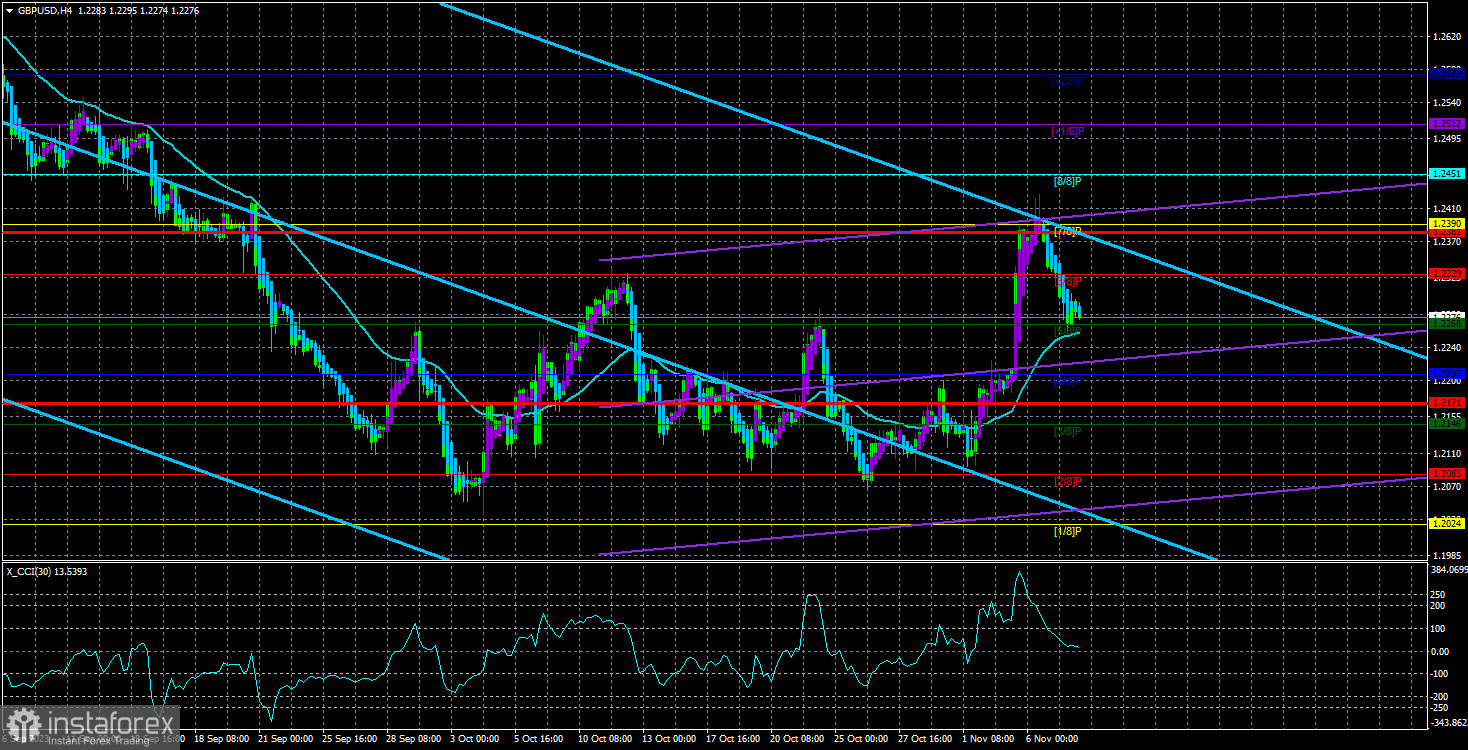

The GBP/USD currency pair continued its downward movement on Tuesday and almost reached the moving average. Now, a rebound from the moving average line can trigger a new upward correction, while a breakthrough could lead to further decline targeting the Murray level "2/8" (1.2085). We believe that the British pound (like the euro) has corrected sufficiently upward to now resume the medium-term downward trend. To be honest, the pound has been correcting for a month, and if it weren't for the macroeconomic backdrop that occasionally provided support, the correction would have been even weaker than it is now. The current correction can be considered weak. The pound has risen by 380 points in a month but fell by 1100 points in the previous two.

We also draw attention once again to the fact that the CCI indicator has twice entered the overbought area. Twice during the correction. We believe this is a strong signal for a resumption of the main downward movement, which remains in a downward direction. Thus, no matter how much the pair corrects or how long it takes, we believe a new decline for the British pound is inevitable. It has risen for too long and without a solid basis.

Regarding the macroeconomic backdrop that can support the dollar or the pound, American statistics were weak last week, which supported the pound. But British statistics are no better than American and often worse. The economic growth in the United Kingdom is practically nonexistent, inflation is much higher, wages are rising at a steady pace, and the Bank of England has no plans for further tightening. We believe that this backdrop alone is enough to anticipate a continuation of the pair's decline.

Thomas Barkin doesn't support Kashkari's view. In a previous article, we drew traders' attention to the fact that some members of the Fed's monetary committee are beginning to change their stance and lean towards the need for a more "restrictive" policy. However, not everyone shares this view. For example, Thomas Barkin, the head of the Federal Reserve Bank of Richmond, believes that there's no need to rush with a new rate hike. He stated on Monday that more economic data should be obtained before making such a decision. Barkin also strongly doubts that a new rate hike will resolve the inflationary problems that have emerged in recent months. The labor market is slowing down, which is a good thing. The economy is strong, which is also positive. He noted that the U.S. population is not reducing its spending despite the high key interest rate.

The president of the Federal Reserve Bank of Richmond also doesn't know if the regulator has reached its peak rate. He believes that mistakes are possible, both in terms of excessive tightening and insufficient tightening. As we can see, opinions within the Fed differ, and it will be very interesting to see the next FOMC meeting minutes. Usually, it's not a significant document, but this time it may shed light on how many members of the monetary committee are willing to support further tightening in the future. If the market starts receiving signals that the Fed is ready to raise the rate again, the dollar will have additional reasons to rise.

As for macroeconomic statistics, there will be very few releases this week. We will have to wait for GDP in the third quarter and industrial production in the UK. And a few less important reports in the United States, such as the consumer sentiment index from the University of Michigan. All of these data will have a weak impact on market sentiment, so today's speech by Jerome Powell remains the key. Powell may comment on the resonant labor market and unemployment reports that came out last Friday. Therefore, we should be prepared for increased volatility and sharp reversals during the American trading session.

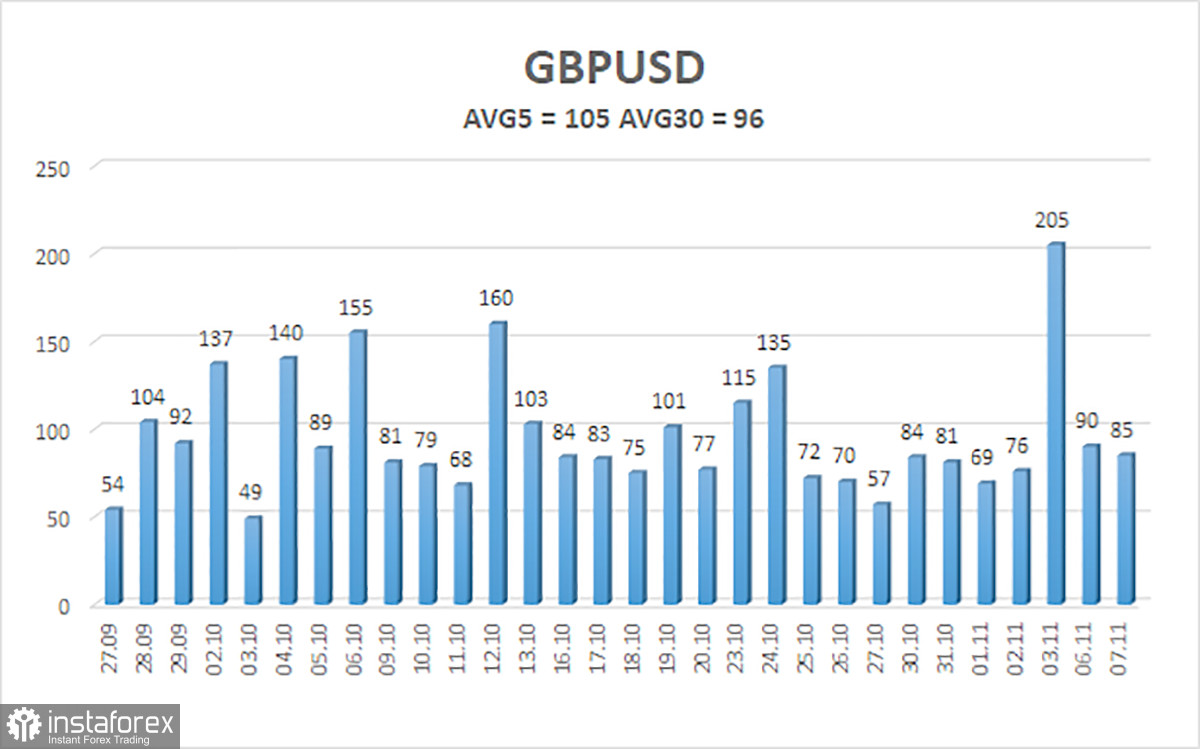

The average volatility of the GBP/USD pair over the last 5 trading days as of November 8 is 105 points. For the pound/dollar pair, this value is considered "average." As a result, on Wednesday, November 8, we anticipate movement that stays within the range defined by the levels of 1.2171 and 1.2381. A reversal of the Heiken Ashi indicator downward signals a new attempt to resume the medium-term trend.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading recommendations:

The GBP/USD currency pair has initiated a new downward movement but has not yet crossed the moving average. Short positions can be considered if the price consolidates below the moving average, with targets at 1.2207 and 1.2171. Long positions will be justified in the event of a bounce from the moving average line, with targets at 1.2329 and 1.2381.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both channels are pointing in the same direction, it indicates a strong current trend.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction for trading.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will trade in the next day based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) indicates an impending trend reversal in the opposite direction.