The currency pair EUR/USD traded with very low volatility on Monday but still turned downward and began to decline. For now, this decline is very mild, but it is only the beginning. Remember that the last surge in growth happened solely due to weak macroeconomic statistics from the United States. If it weren't for that, we probably wouldn't have seen any strengthening of the European currency. However, the data came out weak, which is why we witnessed a significant drop in the dollar on Friday.

However, the question arises: what to do with the dollar and the euro now? In order to continue buying the euro, new growth factors are needed. Until last Friday, the pair had barely risen by 250 points in a month. In other words, traders were not very eager to buy euros. And what has changed now? Yes, the data on the US labor market and unemployment turned out to be weak. Yes, ISM business activity indices dropped in October. But overall, macroeconomic data from the United States is still stronger than that of Europe. The key indicator is GDP. What difference does it make how low business activity is when the economy is growing by almost 5% per quarter? What difference does it make how high business activity indices are when the economy hasn't grown for five quarters? This is the current situation in the European Union and the United States.

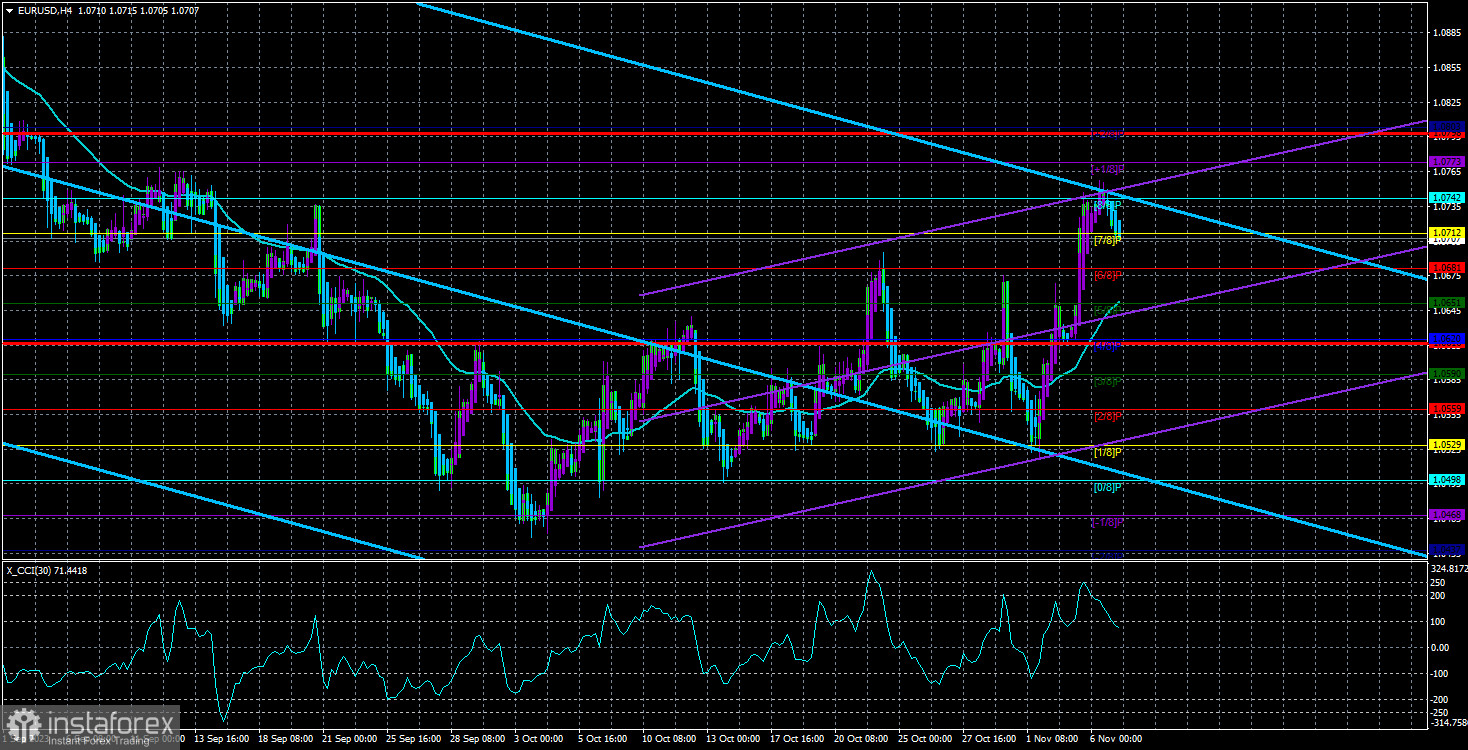

Therefore, in our view, the downward trend is far from over. The ECB is unlikely to raise the key interest rate with a 95% probability. They are content with the current pace of inflation decline. However, the Fed may still tighten its monetary policy, despite the market's lack of faith in such an outcome at the moment. We also want to point out that the CCI indicator has twice entered overbought territory. In the context of correction, this means that correction itself is nearing its end. Therefore, we believe that the decline of the euro will resume in almost any case.

The euro has risen, but it has limited chances of further growth. The fundamental backdrop for the dollar can only change when the Fed starts hinting at its readiness to lower interest rates. Such a scenario can be expected no earlier than next summer. And if inflation continues to accelerate, it might take even longer. This is a potential danger for the dollar, but not in the next few months. Even if inflation starts to slow down again, it will take time for it to drop to at least 3%. Let's not forget that inflation in the European Union is already at 2.9%, but for some reason, no representatives of the monetary committee are currently discussing easing monetary policy. Instead, several officials have stated that a rate cut is not on the agenda in the near future. Consequently, we can conclude that the Fed will not hint at easing with inflation above 3%. This means that the dollar has at least a few more months to strengthen after a year of decline.

We don't see any other factors for the dollar's decline, except for the shift from a "hawkish" to a "dovish" stance by the Fed. At least not at this time. On the 24-hour timeframe, the pair has entered the Ichimoku cloud and may show another surge towards the Senkou Span B line, which we suggest placing at 1.0758. From current levels, there are 50 points left to reach this level. Essentially, the upward movement has already been completed. Of course, we are talking about the foreign exchange market, where anything is possible. Therefore, the cancellation of the downward scenario is planned in the event of overcoming the Ichimoku cloud in the 24-hour timeframe.

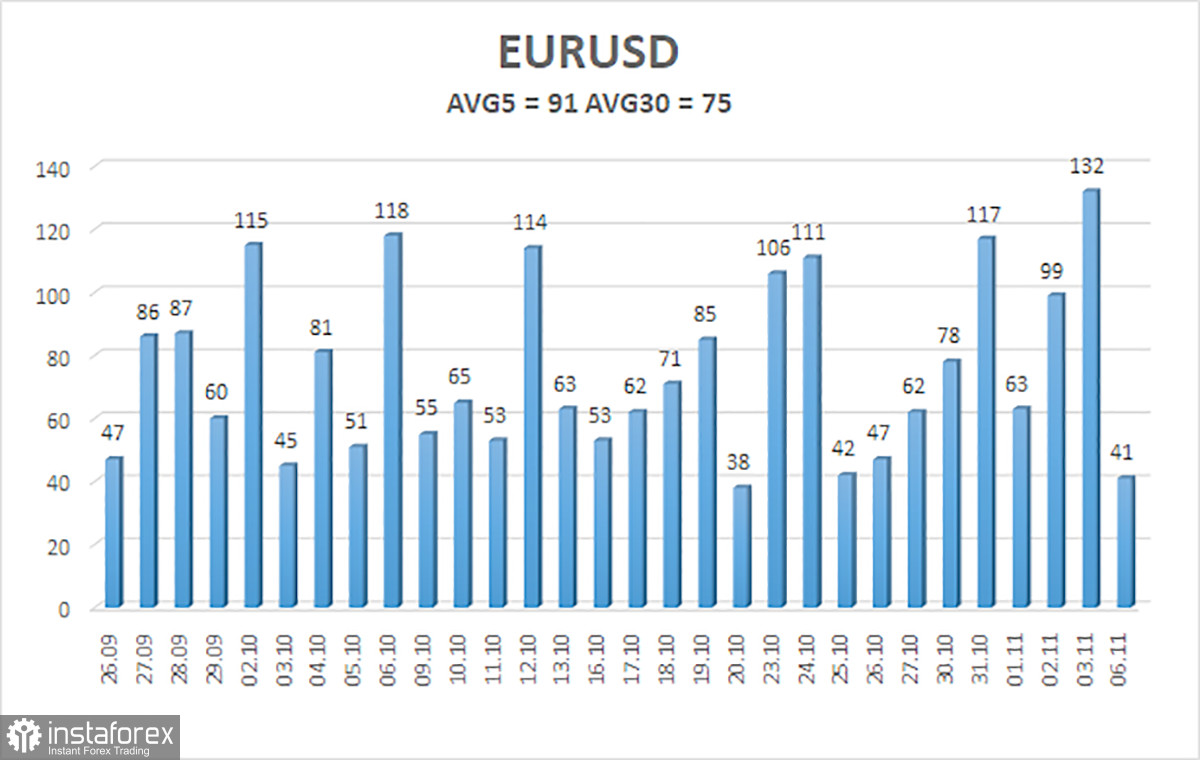

The average volatility of the EUR/USD currency pair for the last 5 trading days as of November 7 is 91 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0616 and 1.0798 on Tuesday. A reversal of the Heiken Ashi indicator upward will indicate a new upward correction.

Nearest support levels:

S1 - 1.0712

S2 - 1.0681

S3 - 1.0651

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0773

R3 - 1.0803

Trading recommendations:

The EUR/USD pair continues to change its direction almost every day. Therefore, relying on moving averages is a challenging task at the moment. Yes, we saw a strong rise on Friday, but it's unlikely that the upward movement will continue. The rise was solely due to strong background conditions, which are not common. From current positions, it is advisable to consider selling, but it should be understood that market fluctuations may continue. Friday did not fundamentally change the nature of the pair's movement.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price range in which the pair will trade in the next day based on current volatility indicators.

CCI indicator - its entry into the overbought territory (above +250) or oversold territory (below -250) indicates that a trend reversal in the opposite direction is approaching.