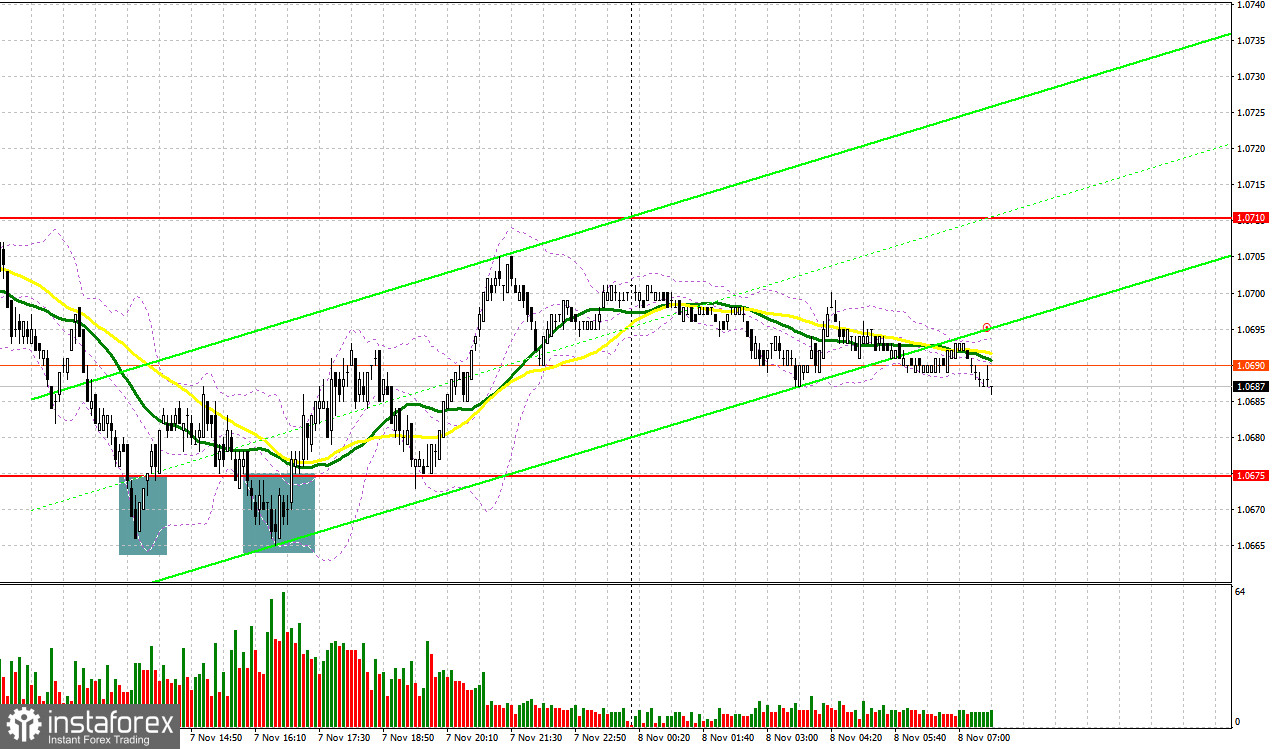

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0695 as a possible entry point. A decline and false breakout at this mark produced a buy signal, but after rising by 10 pips, the pair was under pressure again. In the afternoon, protecting the support at 1.0675 and a false breakout at this mark formed another buy signal. As a result, the euro rose by 30 pips.

For long positions on EUR/USD:

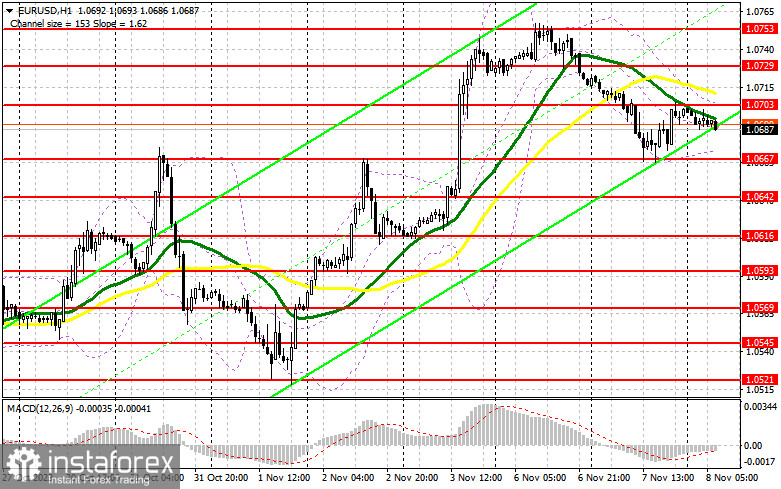

Federal Reserve officials continue to take a wait-and-see approach to rates, which put pressure on the euro in the second half of the day. However, the big players took advantage of the correction and began to gradually return to the market. Today, traders will keep an eye on the German Consumer Price Index, the decrease of which will certainly support the euro. We may also look at the eurozone retail sales report for September. The speech of European Central Bank executive board member Philip Lane may also support the single currency. In case the reports exert pressure on the pair, the bulls will have to be active near the new support at 1.0667. A false breakout on this mark will confirm a correct entry point for long positions, in hopes of building an uptrend and testing the resistance at 1.0703, which was formed yesterday. This is also in line with the bearish moving averages. A breakout and a downward test of this range will give the euro a chance to surge to 1.0753. The ultimate target will be the area of 1.0753 where I will be taking profits. If EUR/USD declines and there is no activity at 1.0667, bears will take control of the market, which will strengthen the bearish correction and maybe even push the pair down to 1.0642. In such a case, only a false breakout on this mark will provide a buy signal. I will be opening long positions on a rebound immediately from 1.0616 with the aim of an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

Sellers will continue to put pressure on the euro, but they can also lose control over the market. To prevent this from happening, we need weak eurozone data and traders to defend the nearest resistance at 1.0703, which is in line with the moving averages. A false breakout at this mark will give a good sell signal to continue the bearish correction down to the support at 1.0667, which was formed yesterday. Only after a breakout and consolidation below this range, as well as its upward retest, do I expect to receive another signal to sell the pair with a target at 1.0642. The ultimate target will be the 1.0616 low where I will be taking profits. In the event of an upward movement in EUR/USD during the European session and the absence of bears at 1.0703, bulls will return to the market and try to reach the 1.0729 high. It is also possible to sell at this point but only after a failed consolidation. I will be opening short positions immediately on a rebound from the monthly high of 1.0753 with the aim of a downward correction of 30-35 pips.

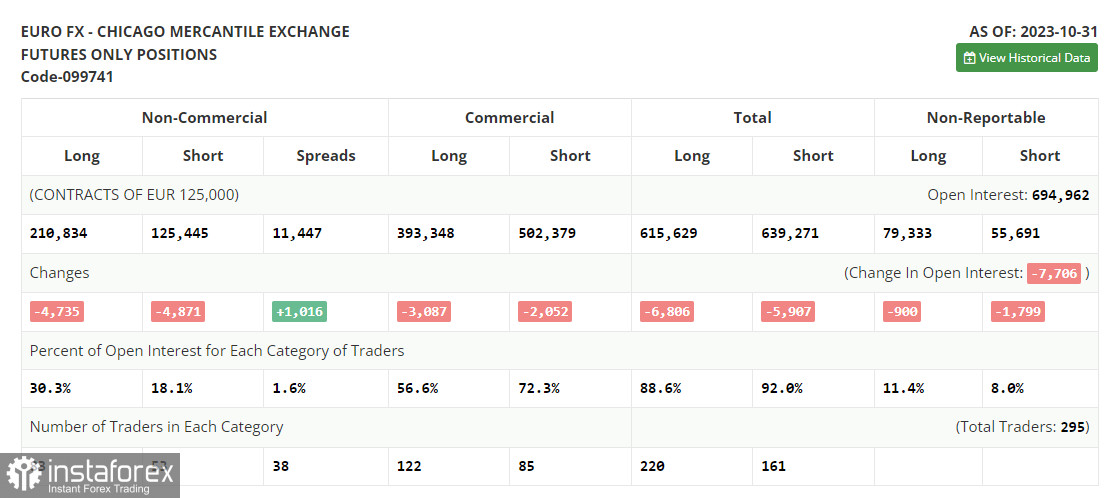

COT report:

The COT report for October 31 showed a reduction in both long and short positions. This positioning was ahead of the crucial meeting of the US Federal Reserve, where the regulator decided to maintain its policy unchanged. However, weaker US labor market data, indicating less robust growth in new jobs, likely led to a more significant realignment of forces, unfortunately not yet reflected in this report. This type of statistics reinforces the idea among investors that the Fed will no longer raise interest rates and that the aggressive policy could be concluded as early as the beginning of next summer. This will continue to put pressure on the US dollar and lead to the strengthening of risk assets. According to the latest COT report, non-commercial long positions decreased by 4,735 to 210,834, while non-commercial short positions fell by 4,871 to stand at 125,445. As a result, the spread between long and short positions increased by 1,016. The closing price went down to 1.0603 from 1.0613.

Indicator signals:

Moving averages:

Trading below the 30- and 50-day moving averages indicates a correction in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0675 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.