The latest CFTC report remained almost unchanged in terms of speculative positioning on major world currencies compared to the previous week. We can only highlight the noticeable increase for the Australian dollar (+520 million), while changes in speculative positions for other currencies such as CAD, EUR, CHF, and NZD were purely symbolic.

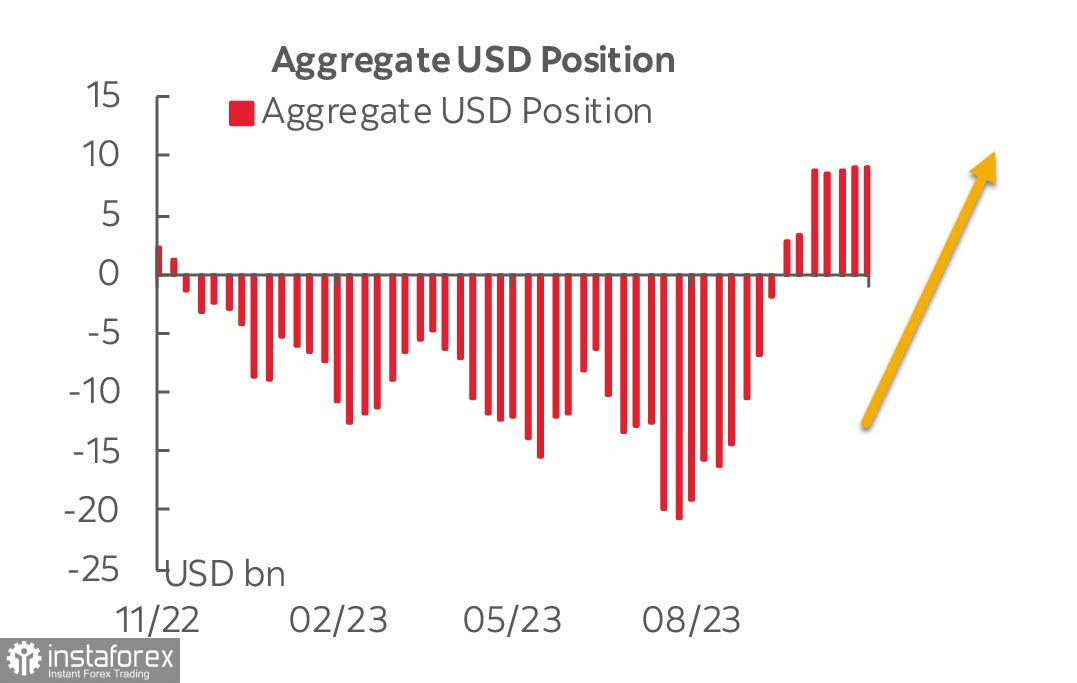

As a result, the U.S. dollar's net positioning hardly changed, decreasing by an inconspicuous 24 million. The upward trend for the US dollar is in doubt, as there has been virtually no movement for the past four weeks.

Economic data from the United States turned out to be weaker than expected. The ISM Manufacturing Index came in at 46.7 for October, compared with 49 for September, and both employment and new orders sub-indexes noticeably decreased.

The U.S. Labor Department's report showed non-farm payrolls increased by 150,000 jobs in October, much less than the expected 180,000 increase. This comes after downward revisions for the last two months (September was revised down to 297,000 from the initial 336,000). There are signs that the labor market is cooling off amidst an increase in the labor force participation. It's also worth noting that the unemployment rate rose to 3.9% in October from 3.8% in September, and history shows that if the unemployment rate increases by at least half a percentage point, the economy tends to move towards a recession.

Weaker-than-expected US data became the main driver for the markets on Friday. The cooling labor market increases the chances that the Federal Reserve has completed its rate-hike cycle. As expected, the FOMC made no changes, only making minor adjustments to the accompanying statement. The markets reacted with a drop in yields, which coincided with the weak ISM data, and the decrease in yields, in turn, offset the primary driver of the dollar's strength.

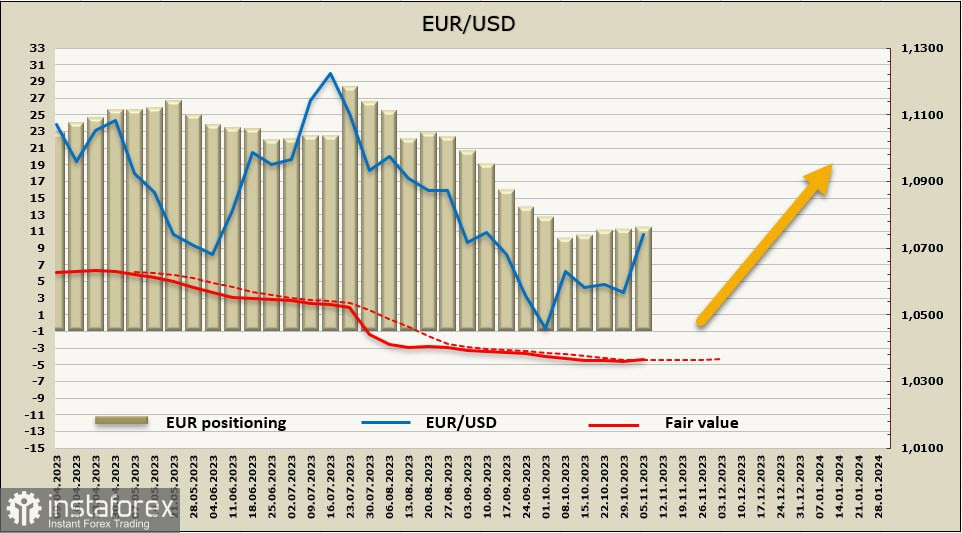

EUR/USD

Inflation in the eurozone continues to decrease, falling from 4.3% to 2.9% in October. Core inflation also slowed from 4.5% to 4.2%. The overall picture appears positive, with prices of goods declining while the inflation growth is mainly driven by the services sector.

The European economy, it is quite likely, is the first to enter a downturn. GDP for the third quarter showed a 0.1% decline, and PMI in the manufacturing and services sectors came in below expectations at 43.0 and 47.8, respectively, with declining volumes of new orders. Signs currently indicate the potential for a "soft landing" scenario, but in such scenarios, there's always a risk of a rapid decline in activity or a sudden increase in wages, which could significantly accelerate the slowdown.

The euro's net position increased by 2 million to 11.287 billion over the reporting week. It appears that the period of selling has either ended, or market participants choose to observe and wait. The price is trying to climb above the long-term average, suggesting a possible reversal of the bearish trend.

A week earlier, we noted that the probability of a more pronounced correction had increased for several reasons and set a reference level at 1.0695. The euro managed to move higher, and the price has clearly ceased its decline. Therefore, at the moment, we assume that the pair will likely reach its nearest target at 1.0760, but it's uncertain if the euro will go higher. Nonetheless, the bullish sentiment regarding the dollar has clearly weakened, so the chances of moving toward the next target of 1.0860/70 have increased.

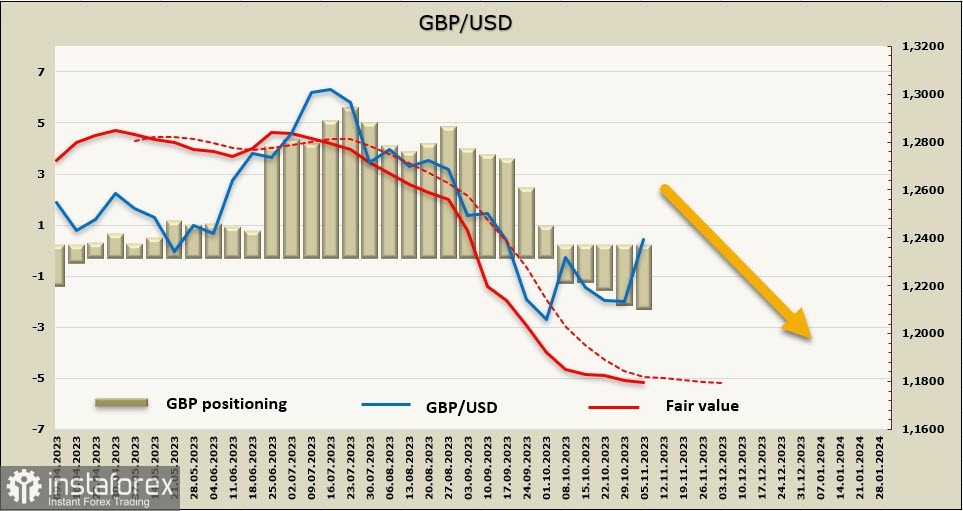

GBP/USD

As expected, the Bank of England leaves rates on hold at 5.25% for the second meeting in succession. The Monetary Policy Committee votes by 6 to 3, with the minority in favor of a further 25-basis point rate hike. "We've held rates unchanged this month, but we'll be watching closely to see if further rate increases are needed," Bank of England Gov. Andrew Bailey said. "But even if they are not, it is much too early to be thinking about rate cuts." Market expectations for the future trajectory of the BoE 's rate policy have remained almost unchanged. A quarter point rate hike is expected by February 2024, which is tantamount to no such expectations.

The UK Manufacturing PMI rose slightly to 44.8 in October, up on September's reading of 44.3 but below the earlier flash estimate of 45.2, remaining in contraction territory. The construction sector remained relatively stable, moving from 45 to 45.6. The situation in the services sector is slightly better, with an increase from 49.2 to 49.5. However, it is still within the contraction area, rather than showing growth, which doesn't increase the chances of the BoE continuing its tightening policy.

The net short GBP position increased by 131 million over the reporting week, with an overall bearish imbalance of -1.547 billion. The pound is one of the few currencies that maintains a negative dynamic in the futures market so attempts at bullish rebounds are currently seen as corrections. The price is still below the long-term average, and there is no distinct direction.

Risk demand supported the pound at the end of last week, and the resistance at 1.2190/2210 did not hold, contrary to our previous assumption. From a technical perspective, the uptrend could potentially push the pair to the resistance level at 1.2756. However, the price doesn't necessarily have a firm bullish bias, so it's more likely that consolidation and a pullback to 1.2336 will occur.