicator had just started to move down from the zero mark, which served as a confirmation of an entry point for short positions. As a result, the pair fell by 20 pips. The Federal Reserve's decision following a weak labor market report exerted pressure on the US dollar and strengthened the euro. The eurozone is set to release Manufacturing PMIs, and a contraction is likely to exert pressure on the euro and push EUR/USD downwards. It is also important to analyze the unemployment rate report for Germany and listen to the speech of European Central Bank Executive Board member Philip Lane, whose remarks could harm the euro's growth prospects. If none of this occurs, the pair will likely extend its upward movement. As for the intraday outlook, I will act more based on the implementation of scenarios #1.

Buy Signal

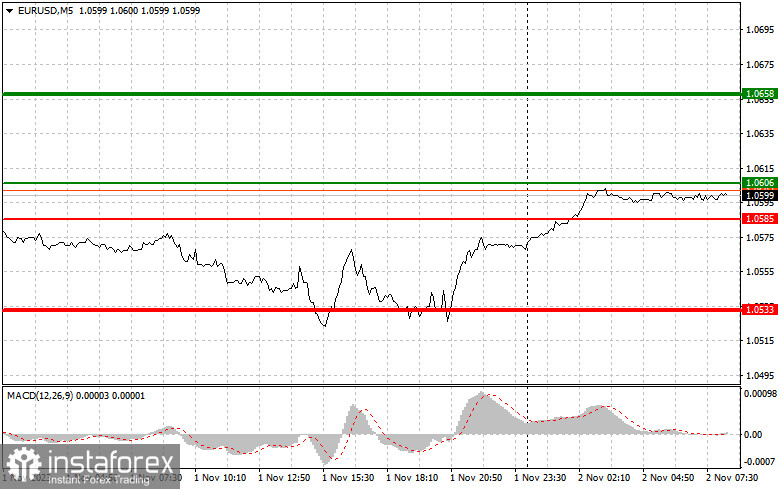

Scenario #1: Today, you can buy the euro when the price reaches around 1.0606 (green line on the chart), with the goal of reaching 1.0658. I recommend exiting the market at 1.0658 and selling the euro in the opposite direction, targeting a 30-35 point move from the entry point. Euro growth can be expected in continuation of yesterday's uptrend following the Fed's decision to leave interest rates unchanged. Important! Before buying, make sure that the MACD indicator is above the zero level and has just started to rise from it.

Scenario #2: You can also buy the euro today if there are two consecutive tests of the price at 1.0585 while the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a market reversal upward. Expect an increase to the opposite levels of 1.0606 and 1.0658.

Sell Signal

Scenario #1: You can sell the euro after it reaches the level of 1.0585 (red line on the chart). The target will be 1.0533, where I recommend exiting the market and buying the euro immediately in the opposite direction (aiming for a 20–25 point move in the opposite direction from the level). Pressure on the pair will increase in case the pair fails to break above the daily high. Important! Before selling, make sure that the MACD indicator is below the zero level and has just started to decrease from it.

Scenario #2: You can also sell the euro today if there are two consecutive tests of the price at 1.0606 while the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a market reversal downward. Expect a decrease to the opposite levels of 1.0585 and 1.0533.

On the chart:

Thin green line – entry price for buying the trading instrument.

Thick green line – the expected price where you can set Take Profit or independently fix profits, as further growth beyond this level is unlikely.

Thin red line – entry price for selling the trading instrument.

Thick red line – the expected price where you can set Take Profit or independently fix profits, as further decline below this level is unlikely.

MACD indicator. When entering the market, it is important to consider the overbought and oversold zones.

Important. For novice traders in the forex market, it is essential to be very cautious when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you are not using proper risk management and are trading with large volumes.

And remember that for successful trading, you need to have a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for intraday traders.