Bitcoin started the new trading week with a consolidation movement near the $35k level, which now acts as a crucial psychological resistance level. Low volatility and reduced trading activity have prevented BTC from making a decisive break above the $35k level and resuming its upward momentum. A similar situation can be observed among sellers, who are unable to break through the support at $34.5k.

Despite the sluggish start to the trading week, one can expect the development of an upward movement for the cryptocurrency. This will become possible after the BTC/USD quotes break out of the range between $34.5k and $35.3k. As of November 7, the likelihood of an upward breakout from this range is considerably higher. However, one should consider various price movement scenarios, as volatility introduces an element of unpredictability to the market.

When can we expect an increase in volatility?

Given the reduction in tensions in the Middle East and relatively stable oil prices, Fed Chairman Jerome Powell's speech on November 8 is expected to be the primary trigger for the market. Investors will be looking for specifics regarding the Federal Reserve's monetary policy, and there is already reason to believe that this speech will have a positive effect on Bitcoin prices. Over 90% of traders on the CME anticipate another pause in interest rate hikes.

A less significant trigger will be the release of U.S. labor market data. Considering the fundamental data released last week, this publication is also expected to be a positive signal for Bitcoin bulls since the U.S. labor market is starting to weaken due to high interest rates. There are no other significant volatile events expected this week, so the primary price movement for BTC should be anticipated during this period.

Bullish momentum or correction?

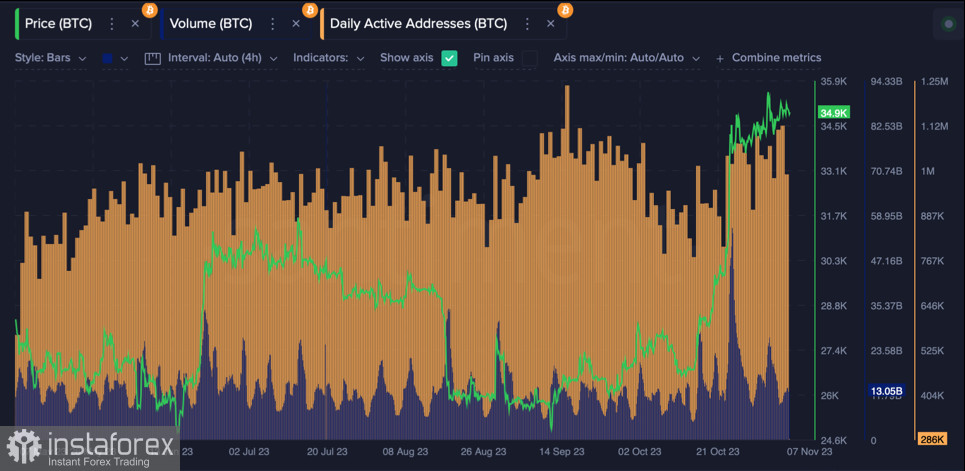

As of November 7, Bitcoin is trading at around $34.9k with daily trading volumes of approximately $13 billion. The asset's price continues to consolidate near the psychological level of $35k. BTC is currently above the 7-day Exponential Moving Average (EMA), which reinforces bullish expectations for a future increase in volatility. Given the positive nature of upcoming macroeconomic events, there is every reason to believe that Bitcoin will establish another high and form a "triple top."

The potential price ceiling for BTC could be in the range of $36.5k to $37k, where a significant resistance zone is located. Subsequently, a price correction can be expected, as stablecoin flows to exchanges have ended, and some traders will want to lock in short-term gains, causing the price to start correcting. For a full-fledged correction to begin, the asset will need to break through the "shoulder" level at $33.7k.

As for potential correction targets for BTC, excluding the formation of a final high, attention should be given to the 0.382 Fibonacci level around $32.5k and the 0.5 Fibonacci level near the $31.4k mark. During this period, one can expect a local redistribution of BTC as well as a decline in key technical metrics. The 1-day Stochastic indicator continues to signal increasing selling volumes, so the start of a correction is just a matter of time.

Conclusion

Bitcoin has exhausted its potential for a rapid bullish rally but still maintains the potential for a final push above the $36k level. Subsequently, one should expect the development of a correction with minimum targets in the range of $31.4k to $32.5k. There is a possibility of a deeper decline in case of negative fundamental factors, increased selling pressure within the correction range, or a combination of these factors.