Analysis of trades and trading tips for the British pound

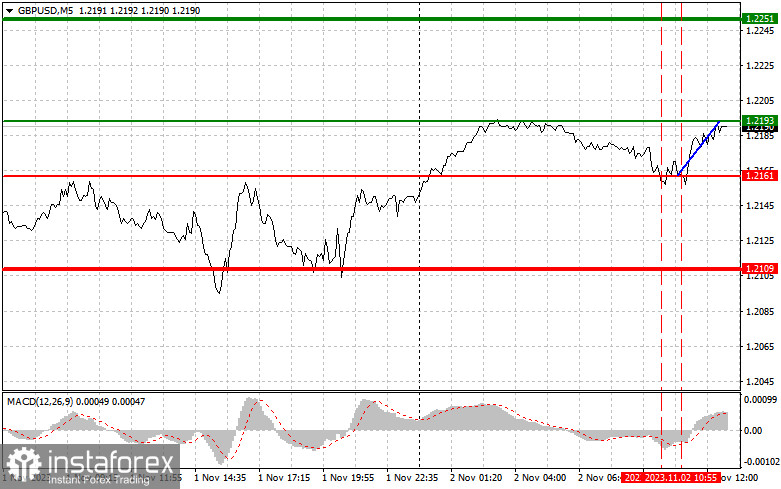

The initial test of the price at 1.2161 occurred when the MACD indicator was in the overbought area, which clearly limited the further downside potential of the pair. For this reason, I refrained from buying the pound. The second test of this level shortly afterward led to an excellent entry point for buying the pound, according to Scenario #2. As a result, the pair moved up by more than 30 points. In addition to the US labor market data, we will also see the outcomes of the Bank of England's meeting. A bullish reaction to these developments, along with a breakthrough of daily highs and significant resistance around the 1.22 level, would provide an excellent buying opportunity, despite MACD indicator readings, and that's the plan I intend to follow. If there's a negative reaction to the data, a major sell-off below 1.2170 is still possible. For this reason, I will act based on the implementation of Scenario #1.

Buy Signal

Scenario #1: Buying the pound today is possible when the entry point reaches around 1.2199 (the green line on the chart), with a target of reaching 1.2251 (the thicker green line on the chart). Around 1.2251, I recommend exiting purchases and opening sales in the opposite direction (expecting a move of 30–35 points in the opposite direction from the level). The pound's rise can be expected only after the Bank of England's meeting, where they are expected to end their interest rate hikes. When you add the weakness of the dollar to this, a strong bullish impulse can be seen. Important! Before buying, make sure that the MACD indicator is above the zero mark and is only just starting its rise from it.

Scenario #2: Buying the pound today is also possible in the case of two consecutive tests of the price at 1.2176 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to a market reversal upward. You can expect a rise to the opposite levels of 1.2199 and 1.2251.

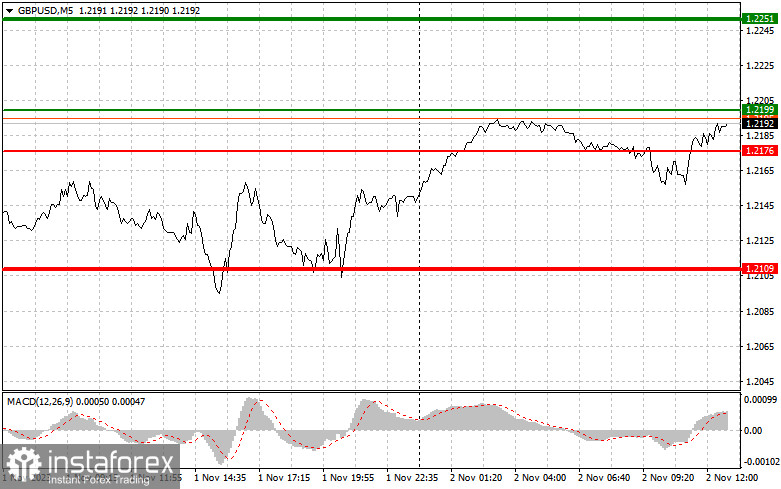

Sell Signal

Scenario #1: Selling the pound is only possible today after the price updates the level of 1.2176 (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be 1.2109, where I recommend exiting sales and immediately opening purchases in the opposite direction (expecting a move of 20–25 points in the opposite direction from the level). Pressure on the pound will increase if the Bank of England takes a firm and unwavering stance and economic forecasts are weak. Important! Before selling, make sure that the MACD indicator is below the zero mark and is only just starting its decline from it.

Scenario #2: Selling the pound is also possible today in the case of two consecutive tests of the price at 1.2199 when the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a market reversal downward. You can expect a decline to the opposite levels of 1.2176 and 1.2109.

Chart Key:

Thin green line – entry price for buying the trading instrument.

Thick green line – expected price where you can place Take Profit or take profits on your own, as further growth above this level is unlikely.

Thin red line – entry price for selling the trading instrument.

Thick red line – expected price where you can place Take Profit or take profits on your own, as further decline below this level is unlikely.

MACD Indicator: When entering the market, it is important to consider the overbought and oversold zones.

Important: For novice traders in the Forex market, it is essential to make decisions about market entry with extreme caution. It's best to stay out of the market before the release of important fundamental reports to avoid sudden price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you don't use proper risk management and trade with large volumes.

And remember that for successful trading, you need a clear trading plan, similar to the one I've presented above. Making impromptu trading decisions based on the current market situation is initially a losing strategy for an intraday trader.