The EUR/USD currency pair showed a strong upward movement on Friday, but it may end very quickly. It is essential to remember that the pair began an upward correction more than a month ago and has managed to rise by 300 points during this time. This might not seem like much, but anything less would signify a flat market. So, 300 points is not insignificant. The recent upturn in the upward movement was linked to weak reports on the US labor market, ISM business activity, and unemployment. If the pair climbs 300 points in a month, the market is clearly not in the mood to buy at the moment.

Thus, our plan remains the same. We expect the correction to end, and then a medium-term downtrend will resume. The euro still has no grounds for counting on long-term growth. Yes, macroeconomic statistics in the US were disappointing on Friday, but this is more of an exception than the rule. Usually, statistics from across the ocean are pleasing. The same applies to monetary policy. While the ECB has set a "fat dot" in tightening and inflation in the European Union has already dropped to 2.9%, in the United States, "no one has closed the door," and inflation has been rising for three consecutive months, currently standing at 3.7%.

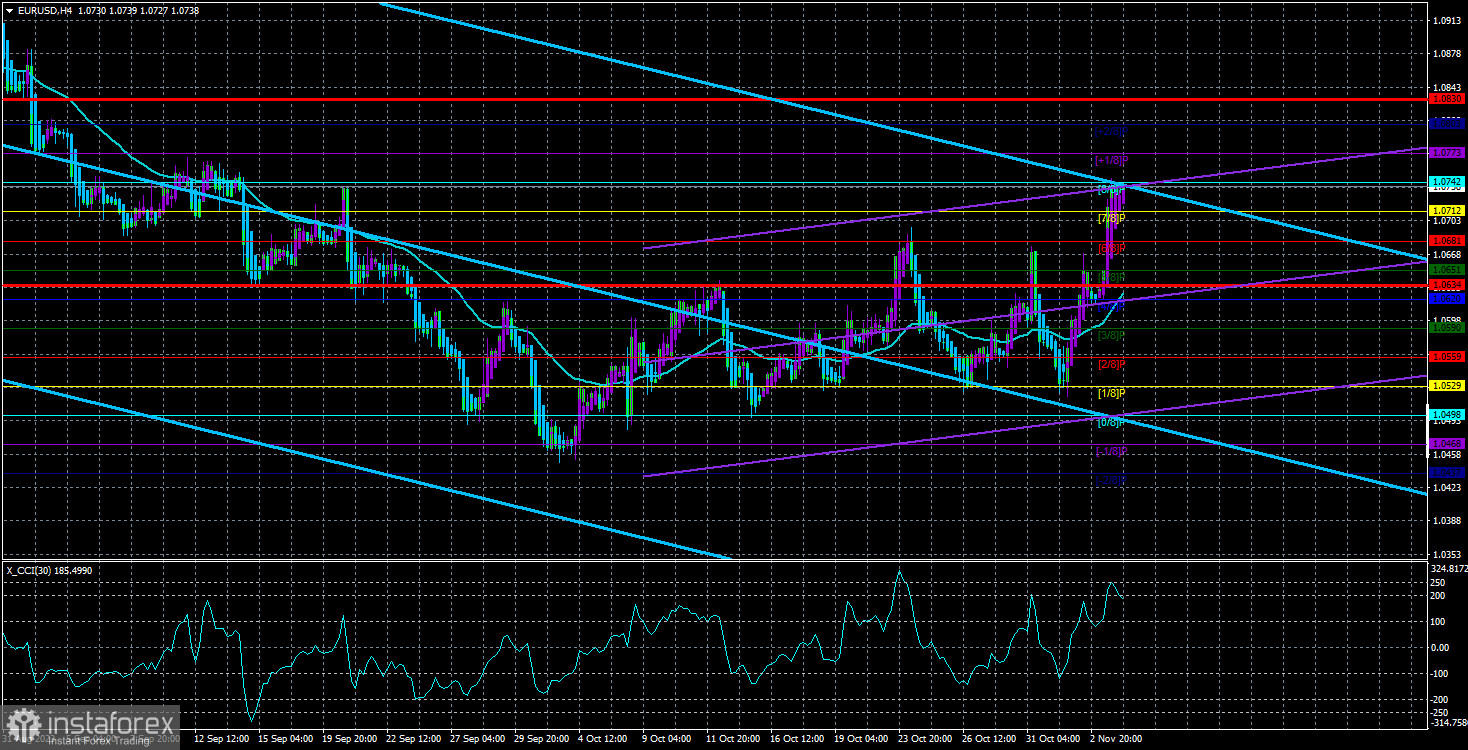

Therefore, there is a much greater chance that the Federal Reserve will raise the key rate at least one more time. This is a "hawkish" factor for the US dollar. As we have mentioned before, the fundamental backdrop may change in favor of the euro, but we do not see any signs of this reversal yet. It's also worth noting that the CCI indicator has entered overbought territory twice in the 4-hour time frame. These are strong sell signals. So, traders have reasons to sell, but we would still wait for other confirmation signals.

The probability of a rate hike in December has dropped to 20%. Looking at the recent macroeconomic statistics in the US from the perspective of the Federal Reserve's monetary policy, it is not possible to draw a definitive conclusion. The GDP in the third quarter grew by 4.9%, and inflation accelerated to 3.7%, which suggests the need for further tightening. However, business activity in both the services and manufacturing sectors has fallen. The unemployment rate has risen, and the nonfarm payroll figure was below 200,000. Therefore, further tightening of monetary policy could lead to more significant job market declines.

So, the situation for the Federal Reserve is ambiguous. Inflation is undoubtedly the most important factor, so we believe that the rate will be raised. It all depends on inflation. Its current value already allows for considering the possibility of additional tightening, but the Federal Reserve does not want to rush in case inflation naturally decreases in November and December. Therefore, we advocate another rate hike, but under current circumstances, it is not as clear-cut as before.

It's also worth noting that the probability of tightening in December, according to the FedWatch tool, has dropped to 9.7% after Friday's statistics, although it was nearly 30% before. This indicates that the market is concerned about further labor market slowdowns in the US and currently does not believe in a new rate hike. This is not great for the dollar, but it's not critical. We still believe that both currency pairs have not dropped enough in the last three months to consider the downtrend finished. Moreover, the ECB and the Bank of England are also not eager to raise rates in the near future, so the euro and the pound also lack fundamental support.

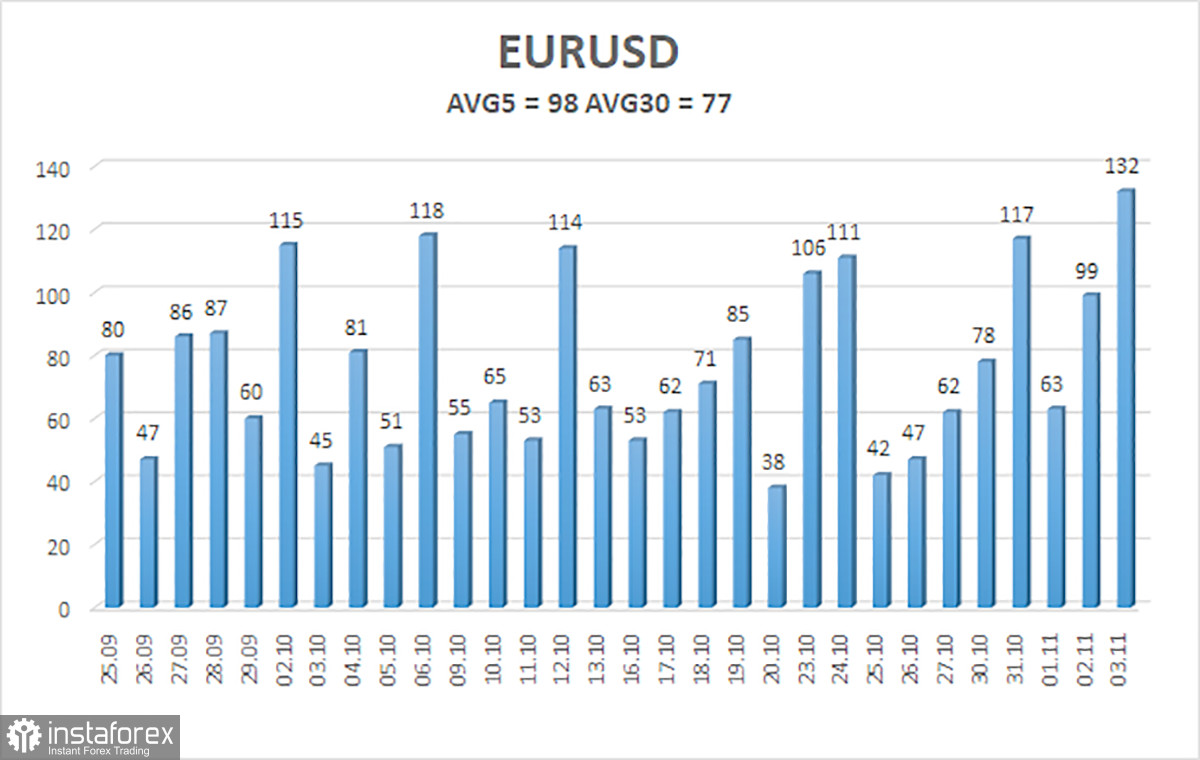

The average volatility of the EUR/USD currency pair over the past 5 trading days as of November 5th is 98 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0634 and 1.0830 on Monday. A reversal of the Heiken Ashi indicator will indicate a new downturn.

Nearest support levels:

S1 - 1.0712

S2 - 1.0681

S3 - 1.0651

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0773

R3 - 1.0803

Trading recommendations:

The EUR/USD pair continues to change its direction almost every day. Therefore, relying on moving averages at the moment is a challenging task. Yes, on Friday, we saw a strong rise, but it's unlikely that the upward movement will continue. The unusually favorable market conditions, which are not frequent, were the only factor driving the increase. We believe that from the current positions, it makes sense to consider selling, but it's important to understand that market fluctuations may continue. Friday didn't fundamentally alter the character of the pair's movement.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will likely trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) signifies an impending trend reversal in the opposite direction.