EUR/USD

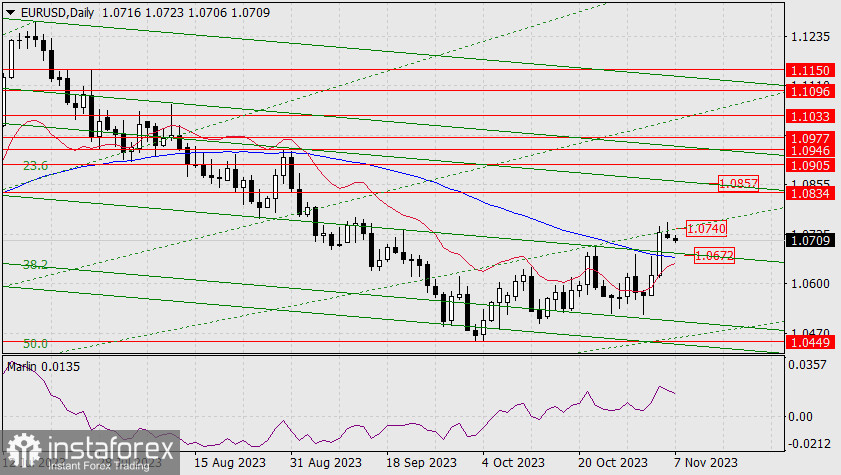

On Monday, the euro failed to continue Friday's rally. An attempt to push the price above the Fibonacci ray had failed, meaning it couldn't close the daily candle above this line. As a result, the day ended with a loss of 15 pips.

On one hand, this isn't a good sign for the bulls, as it indicates that the initial momentum for pushing the medium-term growth is gradually fading. On the other hand, the price is staying above more significant supports, such as the price channel line and the MACD line (1.0672). Therefore, the price may consolidate safely above 1.0672. However, a drop below 1.0672 would return it to the bearish scenario.

On the 4-hour chart, the Marlin oscillator's signal line is declining ahead of the price. This indicates that the oscillator is discharging (releasing tension) before it revives the upward movement. The 1.0672 level and the MACD indicator line, which is currently below it, act as support for the correction or consolidation. The overall trend remains bullish.