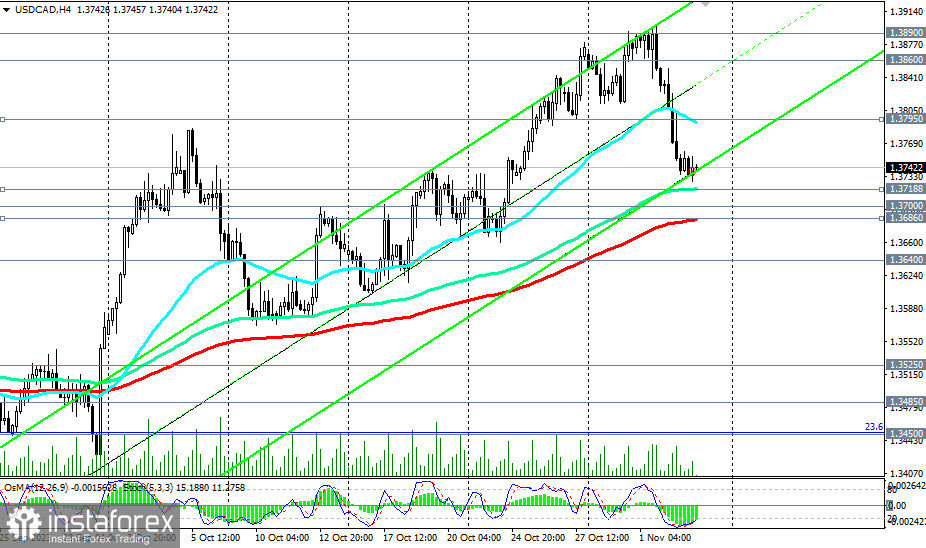

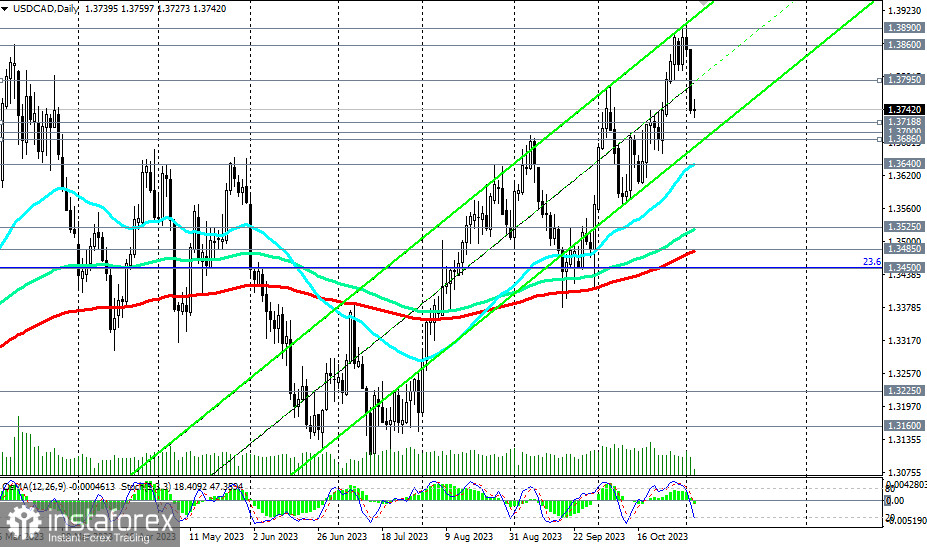

As of this writing, USD/CAD was trading near the level of 1.3743, within the midrange of today's narrow range between the levels of 1.3760 and 1.3727. In general, USD/CAD remains in the zone of medium-term support—above the level of 1.3485 (200 EMA on the daily chart), long-term support—above the level of 1.3160 (200 EMA on the weekly chart), and global support—above the level of 1.2700 (200 EMA on the monthly chart) in the bull market, also receiving support from fundamental factors.

Therefore, our main scenario is the resumption of growth. The first signal for new long positions may be the breakout of the upper boundary of the aforementioned range at 1.3760, and the breakout of the important short-term resistance level at 1.3795 (200 EMA on the 1-hour chart) would confirm it. Growth targets are located at local resistance levels of 1.3860, 1.3890, 1.3900, and 1.3970.

In an alternative scenario, USD/CAD will resume its decline. The first signal for selling would be the breakdown of support levels at 1.3727, 1.3719 (144 EMA on the 4-hour chart), and the confirming signal would be the breakdown of the important short-term support level at 1.3686 (200 EMA on the 4-hour chart). Downside targets include the support levels 1.3640 (50 EMA on the daily chart) and 1.3600.

In the further development of this scenario, the breakdown of key support levels at 1.3485 and 1.3450 (23.6% Fibonacci level of the correction in the upward wave from the level of 0.9700 to 1.4600, reached in June 2016) would return USD/CAD to the medium-term bear market zone, and the break of support levels at 1.3200 and 1.3160 (200 EMA on the weekly chart) would bring it back into the long-term bear market zone, making short positions preferable again.